Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

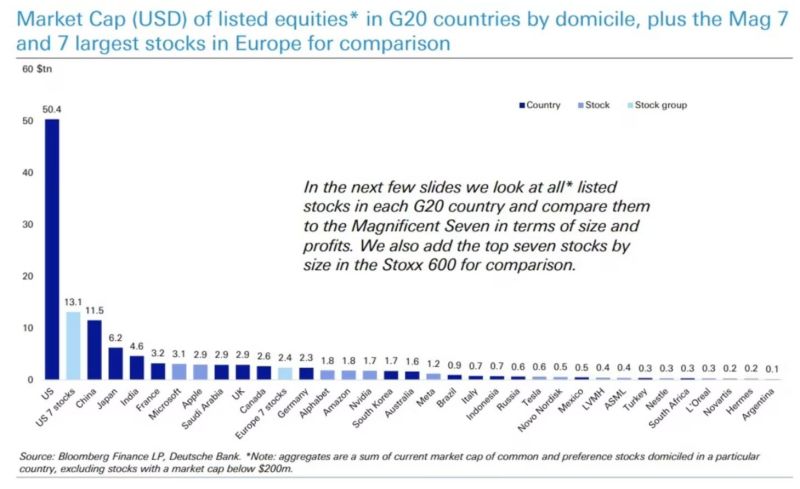

The Magnificent Seven now have a higher market cap than the entire stock markets of Japan, France, the United Kingdom and Mexico COMBINED!

source : barchart

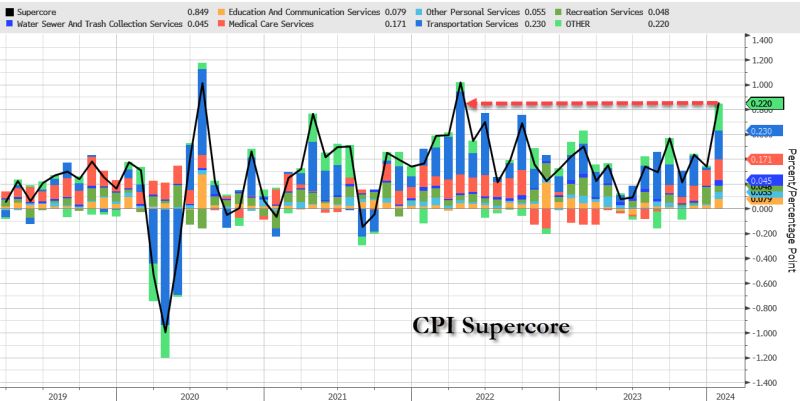

Headline CPI and Core CPI came out hotter than expected. SuperCore is the hottest since May 2023

-> Headline CPI: o Consumer prices rose 0.3% MoM (more than the 0.2% expected), driving the YOY change to 3.1% YoY versus 2.9% expected. Still, the decline from the +3.4% shows the disinflation trend is in place o Under the hood, food and Energy services costs jumped MoM along with transportation services -> Core CPI: o The index for all items less food and energy rose 0.4% MoM in January, the biggest jump since April 2023. The shelter index increased 0.6% MoM in January and was the largest factor in the monthly increase in the index for all items less food and energy. o Core CPI fell below 4.00% YoY for the first time since May 2021, but the +3.86% YoY print was hotter than the 3.7% expected. -> SuperCore CPI: o Core CPI Services Ex-Shelter index soared 0.7% MoM (the biggest jump since September 2022), driving the YoY change up to +4.4% - the hottest since May 2023 (see chart below). Our take: The disinflation trend remains in place. However, the “easy part” of the disinflationary process is behind. Buoyant final demand might sustain some upward pressures on prices. This data raises the odds that the Fed will stay put in March. Source: Bloomberg, www.zerohedge.com

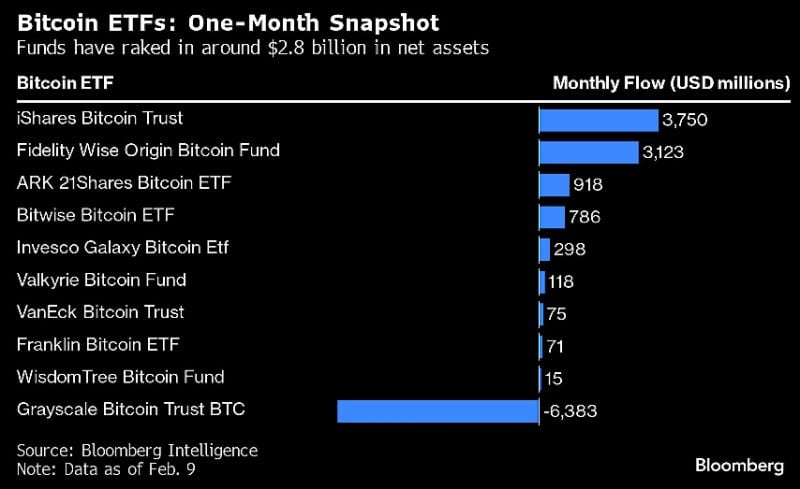

Bitcoin spot ETF launch will be remembered as a major commercial success.

There’s been over 5500 ETF launches in history. NEVER before has an ETF reached $3 Billion AUM in less than 30 days… until now. Both Blackrock and Fidelity’s Bitcoin spot ETFs have just done it. A month after the SEC approval, investors have poured a net $2.8bn into Bitcoin ETFs. Gear up for a Bitcoin FOMO rally to all-time highs, Bernstein's Chhugani says: The market priced in the ETF approval news quickly, but has not priced in the ETF inflows and the upcoming supply crunch. Chhugani believes that the money is still coming from the ‘believers’, who have discovered an easy way to get Bitcoin in their broker accounts via the ETFs. "The disbelievers stay on the sidelines, and based on our investor conversations, we feel that the early interest we are getting is from new curious investors, not yet deployed, but intrigued enough to learn about Bitcoin. The ETF has added a sense of legitimacy, so far missing in the crypto sector. We expect many of these new Bitcoin enthusiasts to allocate capital in the coming days and we think Bitcoin ETFs/Bitcoin miners could benefit, in that scenario". Source: Bloomberg, HolgerZ

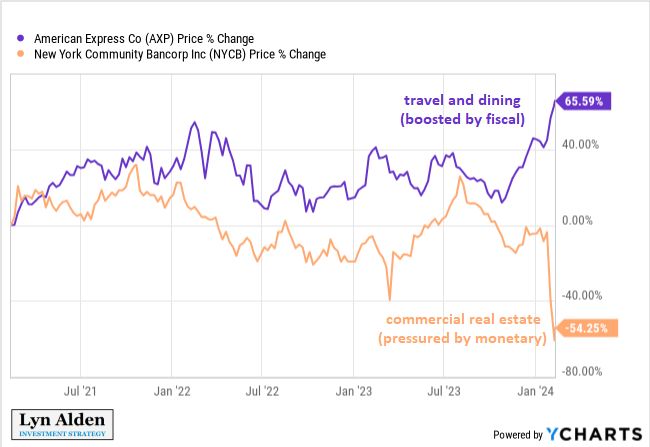

Great comment by Lyn Alden about the impact "FISCAL DOMINANCE" on sector performance divergence...

Bottom-line: go LONG Fiscal deficits receivers and go SHORT Fiscal deficit payers (i.e interest-rate sensitive sectors) "The wider-than-normal divergence between loose fiscal policy (which is stimulating) and tight monetary policy (which slows things down) contributes to wider-than-normal divergence between the performance of different economic sectors. It results in a wider-than-normal gap between sectors that are directly or indirectly on the receiving side of the deficits (eg business that rely on spending from upper and upper-middle class spenders) vs those that are the most sensitive to interest rates and thus are the most hurt by tight monetary policy (eg commercial real estate). And because some sectors of the economy are doing great partially due to the fiscal stimulus, it makes it unlikely that monetary policy or other assistance will arrive to the weaker areas any time soon. And ironically, because public debt levels are high, tight monetary policy *contributes* to looser fiscal policy by increasing the overall interest expense of the government, which goes to various entities in the economy and strengthens some of the sectors that are not sensitive to interest rates. This is a condition known as fiscal dominance". Lyn Alden

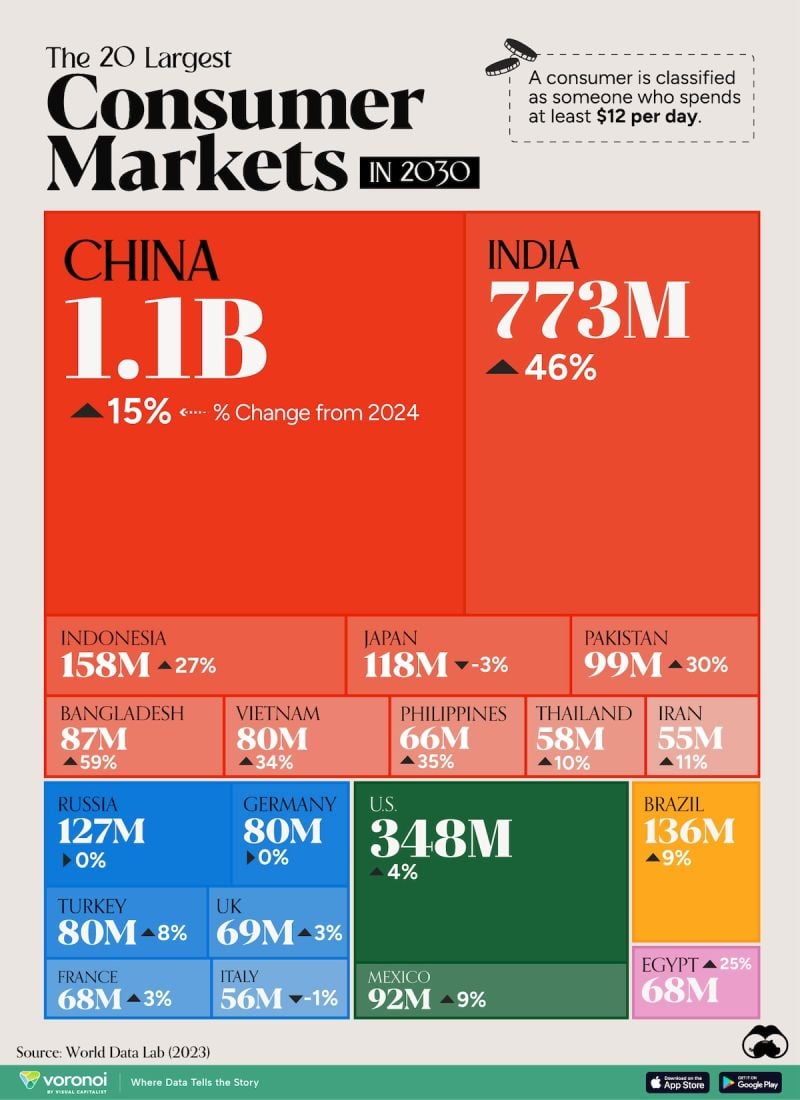

The World’s Largest Consumer Markets in 2030 🌏

Source: Visual Capitalist

In Case You Missed It: On February 8th the Wall Street Journal reported that OpenAI CEO Sam Altman wants to raise up to $7 trillion

For a “wildly-ambitious” tech project to boost the world’s chip capacity, funded by investors including the U.A.E. — which in turn will vastly expand its ability to power AI models. To put numbers in perspective: $7 TRILLION is around ~10% of global GDP…Or the combined market cap or BOTH Microsoft & Apple. That means he wants to totally reshape the global semiconductor industry. By the way, where will all the energy needed come from? Source: VB, Creative Capital, WSJ

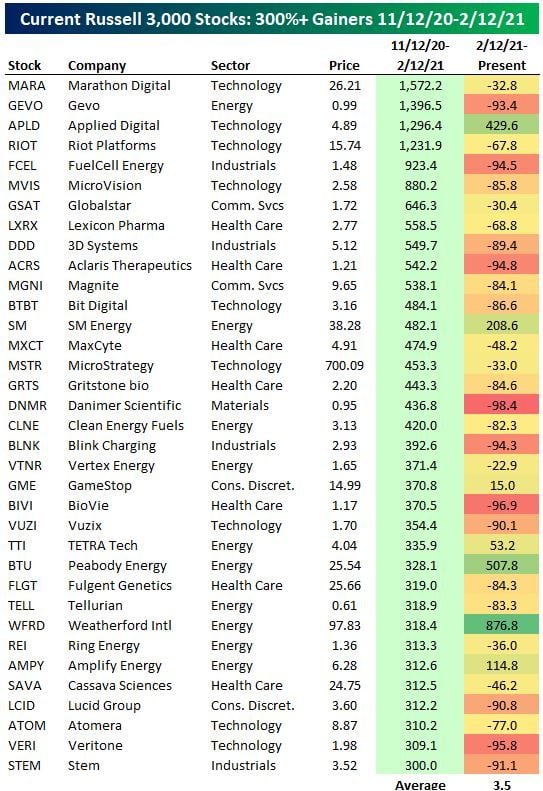

Meme Stock Anniversary

Three years ago today, the "meme-stock mania" that saw hundreds of profitless stocks surge hundreds of percent in a matter of months hit its ultimate peak. In the three months leading up to February 12th, 2021, the average stock in the Russell 3,000 (current members) rallied 40%, but there were 178 stocks that saw three-month rallies of more than 100%, 35 stocks that rallied 300%+, and four stocks that rallied over 1,000%. Below is a table of the 35 stocks currently in the Russell 3,000 that rallied 300%+ in the three months leading up to 2/12/21( include also how each of these stocks has performed since 2/12/21) source : bespoke

Investing with intelligence

Our latest research, commentary and market outlooks