Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

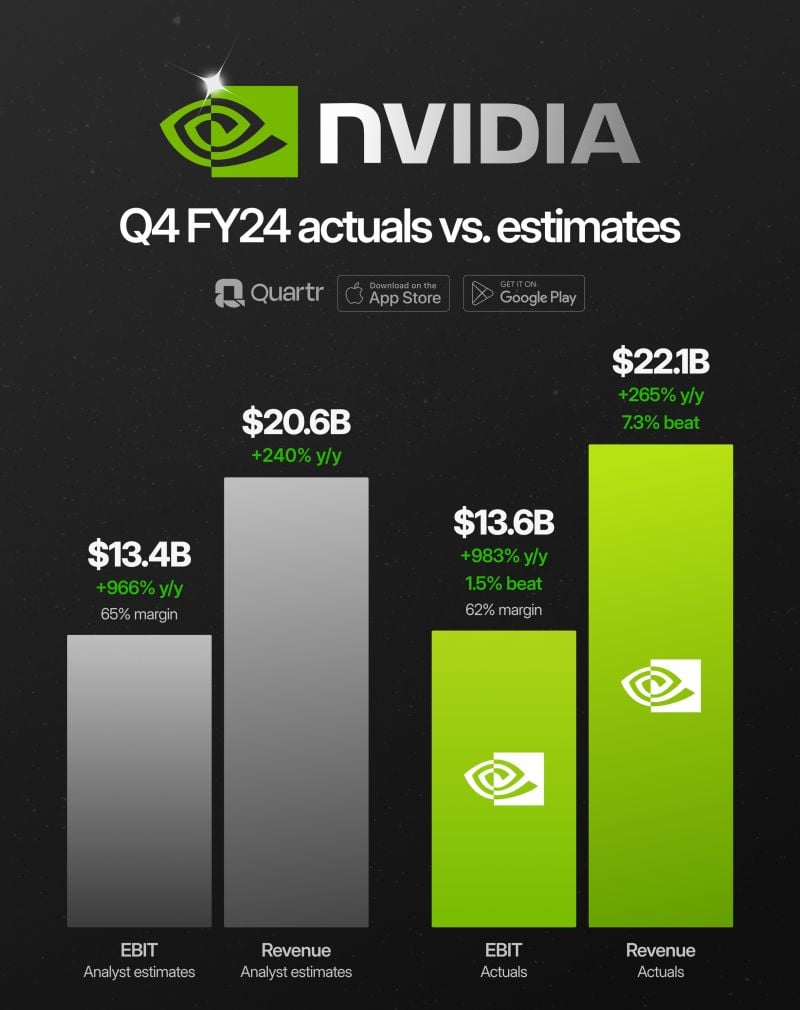

Nvdia results are out - $NVDA beats in revenue & earnings - the stock is up more than 8% after hours.

"Accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries and nations." – Co-founder & CEO, Jensen Huang Nvidia reported fourth fiscal quarter earnings that beat Wall Street’s forecast for earnings and sales, and said that revenue during the current quarter would be better than expected, even against elevated expectations for massive growth. Revenue +265% *Data Center +409% *Gaming +56% *Professional Vis. +105% *Automotive -4% EBIT +983% *marg. 62% (21) EPS +765% Source: Quartr

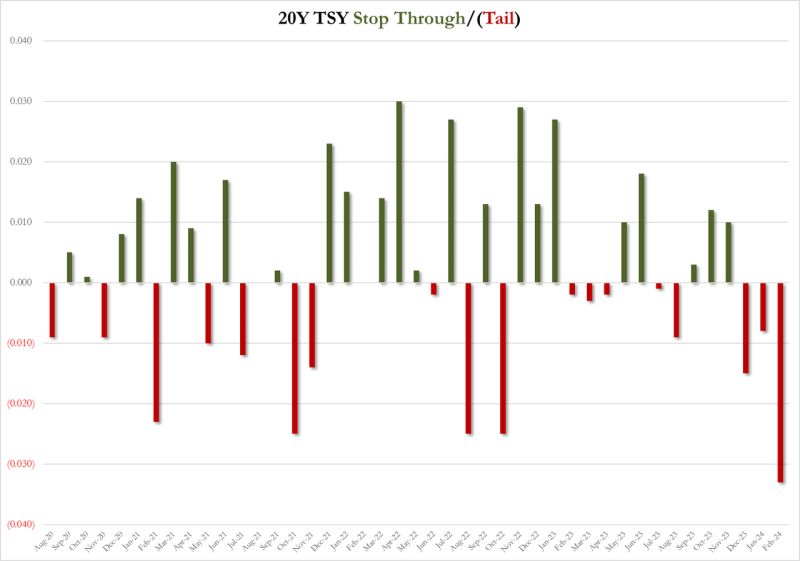

US yields surged after terrible 20Y Auction with biggest tail on record.

The high yield of 4.595% was well above last month's 4.423% but worse, it tailed the yields that prevailed when it was issued (4.562%) by a whopping 3.30bps, which was the biggest tail on record for the tenor since the 20Y auction was introduced in May 2020. The bid to cover tumbled to 2.39, down from 2.53, well below the 2.59 six-auction average, and was the lowest since August 2022. The internals were even uglier, with Indirects awarded just 59.08%, lower than last month's 62.16%, sharply lower than recent average of 68.2% and the lowest since May 2021. And with Directs taking down 19.7%, Dealers were left holding 21.2%, the most since May 2021. Overall this was a very ugly auction, perhaps one can attribute it to nerves from today's FOMC Minutes which however should be a non-event as they are already rather dated and do not reflect the latest reflationary spike. In any case, yields promptly spiked with the 10Y rising as high as 4.325% before retracing some of the move, which also sent stocks sliding briefly before recovering. Source: www.zerohedge.com

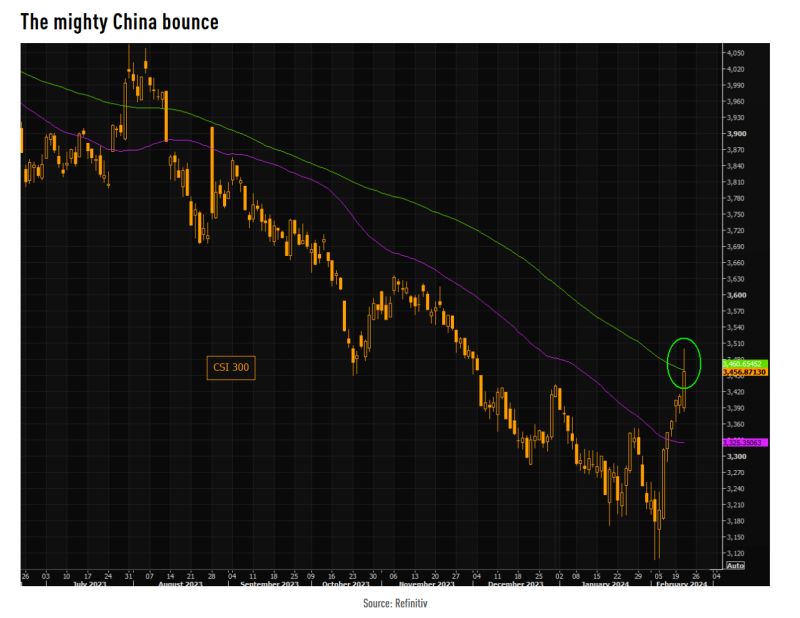

CSI 300 is up some 11% from early Feb lows.

The index is well above the 50 day, and touched the 100 day for the first time since last summer. Source: TME

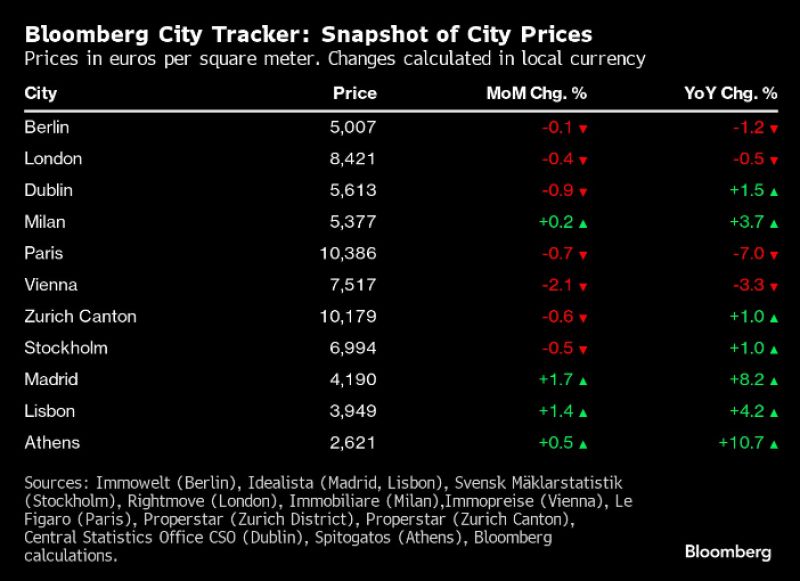

Bloomberg city tracker European major cities

Berlin’s housing slump is over as shortage lures investors. The prospect of higher rents in the German capital is countering the downward pull of financing costs. Berlin rents jumped 20% YoY in Q4, faster than national average of 7.7%. As a side note, Athens' price jump is quite interesting Source: HolgerZ, Bloomberg

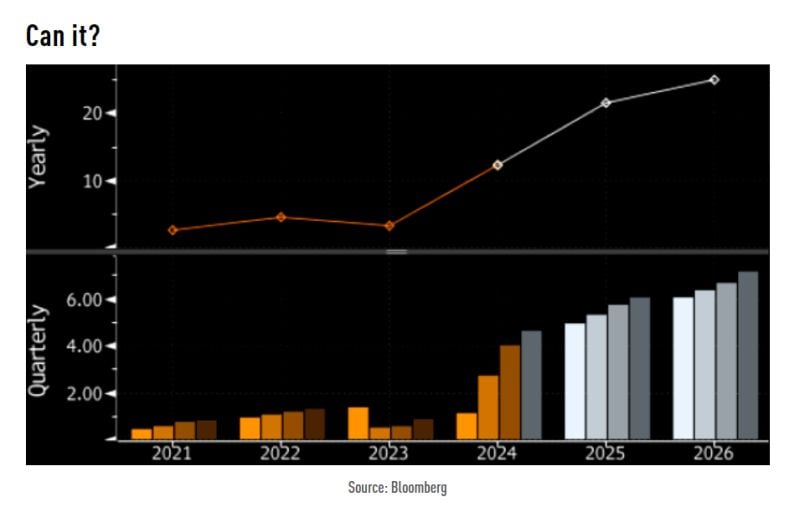

nvidia $NVDA EPS growth projections (grey) aren't modest...

Source: TME, Bloomberg

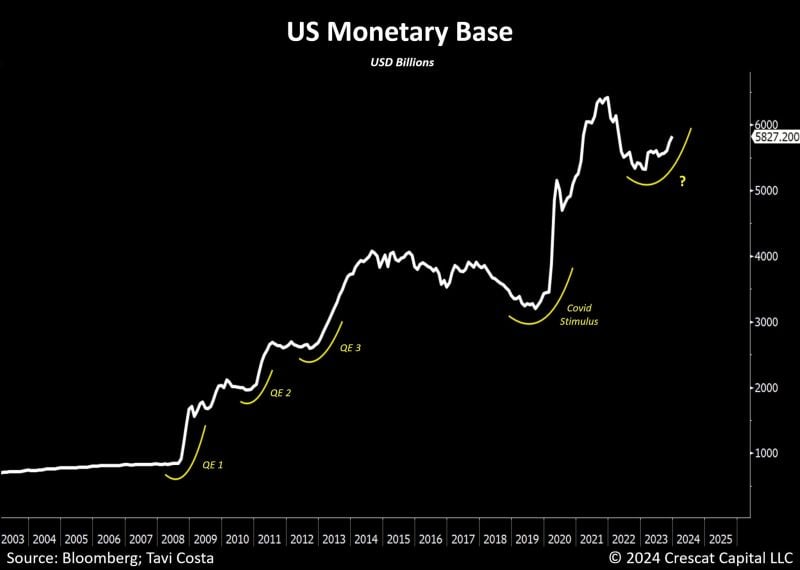

The US monetary base has been rising significantly recently.

In the last 12 months alone, there has been a rise of $420 billion, primarily fueled by bank reserves. While the Fed should not classify this as QE due to mechanical differences, it seems to echo the patterns of previous periods of monetary stimulus following the Global Financial Crisis. The economy (and markets) are addicted to liquidity. Source: Bloomberg, Tavi Costa

Investing with intelligence

Our latest research, commentary and market outlooks