Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

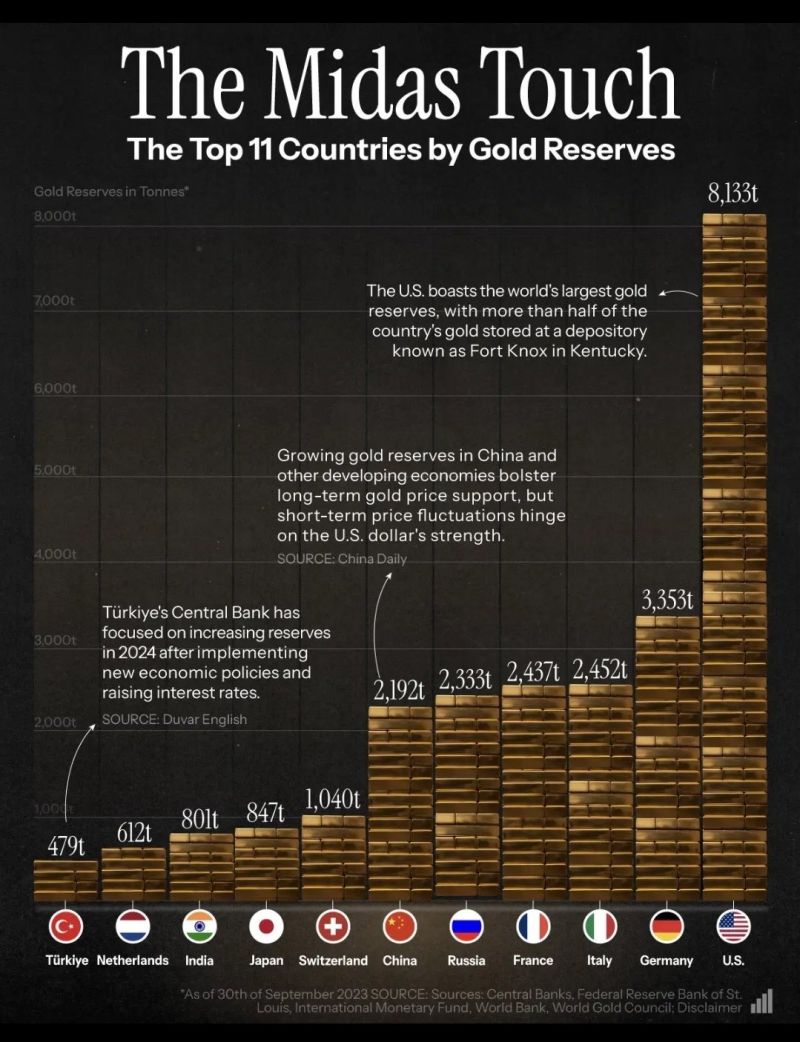

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Reddit made its IPO filing public ahead of a planned stock market debut in March.

It also disclosed $90.8 million in losses and revenue growth of roughly 21% in 2023. REDDIT IPO STATS: Ticker: $RDDT Exchange: NYSE Deal size: $100m (we est. $750m) Mkt Cap: Est. ~$5+ billion Annual Sales: $804m Net Loss: -$91m IPO Timing: Est. mid-March

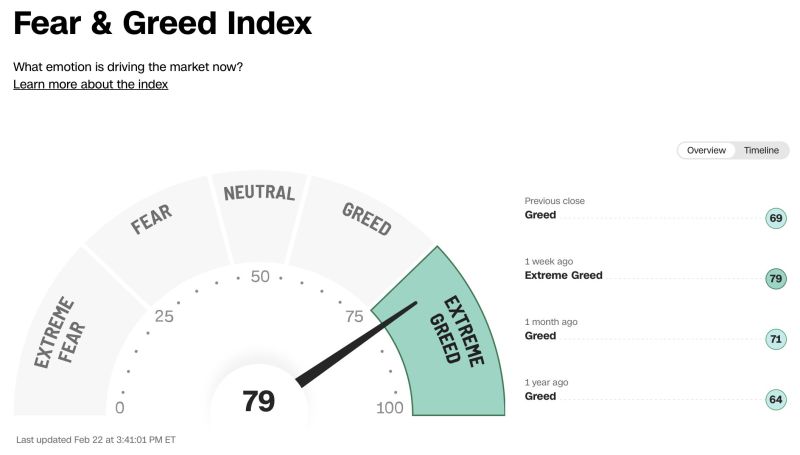

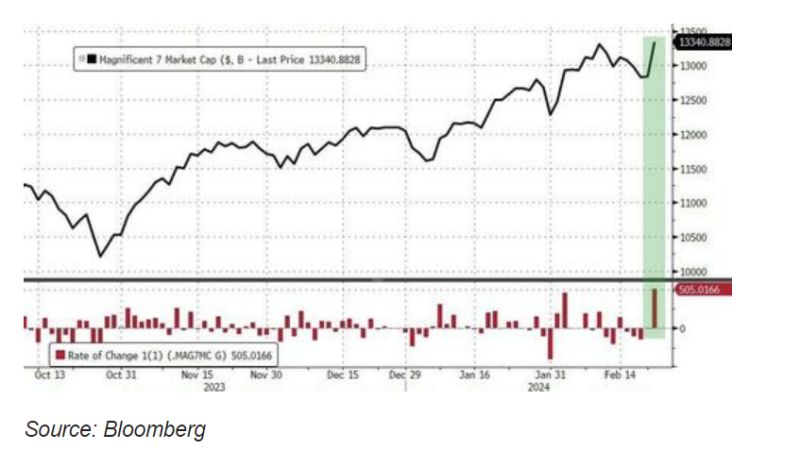

A record day on Wall Street: MAG7 stocks added over $500BN today to a new record high, second only to 11/10/22's explosion higher driven by AAPL...

And all that market cap gain was driven by a $2.1BN 'guide-up' on nvidia Q1 revenue... $NVDA stock is up +$277BN today, adding the most market cap in a single-day ever - up $277BN...That is 2 Goldmans, half a JPMorgan, or a whole Netflix or Adobe added in a day...And as goes NVDA, so goes the entire stock market with Nasdaq leading the charge (up 3%) and the S&P up over 2%. Small Caps lagged with a mere 0.75% gain... Source: www.zerohedge.com

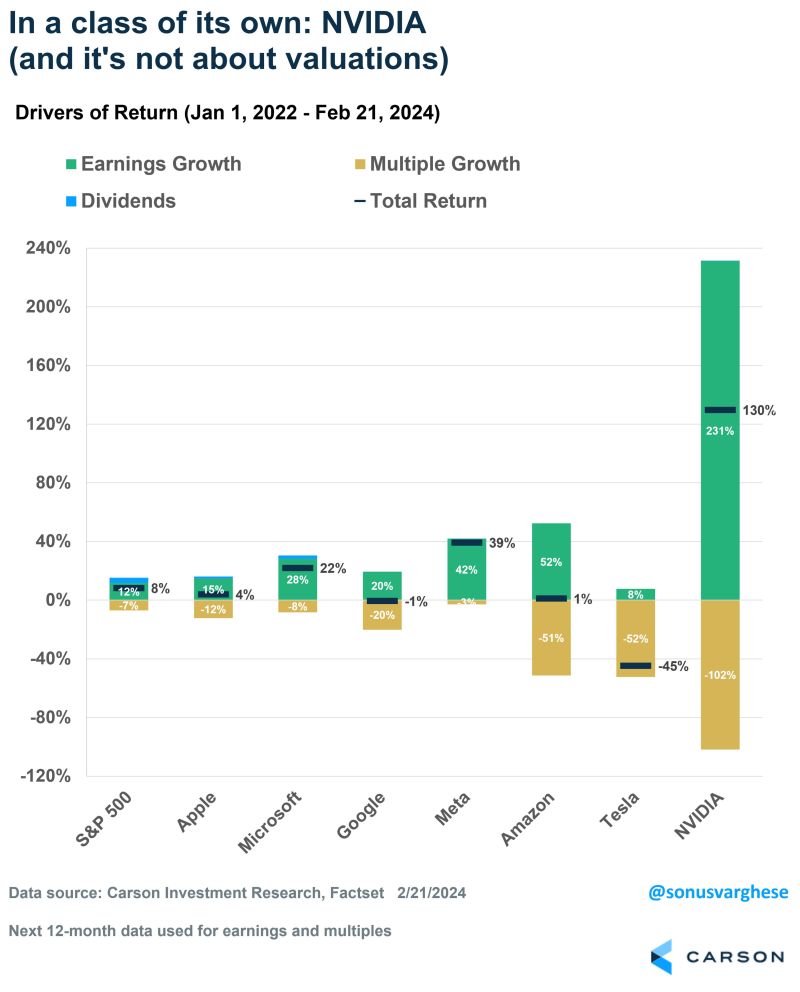

Are Mag7 stocks in a bubble?

No doubt, in some ways they are really pricey BUT as shown by this work from Sonus Varghese on this important question, fundamentals justify to some extent their dominance. Since 2021, NVDA stock is up 130%, yet earnings are up 231%. And other Mag 7 names are similar... Source: Carson, Ryan Detrick

The chart is a log graph of $1 invested in the S&P 500 in the year 1950 by Personal Finance Club.

They listed all of the market crashes that were 15% or more. They removed the Y-axis, but it shows $1 growing to over $1,000! Note that there were many -10% corrections over the period but that only -15% and worse are listed below

Nvidia, $NVDA, has added nearly $250 billion in market cap so far today.

This puts the stock on track to post the biggest single-day market cap gain in stock market history. The previous record? It was Meta, $META, just 20 days ago after reporting their quarterly earnings. Nvidia is now just 5% away from being the third US company with a $2 trillion+ market cap. Big tech stocks are getting bigger. Source: The Kobeissi Letter, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks