Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Nvidia's red-hot rally to start 2024 has pushed many Wall Street analysts to adjust their targets

at least 5 firms hiking price targets on the artificial intelligence-darling this month. This week, UBS lifted its target to $850 from $580, Mizuho raised its target to $825 from $625. Demand for Nvidia’s H100 AI accelerators continues to outstrip supply, Mizuho’s Vijay Rakesh wrote in a client note, calling the stock the best AI play. Source: Bloomberg, HolgerZ

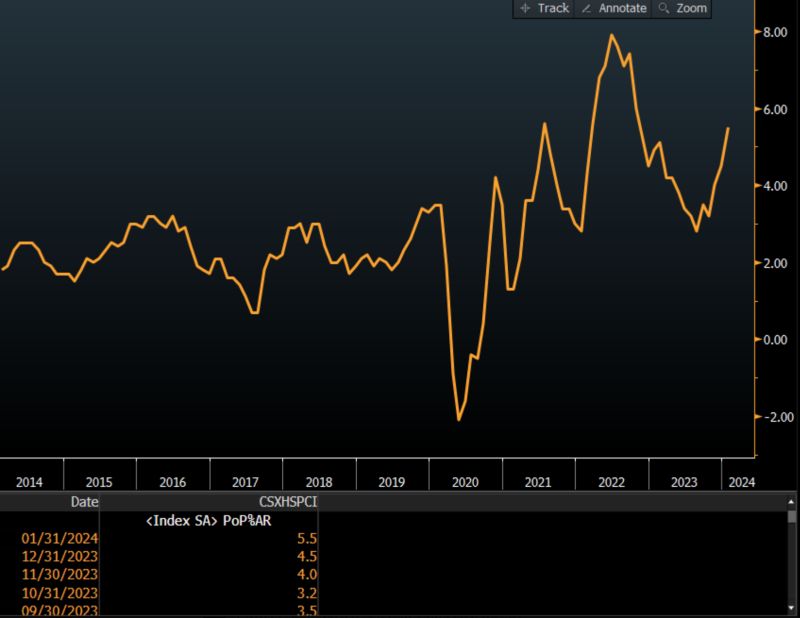

Another look at yesterday's inflation report by MacroAlf.

This chart shows supercore inflation - a measure of sticky inflationary pressures Powell & Co often refer to: - It slowed down vertically towards ~3% until the end of last year - But since then it has now accelerated rapidly to 5.5%! Source: MacroAlf

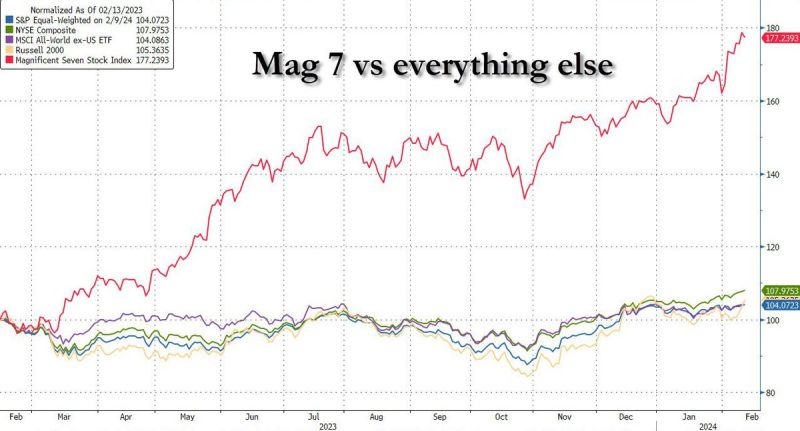

Since February 2023:

1. Magnificent 7: +77% 2. S&P 500: +20% 3. Russel 2000: +5% 4. S&P 500 Equal Weight: +4% If you remove the Magnificent 7 from the S&P 500, the index is barely up 5% over the last year. Source: The Kobeissi Letter

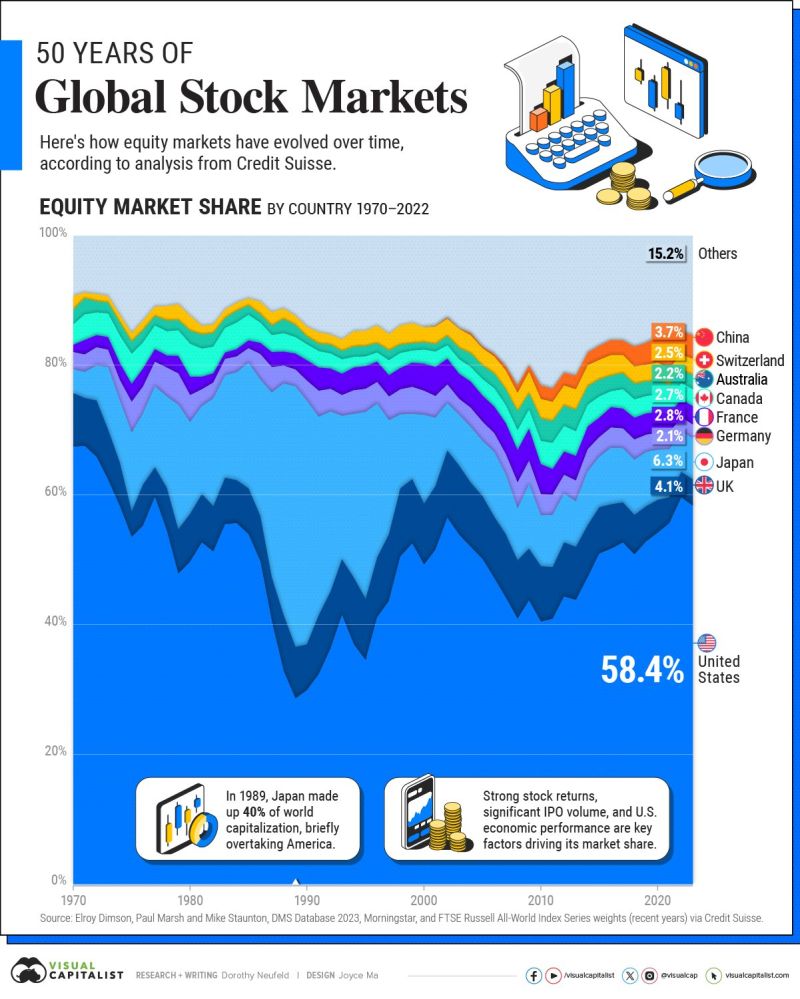

Ranked: The Largest Stock Markets Over Time, by Country (1970-Today)

Source: Visual Capitalist

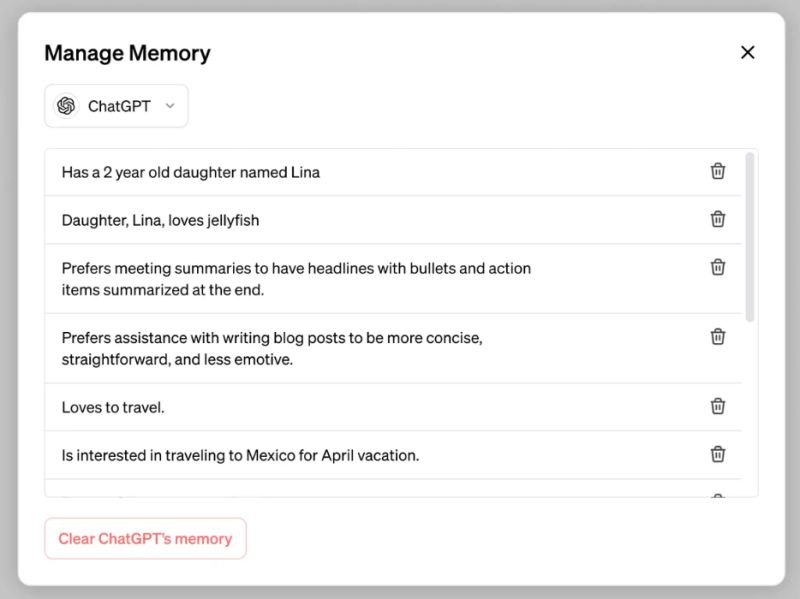

ChatGPT will create a digital memory to help personalize its responses

OpenAI is adding a feature that will allow ChatGPT to remember both information about individual users and how they want the chatbot to respond to different types of queries. The feature is rolling out to a small number of free and paid ChatGPT Plus subscribers. OpenAI says the memory feature will be made available to business customers once the company is ready to broadly release the feature. An incognito-like mode will be available allowing people to conduct queries without drawing on memories. source : axios

Investing with intelligence

Our latest research, commentary and market outlooks