Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Central banks have completely messed up market messaging.

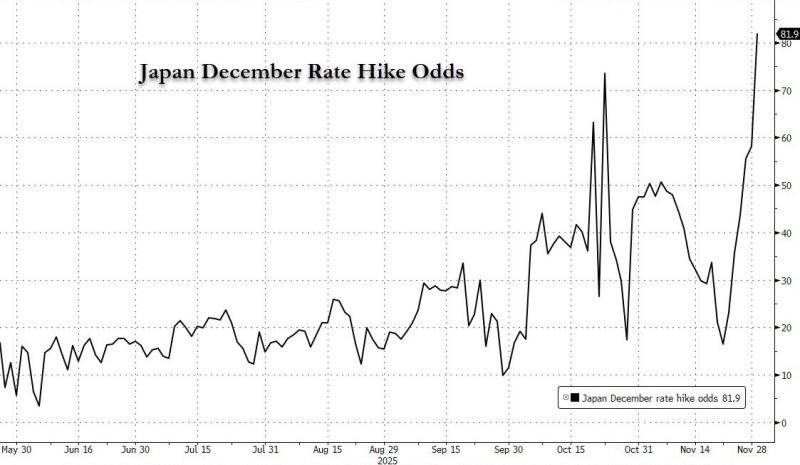

First Fed's schziophrenic communications sent Dec rate cut odds from 80% to 30% to 100%, and now the BOJ just send Dec rate hike odds to 80% from 20% ten days ago! Source: zerohedge

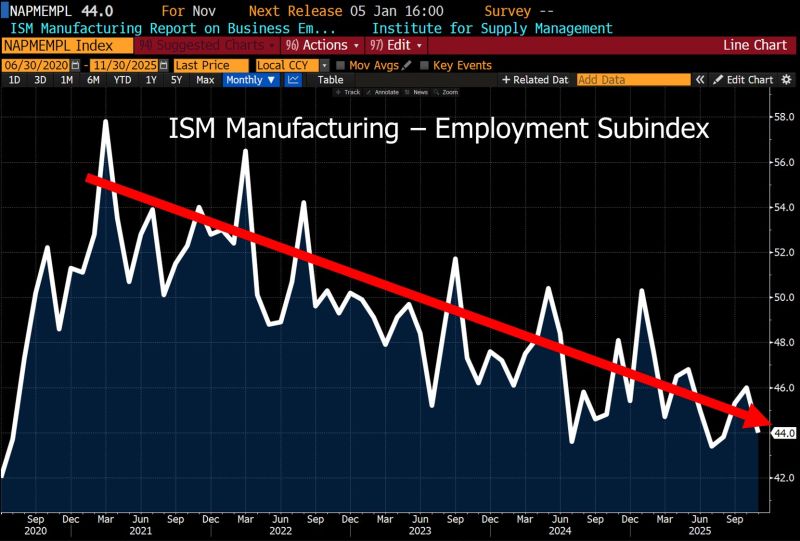

This might force the hand of the Fed...

Powell may have floated the idea of a pause, but the cooling U.S. labor market tells a different story — and it’s opening the door to lower policy rates. Here’s the twist: Inflation is holding around 3.0%, dipped to 2.3%, and is averaging 2.7% for the year. GDP? Still strong. Demographics? Warping the job market. And yet… rate cuts are coming. Why? Because the other half of the Fed’s mandate is screaming for it. Lower rates conveniently support: Debt sustainability Financial-sector stability Liquidity across the system Central banks want lower rates — and their messaging shows it. That’s why we’re hearing nonstop about financial-sector risks, bond-market volatility, and liquidity needs… and far less about headline inflation.

Gold is on pace for its best year since 1979, up over 60% in 2025.

Source: Charlie Bilello

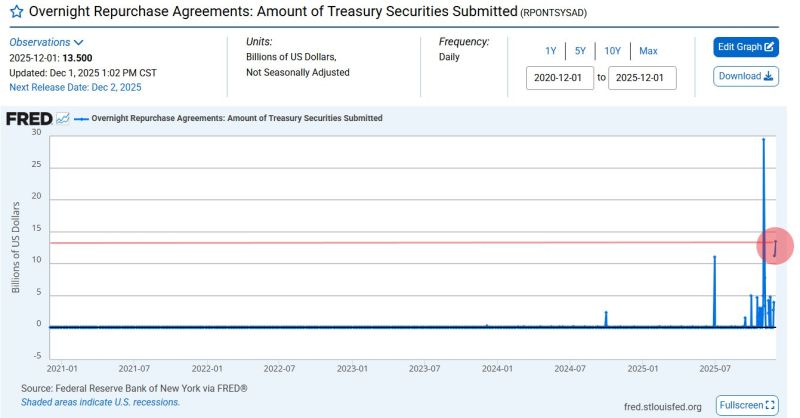

Fed Reserve just pumped $13.5 Billion into the U.S. Banking System through overnight repos.

This is the 2nd largest liquidity injection since Covid and surpasses even the peak of the Dot Com Bubble Source. Barchart

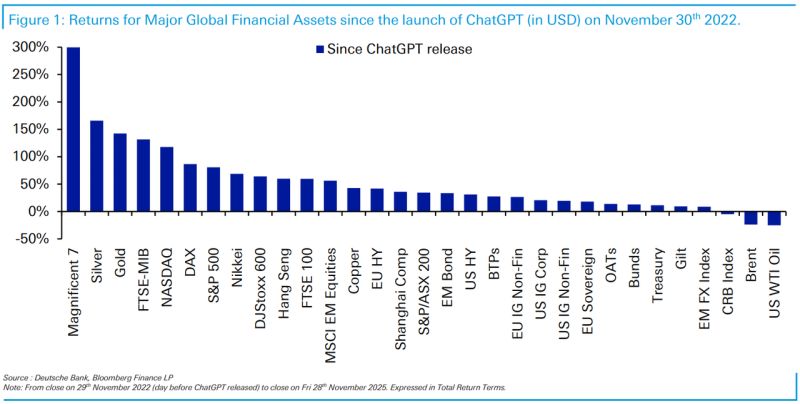

🔥 Three Years Since The Launch Of ChatGPT, Here Are The Biggest Winners And Losers 🔥

To celebrate ChatGPT’s 3-year anniversary, Deutsche Bank kicked off “AI Week” — using AI to build every Chart of the Day. And the first set of charts tells an incredible story: 🚀 Winners: The Magnificent 7 didn’t just outperform… they rewrote market history. Nvidia: +1,020% Broadcom: +712% Western Digital: +500% Meta: +499% The Mag-7 as a group? ~+300% since late 2022. Stunning. 💥 Losers: Market darlings turned disasters: First Republic – gone SVB – collapsed Moderna – -85% from 2022, -95% from peak Pfizer? Now trading back at 1998 levels and -60% from its highs, despite 3× the earnings it had in 2000. 💡 The Lesson: In just three years, AI exploded, market leadership flipped, and the biggest winners and losers were almost impossible to predict in real time. Nothing in markets is permanent — not hype, not dominance, not even “blue-chip safety.” A perfect way to kick off AI Week. Source: DB, zerohedge

Japan 10 year - US 10 year: the big crocodile jaw

Japan might have to use yield curve control again to save its bond market Source chart: The Market Ear

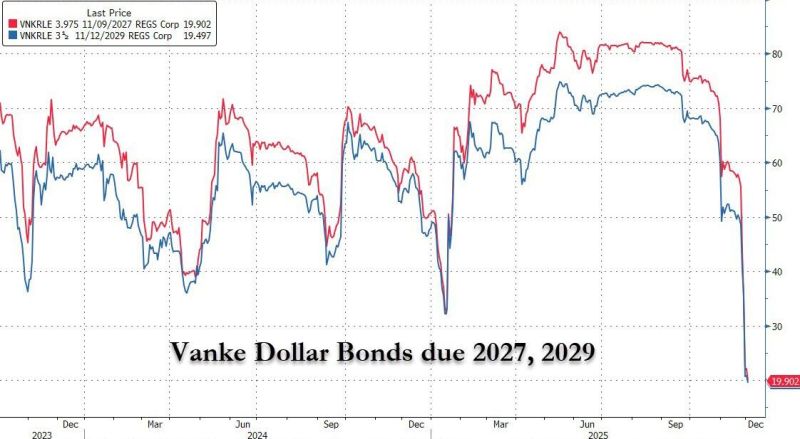

🔥 China’s Latest Property Shock: Vanke Just Broke the Last Illusion 🔥

Vanke, once viewed as China’s “safe” developer after Evergrande, just stunned markets. It’s asking for a 1-year delay on a ¥2B bond with zero upfront payment and even the interest pushed back a year. Creditors expected support. Instead, they got nothing. 📉 The fallout: ➡️ Bond crashed from near par to ¥27 ➡️USD notes collapsed to 20 cents ➡️Analysts warn this “shatters investor confidence” Vanke is now pledging core assets, being rejected for emergency loans, and facing warnings that its commitments are “unsustainable.” This isn’t one company’s problem — it’s the latest sign that China’s 5-year property downturn has no bottom. Home prices continue to fall, sales data is going missing, and global banks see years of decline ahead. And with China’s middle class holding most of its wealth in property, a deeper slump could be devastating. The crisis is no longer at the fringes. If Vanke is wobbling, the entire foundation is shaking. Source: zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks