Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

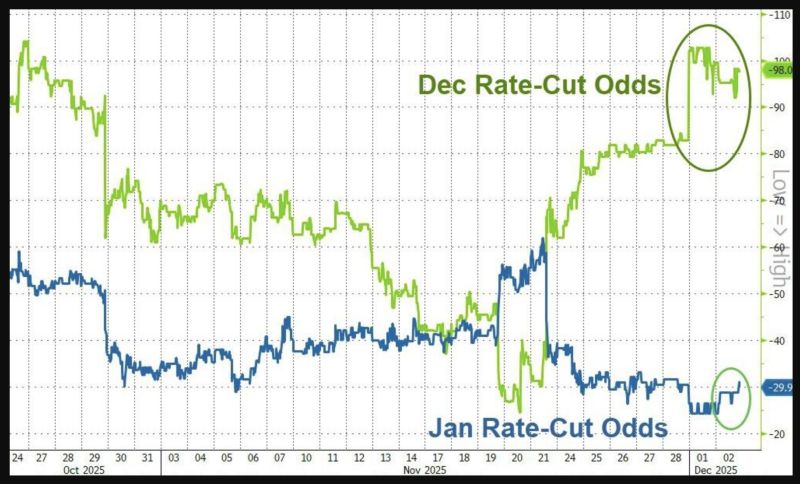

Rate-cut odds seem to indicate December meeting is a done deal.

But we also note that January odds are rising... Source: zerohedge

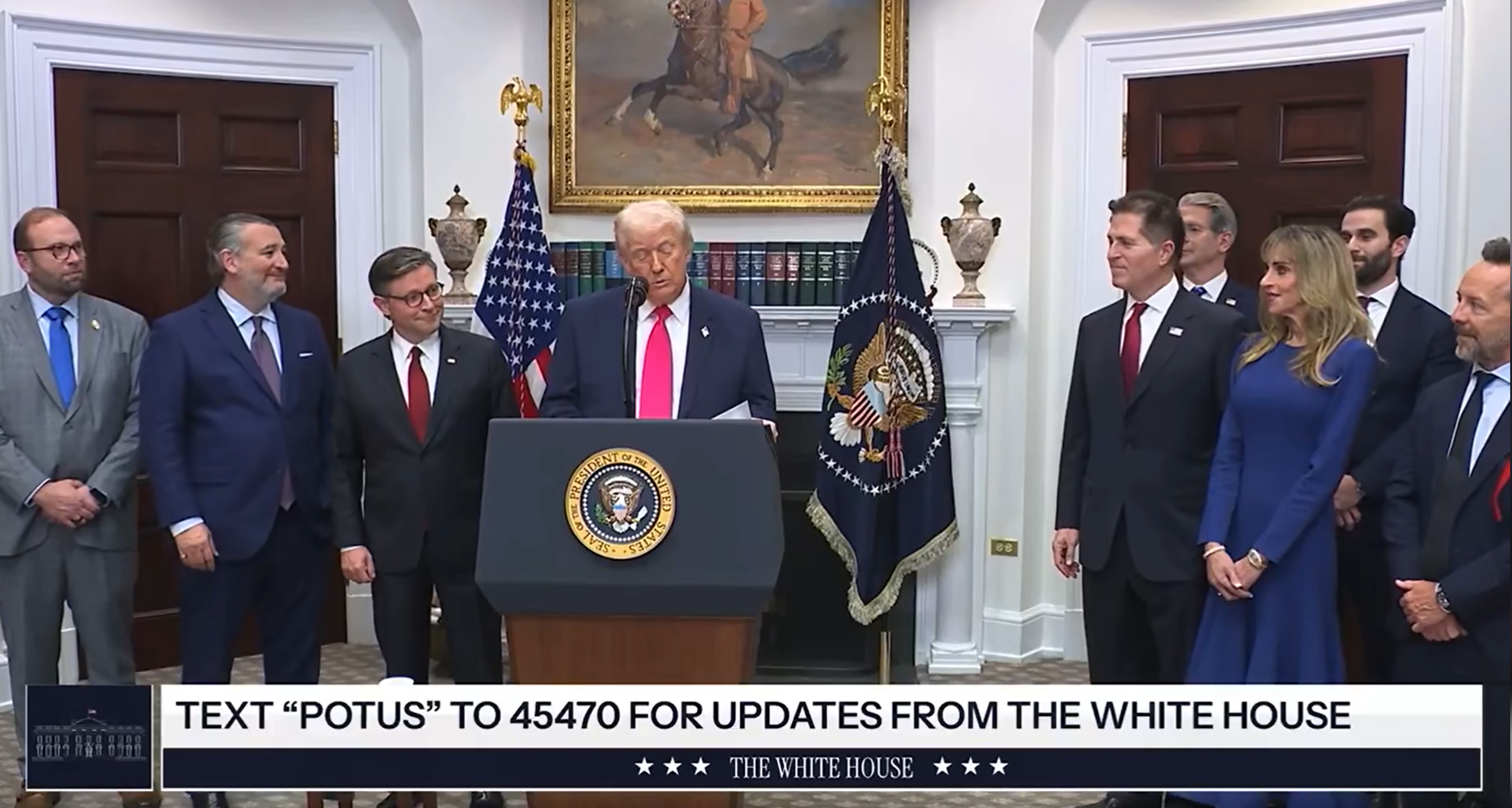

TRUMP: “I guess a potential Fed Chair is here too…I don’t know, are we allowed to say that? Thank you Kevin.”

It looks like the next Fed Chair will be Kevin Hasset, who is obviously very close to Donald Trump. At many occasions, Kevin Hassett has emphasized the need for lower interest rates to stimulate economic growth and criticize the Federal Reserve (Fed) for being too slow to ease monetary policy. Here are some of his key dovish sentiments: ➡️ Advocacy for Immediate Rate Cuts: Hassett told Fox News that he would be "cutting rates right now" if he were Fed chair. ➡️Call for Aggressive Easing: He advocates faster and deeper rate cuts than the current Fed leadership. ➡️Focus on Lower Borrowing Costs for Consumers: He has emphasized the importance of “cheaper car loans and easier access to mortgages,” framing lower rates as a tool to support middle-class financial health. ➡️Criticism of Current Policy as Too Restrictive: He has consistently argued that interest rates in the United States are too high and risk constraining investment, hiring, and household borrowing. He has warned that staying too restrictive for too long could undermine growth just as the economy is showing signs of cooling. ➡️Alignment with Presidential Preferences for Lower Rates: Hassett has publicly aligned himself with the view that interest rates in the United States are too high. He has also said Americans should expect the President to pick a chair who will help deliver lower borrowing costs.

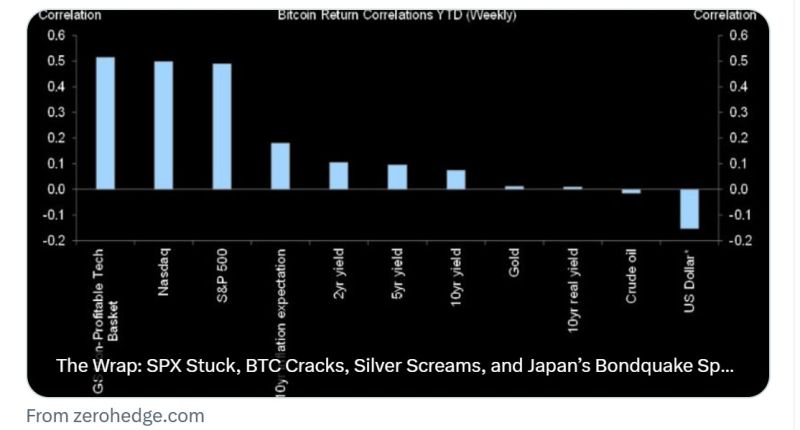

The Market Ear: "When you trade BTC, you're basically trading unprofitable tech, not a store of value, not dollar debasement".

As shown below, bitcoin has a high correlation with unprofitable tech stocks and the Nasdaq.

$IBM CEO says that at today’s costs it takes about $80B to build & fill a 1 GW AI data center

So the ~100 GW of announced capacity implies roughly $8T of capex & “no way you’re going to get a return on that,” since you’d need “about $800B of profit just to pay for the interest” Source: Wall St Engine

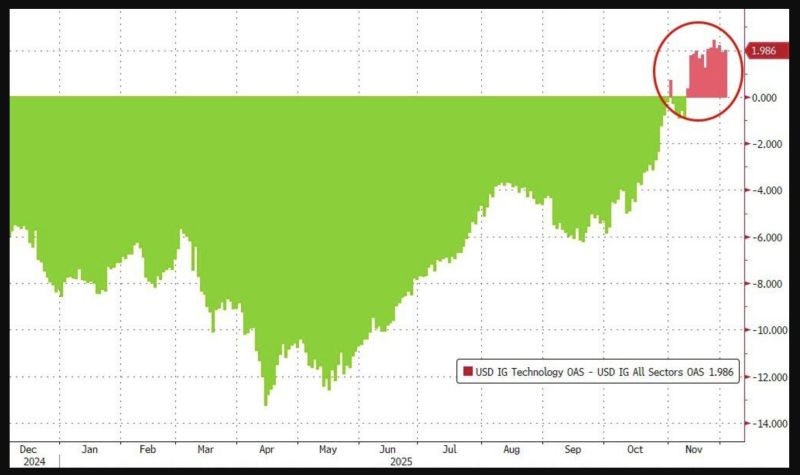

Overall Tech credit Spreads continue to trade wide to the overall IG credit market...

Source: zerohedge

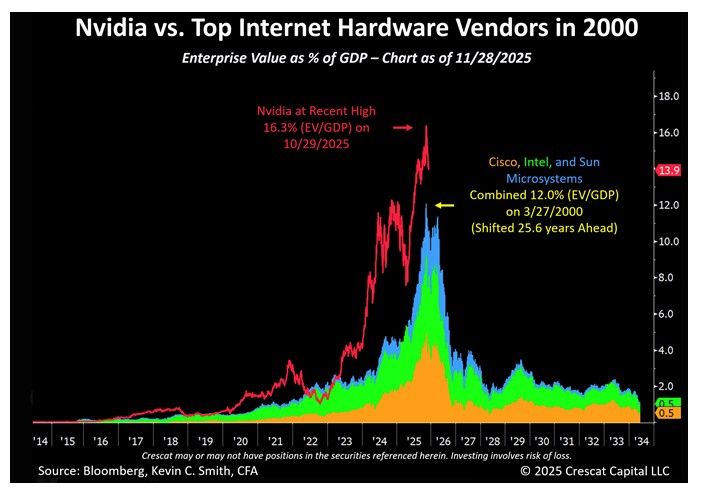

Great chart by Tavi Costa showing Mega-caps hardware stocks Entreprise Value as a % of GDP - 2000 vs. today...

We think Nvidia has a different profile. Still, this is a scary one...

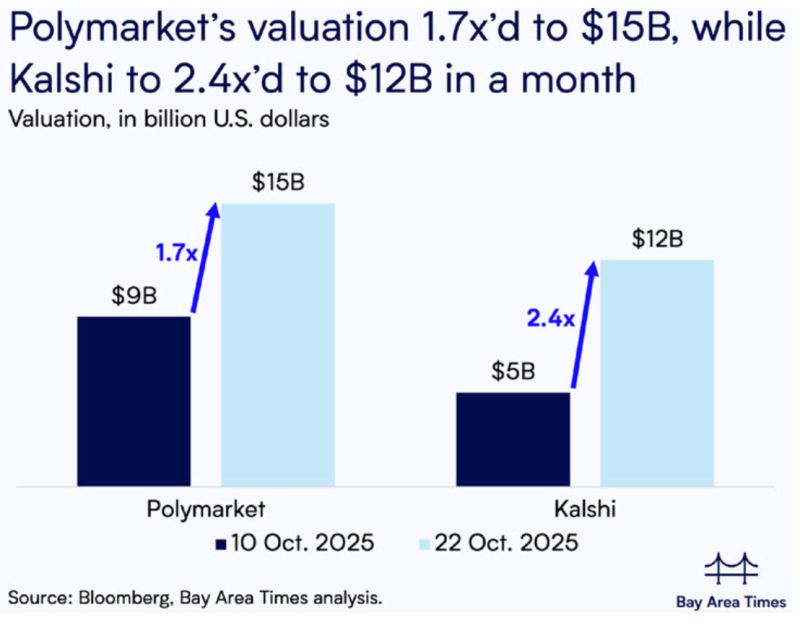

Kalshi and Polymarkets are among the pre-IPOs superstars right now...

Source: Bloomberg, Bay Area times, RBC

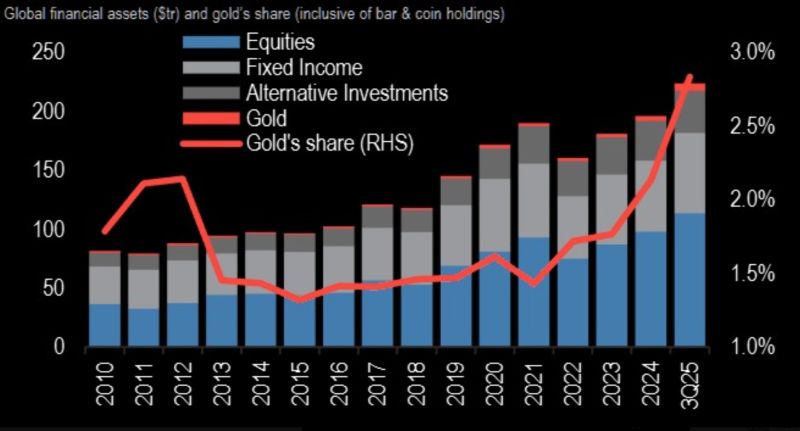

Gold is only 2.8% of investor AUM... imagine 4–5%.

Source: The Market Ear

Investing with intelligence

Our latest research, commentary and market outlooks