Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

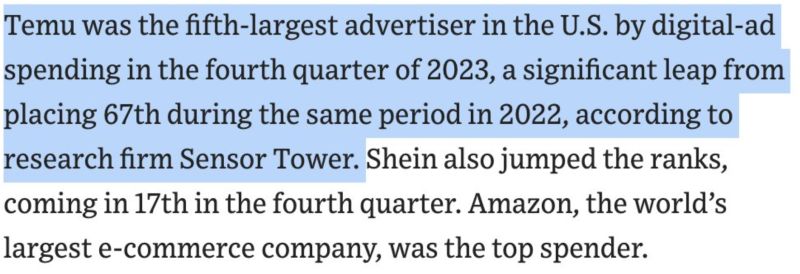

The Spend, Spend, Spend Strategy..

Temu is going all in on Marketing (including in this Sunday’s Super Bowl) Marketing spend: • 2023 - $1.7 billion • 2024 - $3 billion (est.) source : wsj

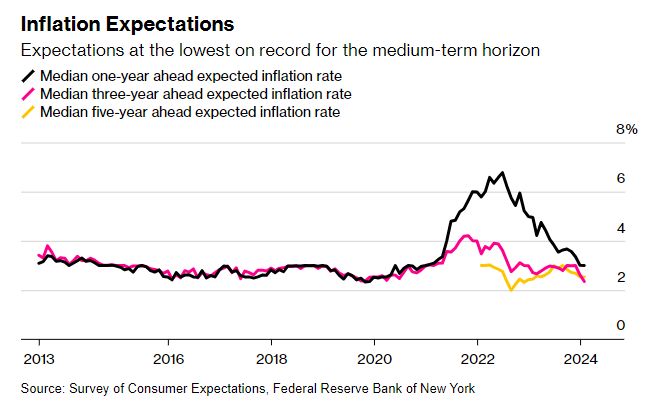

Has the fed won the party?

US Medium-Term Inflation Expectations Lowest in 11 Years of Data – Source: Bloomberg

THE SILENT BULL MARKET...

Japanese stocks index Nikkei 225 closes up 1066.55 points and within striking distance of all time high 38957! It briefly crossed the 38,000 mark for the first time since the asset bubble burst in 1990 as it rallied about 3% and pushed 34-year highs. In times of financial repression aka negative real rates, real assets go up. January PPI came weaker than expected (+0.0% m/m vs. 0.1% expected) Futures going higher still: Nikkei 38110 Source chart: IG

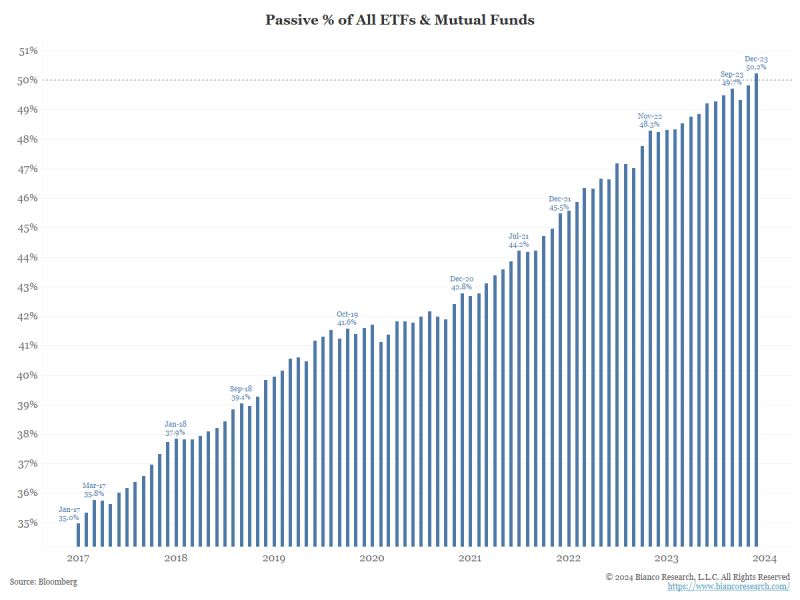

According to Bloomberg's estimates, passively managed money just exceeded 50% of all assets.

Money management just crossed the Rubicon. Source: Bianco Research

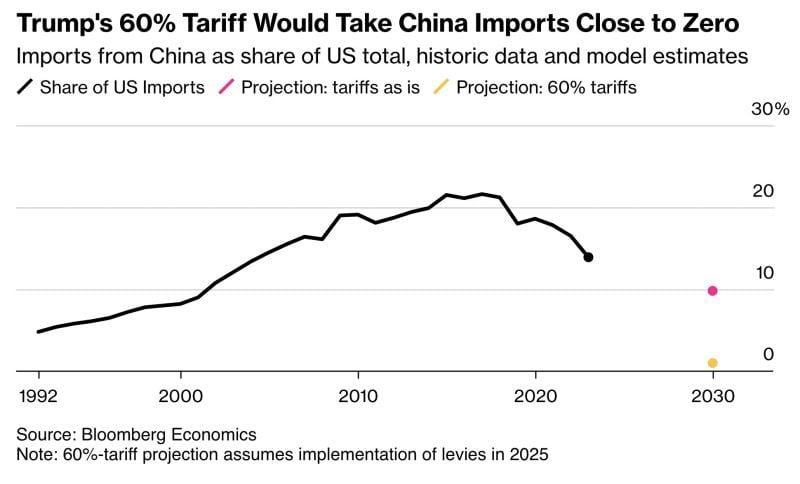

Donald Trump is pitching a 60% tariff on all Chinese imports.

That would shrink a $575bn trade pipeline to practically nothing, Bloomberg analysis shows. For China ’s economy and its slumping stockmarket — down >40% from its 2021 high — that’s bad news. Worse, Trump’s rhetoric may add pressure on Biden to take harsher measures in the run-up to election day Source: HolgerZ, Bloomberg

Jamie Dimon believes U.S. debt is the ‘most predictable crisis’ in history

And experts say it could cost Americans their homes, spending power and national security - Fortune Source: Markets & Mayhem

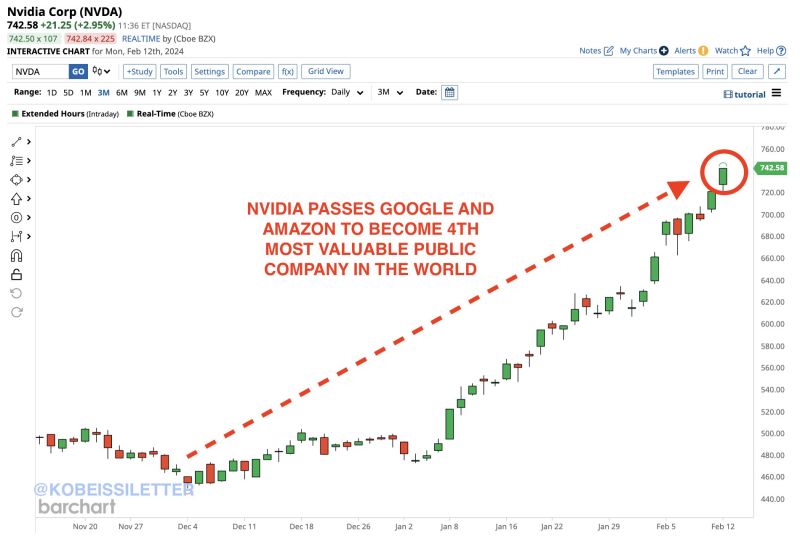

BREAKING: Nvidia, $NVDA, is now the 4th most valuable public company in the world, worth $1.84 trillion.

Today, Nvidia's market cap passed both Google and Amazon for the first time in history. Since January 1st, Nvidia has officially added $650 BILLION in market cap. That's more than the entire value of Tesla in less than 6 weeks. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks