Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

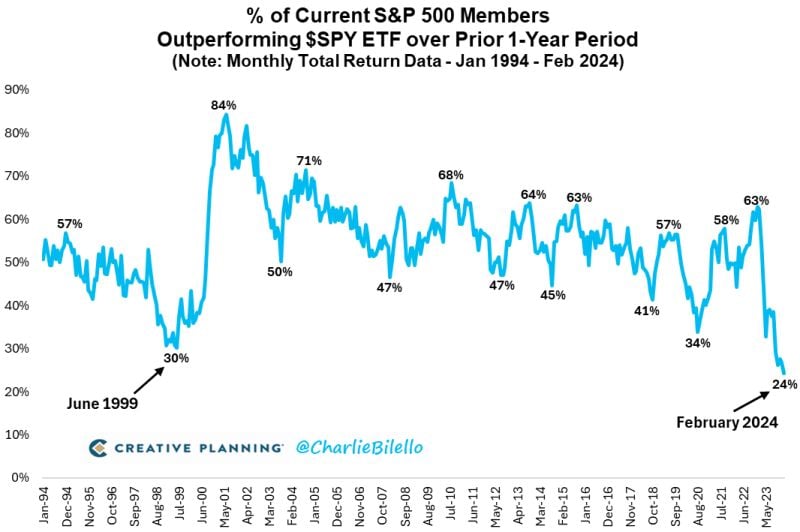

Only 24% of S&P 500 members outperformed the index over the last year, the lowest % on record w/ data going back to 1994.

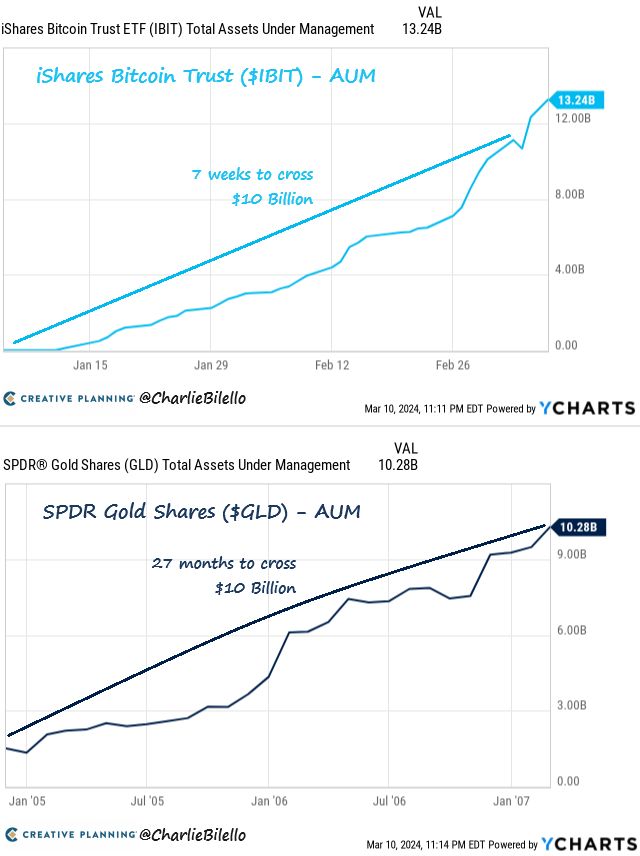

Source: Charlie Bilello

How do you make your money work while you're sleeping?

Source: Markets & Mayhem

What are the stocks favoured by retail investors?

$NVDA, $TSLA, $AMD, and $SMCI Source: Markets & Mayhem, Vanda Research

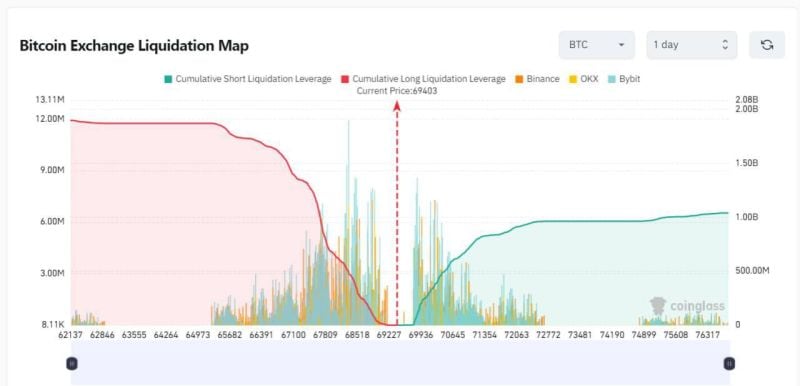

ALERT -> $1,000,000,000 WORTH OF SHORTS WILL GET LIQUIDATED IF bitcoin $BTC HITS $75,000

Source: Ash Crypto

Investing with intelligence

Our latest research, commentary and market outlooks