Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The Nikkei has just surpassed its highest level in 35 years.

Japan being the birthplace of one of the oldest forms of technical analysis (Heikin-Ashi candlesticks), will this new-high signal reignite domestic investors’ long lost interest in their market?

Should Nvidia have a higher market cap than Google and Amazon?

$NVDA $GOOGL $AMZN Source: Charlie Bilello

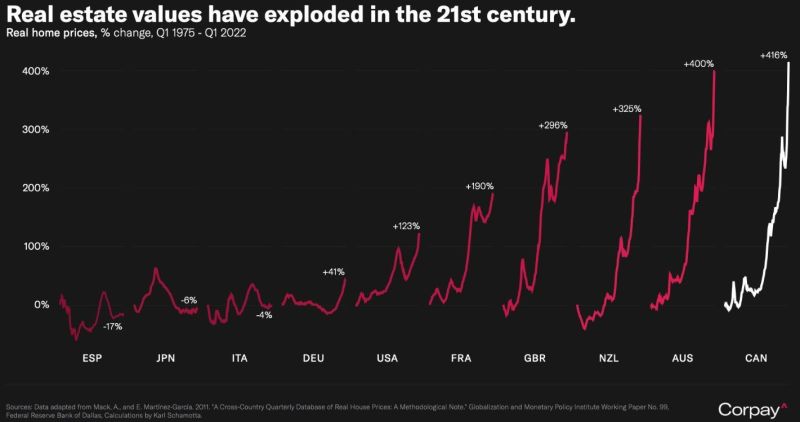

House prices adjusted for inflation since 1975.

The charts for Canada, Australia, New Zealand, and the UK look like a s**tcoin during a pump. The Japanese real estate bubble of the 1990s is barely visible as a comparison... Source: Bloomberg, MacroAlf

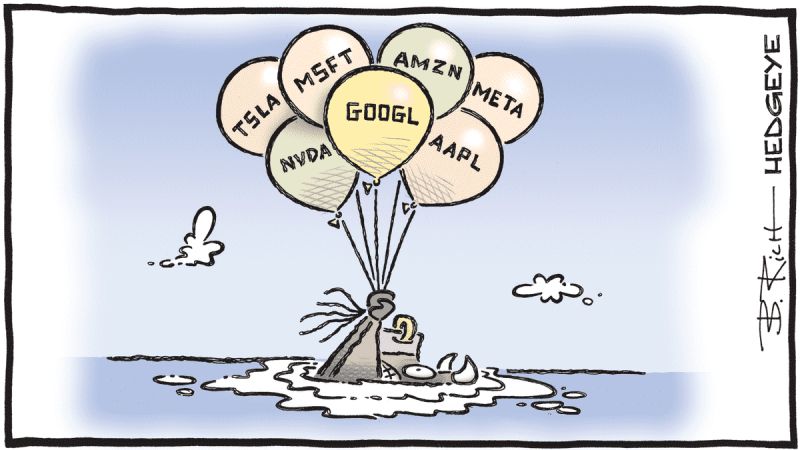

Yesterday was one of the most distorted markets we've seen yet. Just 2% of the index contributed over 60% of the bullish momentum.

That means ONLY TEN companies were the cause of well over half of the move in $SPX yesterday. $NVDA single handedly contributed an additional 50bps to the return in $SPX. Source: Hedgeye

Nvidia has now surpassed Germany's DAX in market capitalization.

Valued at just under $2 trillion, the chip company, established in 1993, now exceeds the total value of the DAX, which includes 40 companies, some over 130 years old. Source : HolgerZ

Goldman Sachs' analysts no longer expect a U.S. interest rate cut in May and see four 25 basis point cuts this year.

"Because there are only two rounds of inflation data and a little over two months until the May (Fed) meeting, the comments suggest to us that a rate cut as early as May, which we had previously expected, is unlikely," Goldman Sachs analysts said in a note. They now forecast an extra cut next year instead, with an unchanged terminal rate forecast of 3.25-3.5%." source : goldmansachs, reuters

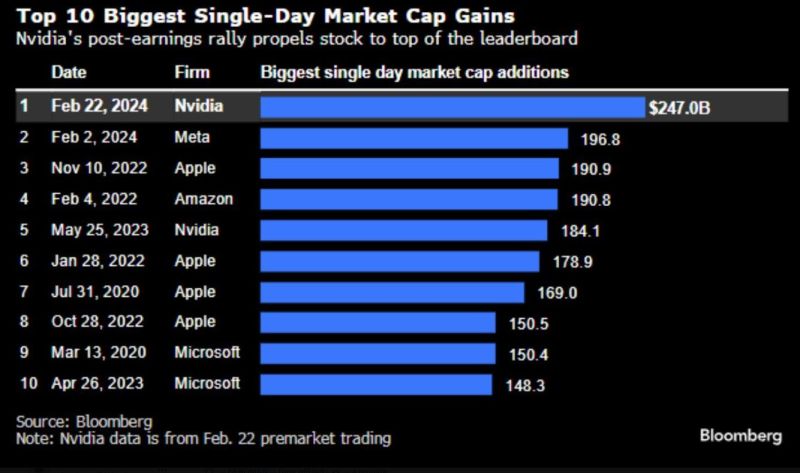

Nvidia has added nearly $250 billion in market cap so far today.

This puts the stock on track to post the biggest single-day market cap gain in stock market history. The previous record? -) Meta, 20 days ago ... source : The Kobeissi Letter, bloomberg

China to send more pandas to US

China's Wildlife Conservation Association is working with the National Zoo in Washington in an arrangement that could bring more pandas back to the United States, signalling improving diplomatic relations between the two superpowers. China has lent its beloved bears to zoos in various countries over the years as goodwill animal ambassadors and also fostered a modern Sino-U.S. "panda diplomacy" with the gesture.Back in November, the National Zoo in Washington returned three pandas to China as part of a more than 50-year-old legacy, leaving Georgia's Zoo Atlanta as the only one in the U.S. with a giant panda program. Source : reuters

Investing with intelligence

Our latest research, commentary and market outlooks