Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

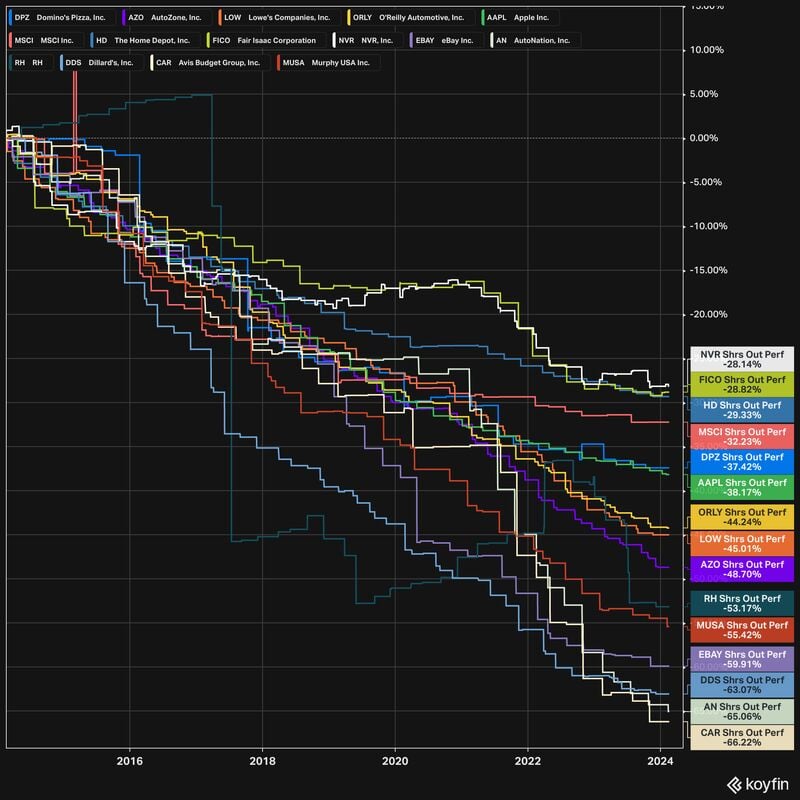

Warren Buffett loves share cannibals.

"The math isn't complicated. When the share count goes down, your interest in the businesses goes up. Every small bit helps if repurchases are made at value-accretive prices". Source: Koyfin Charts

Shopping online at 2 a.m.?

Americans shopping online after midnight often make riskier transactions and are more likely to default on their loans, according to Affirm. The fintech firm uses the hour a consumer attempts a transaction as a key data point to help determine whether to approve loans. Other factors include a user’s repayment history with Affirm and transaction data from credit bureau Experian. “Human beings don’t make the best decisions at two o’clock in the morning,” Affirm said. “It’s clear as day — credit delinquencies spike right around 2 a.m.” While the data is clear that late-night financial decisions are riskier, the reasons for it are less so. source: cnbc, affirm

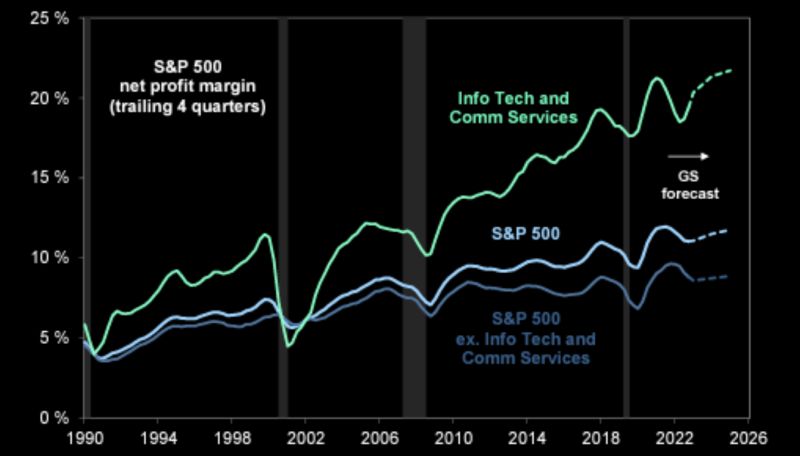

Goldman Lifts S&P 500 Target to 5,200 on Profit Expansion

Goldman now sees the S&P 500 rising to 5,200 by the end of this year, raising his forecast by about 2% from the 5,100 level he predicted in mid-December. The new target implies a 3.9% jump from Friday’s close. Goldman’s 5,200 price target for the S&P 500 in 2024 is now among the highest on Wall Street, joining the ranks of Wall Street bulls. source : gs

Hmmmmm... Observations that provoke thought ?

One of these companies sells chips that power the world and the other sells sweatshirts to teenagers and young adults. source : kofin, tme

According to GS, Index margins excluding “Tech” will only expand modestly in 2024.

source : gs, tme

Reminder

U.S. markets are closed Tomorrow, Monday, Feb. 19, in observance of Presidents Day. The NYSE, Nasdaq and bond markets will be closed. The next market holidays will be Friday, March 29, for Good Friday, followed by Memorial Day on Monday, May 27.

Investing with intelligence

Our latest research, commentary and market outlooks