Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

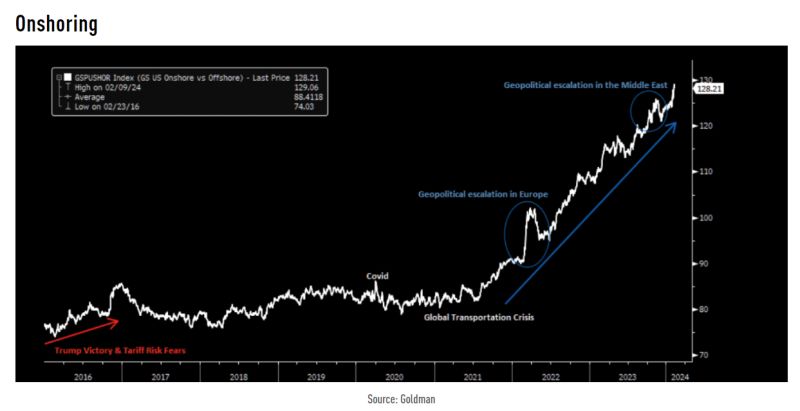

China and US elections reiterate the durability of the onshoring theme.

Source: Goldman Sachs

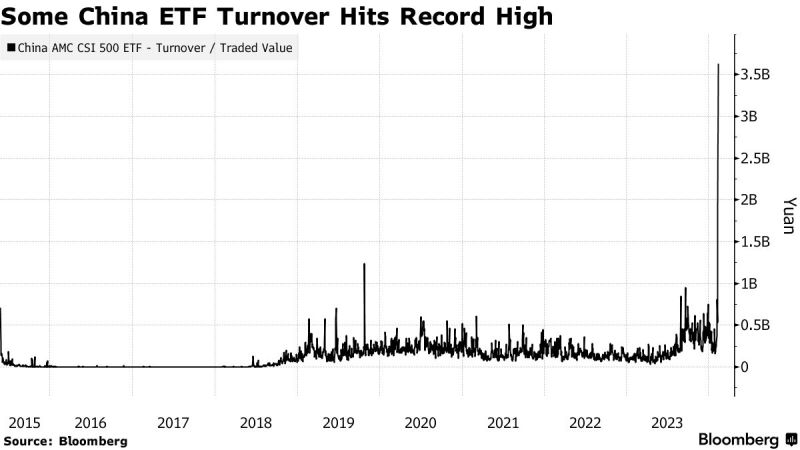

China’s National Team Is Back at Work as Stock Trading Resumes – Bloomberg

Several exchange-traded funds in China tracking the nation’s stocks saw a surge in turnover on the first trading day after the Lunar New Year holiday, a likely sign that state-backed funds continue to support the market. Traded values of China AMC CSI 500 ETF and Harvest CSI 500 ETF both surged to records, while those of Tianhong CSI 500 ETF, BOC International CSI 500 ETF and CIB CSI 500 ETF were higher than their average levels.

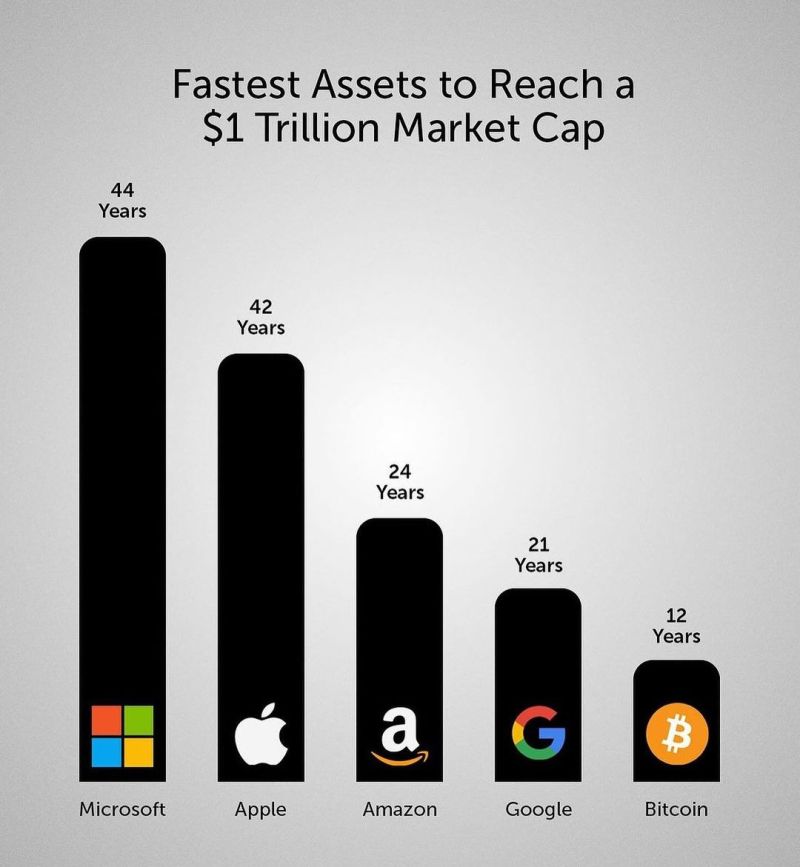

Bitcoin became fastest assets to reach a $1 Trillion Market Cap🚨

Source: bitcoinlfgo

BREAKING: LEGENDARY HEDGE FUNDS MILLENNIUM MANAGEMENT AND TWO SIGMA HAVE MASSIVELY INCREASED THEIR JD.com $JD STAKES

THEY NOW OWN TOGETHER $275M IN THE STOCK Source: Daily Compounding

Direct foreign investment into China slumps to 30y low.

Foreign firms only added $33bn to their FDI liabilities, the lowest since 1993, indicating a lack of confidence Source: Bloomberg, HolgerZ

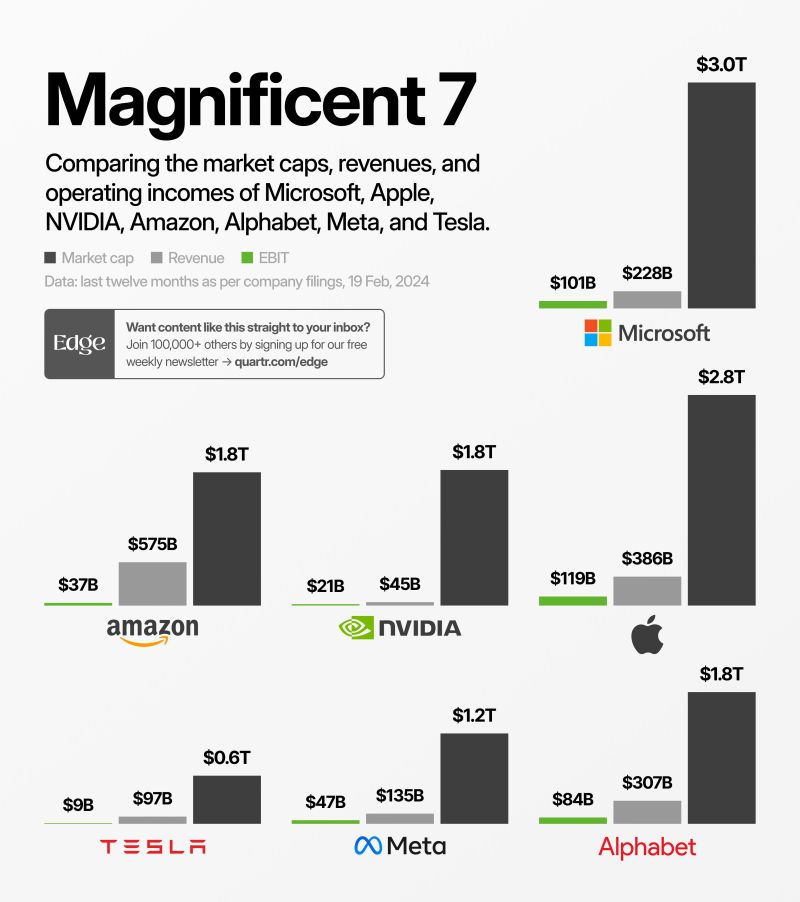

Visually comparing the market caps, revenues, and operating incomes of the so-called "Mag 7".

Looking at these numbers, what stands out to you the most? Source: Quartr

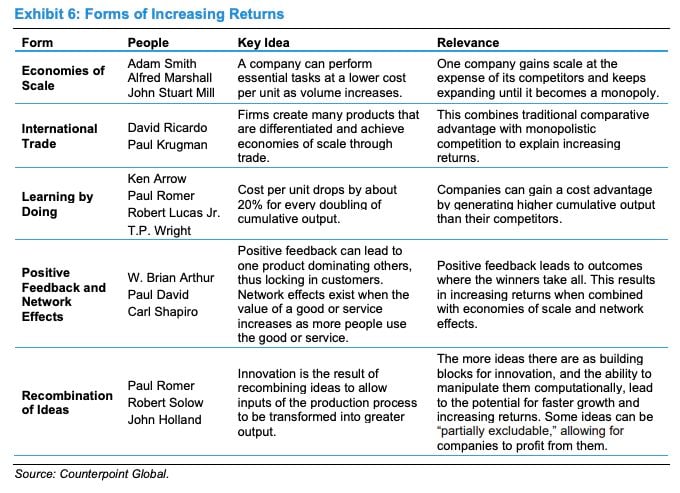

Five Forms of Increasing Returns by MJ Mauboussin - Morgan Stanley

1) Economies of Scale 2) International Trade 3) Learning by Doing 4) Positive Feedback/Network Effects 5) Recombination of Ideas Source: Brandon Beylo on X

Investing with intelligence

Our latest research, commentary and market outlooks