Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

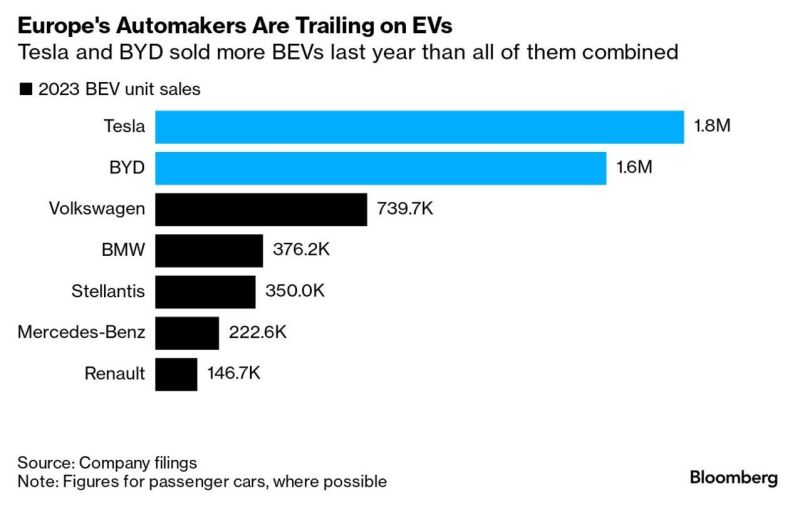

What‘s wrong with Europe in one chart.

These European companies have been in the automotive business for decades. Why are they so painfully slow to adapt to new reality? Source: Michel A.Arouet, Bloomberg

Nvidia options signal nearly $200bn swing after earnings.

Prices for short-term calls and puts imply a 10.6% move in the chipmaker’s shares on Thursday. Source: Bloomberg, HolgerZ

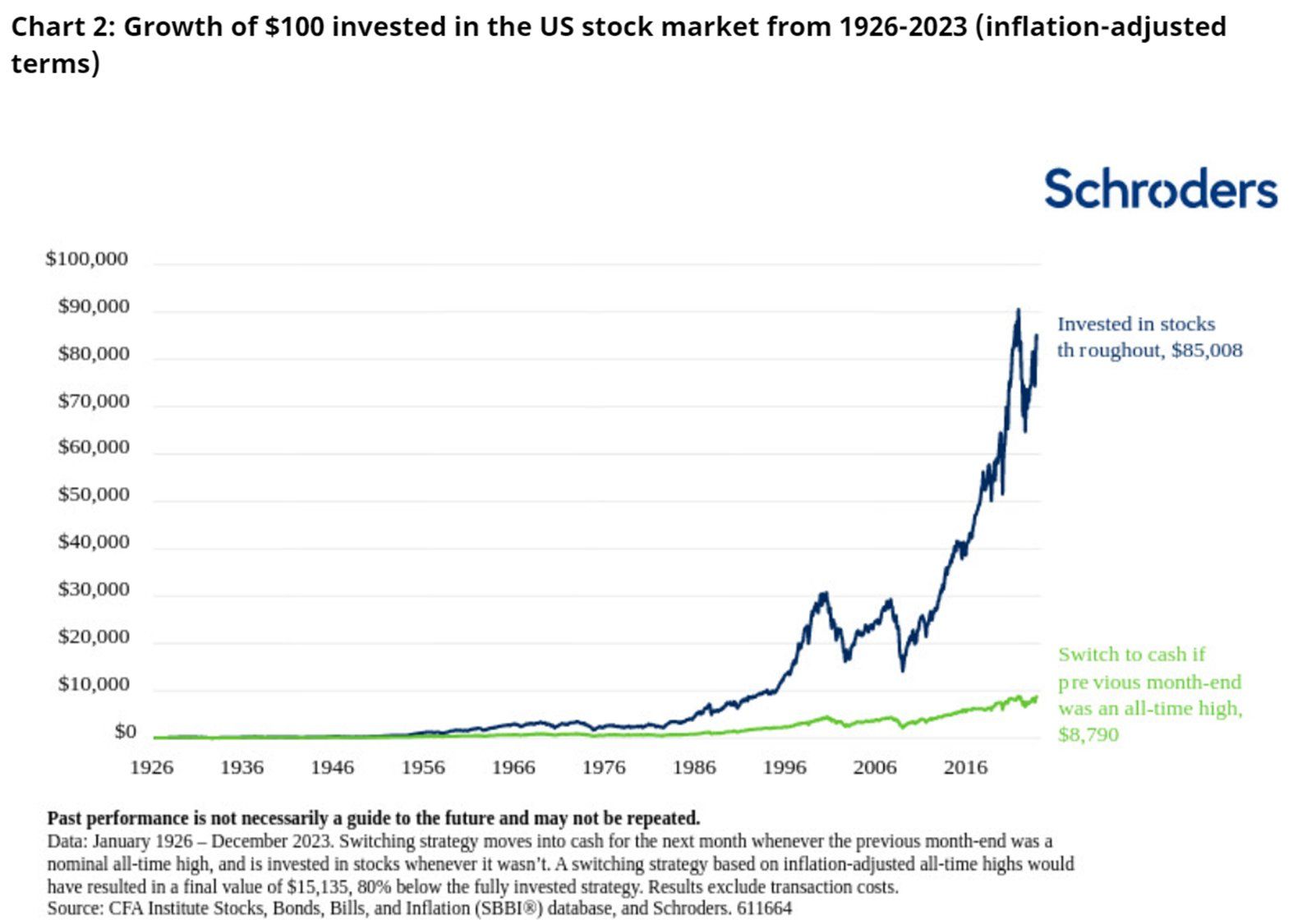

Should you exit equities (or avoid investing into equities) when they hit all-time high?

The answer is 'NO'. Returns have been higher than average, following all-time highs. More importantly, exiting at all-time highs is disastrous for your return! Massive chart by Duncan Lamont / Schroders thru Jeroen Blokland.

Nvidia : Place Your Bets

Nvidia is expected to report earnings Today after market close. Wall Street consensus for adjusted Q4 EPS is $4.60 a share, up more than 700% from 65 cents a year ago. Q4 revenue is expected to be $20.43 billion. A miss in earnings or lower forward guidance is likely to cause a wave of profit taking in the technology sector and drag the broader market with it. A stronger than expected report could add fuel to upward momentum and draw in more investors who are already experiencing some degree of FOMO from the stock’s dazzling performance. Nvidia stock price is up 46.6% so far in 2024, adding to its 238% gain in 2023. Source : forbes

UBS hikes its S&P 500 target to 5,400, highest on Wall Street

UBS raised its S&P 500 year-end target for the second time in little over a month, from 5,100 to 5,400. It argues that hot inflation driven by strong demand is actually positive for stocks. The new target, which is roughly 9% above current levels, is the highest on Wall Street. Source : ubs

Visualizing the Most Valuable Brands in 12 Countries

At the start of 2024, Apple was found to be the world’s most valuable brand, with a value of $517 billion—a 73.6% increase over the previous year. China may have 20 brands in the top 100, but South Korea’s Samsung trumps it for second place outside of the U.S. with a value of $99 billion. Overall, Asian brands have attained significant value in recent years. China’s TikTok (along with its domestic counterpart, Douyin) is well known all around the world and had a value of $84 billion, while Japan’s Toyota and Saudi Arabia’s Saudi Aramco had brand values of $53 billion and $42 billion respectively. Europe’s most valuable brand is Germany’s Deutsche Telekom at $73 billion, while French luxury fashion house Louis Vuitton had a value of $32 billion. source : visualcapitalist

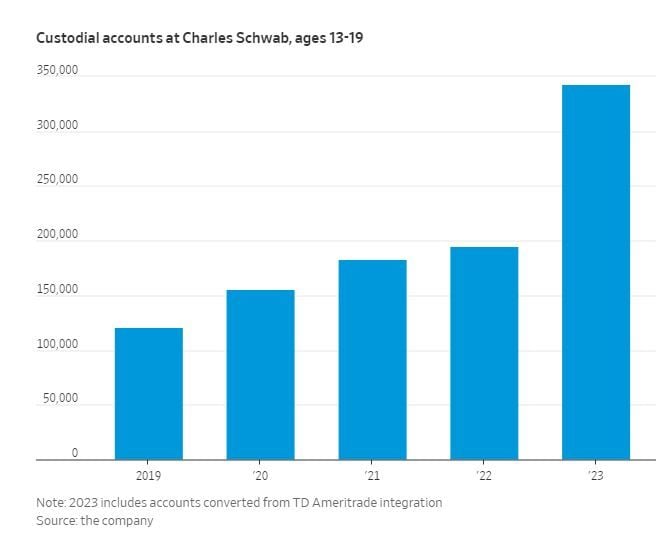

Teenagers are jumping into the U.S. stock market

A Fidelity study on teens and money recently estimated that about a quarter of teenagers in the U.S. have started investing, based on an online survey of 2,081 respondents ages 13 to 17. Trades placed using Fidelity’s Youth app, an account opened by parents but owned by teens, jumped in the fourth quarter. Many young investors are starting to invest earlier than previous generations did. Almost two-thirds of Gen Z investors said they first started learning about investing in high school or middle school, compared with about 38% of millennials in a 2023 Bank of America survey of affluent individuals. Some are introduced to stocks through family members or teachers, while others have turned to social media. source : wsj

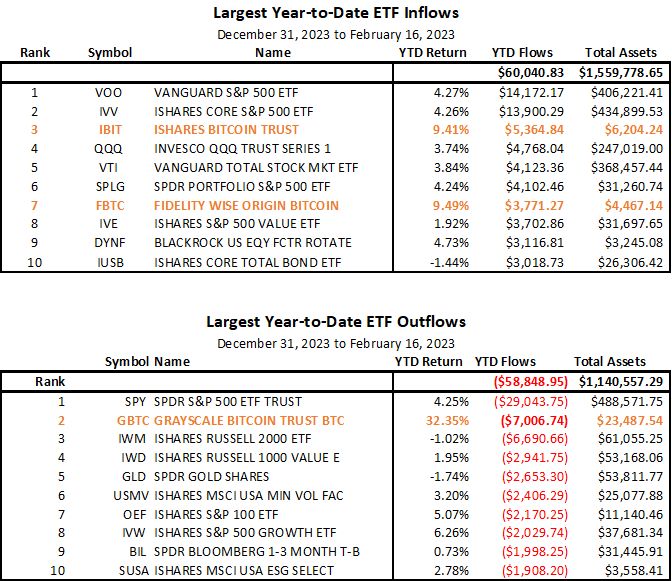

Here are the top 10 ETFs with the most inflows (top) and outflows (bottom) for all 4,500 US ETFs.

Inflows IBIT is #3 and FBTC is #7 Outflows GBTC is #2 And remember, the spot BTC ETFs started trading on January 11! Source: Bianco Research

Investing with intelligence

Our latest research, commentary and market outlooks