Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Google pledges 25 million euros to boost AI skills in Europe

Google opens new tab has pledged 25 million euros ($26.98 million) to help people in Europe learn to use artificial intelligence (AI). Announcing the funding on Monday, the tech giant said it had opened applications for social enterprises and nonprofits that could help reach those most likely to benefit from training. The firm will also run a series of “growth academies” to support companies using AI to scale their companies and has expanded its free online AI training courses to 18 languages. The data centre will be located in the town of Waltham Cross, about 15 miles (24.14 km) north of central London. source : reuters

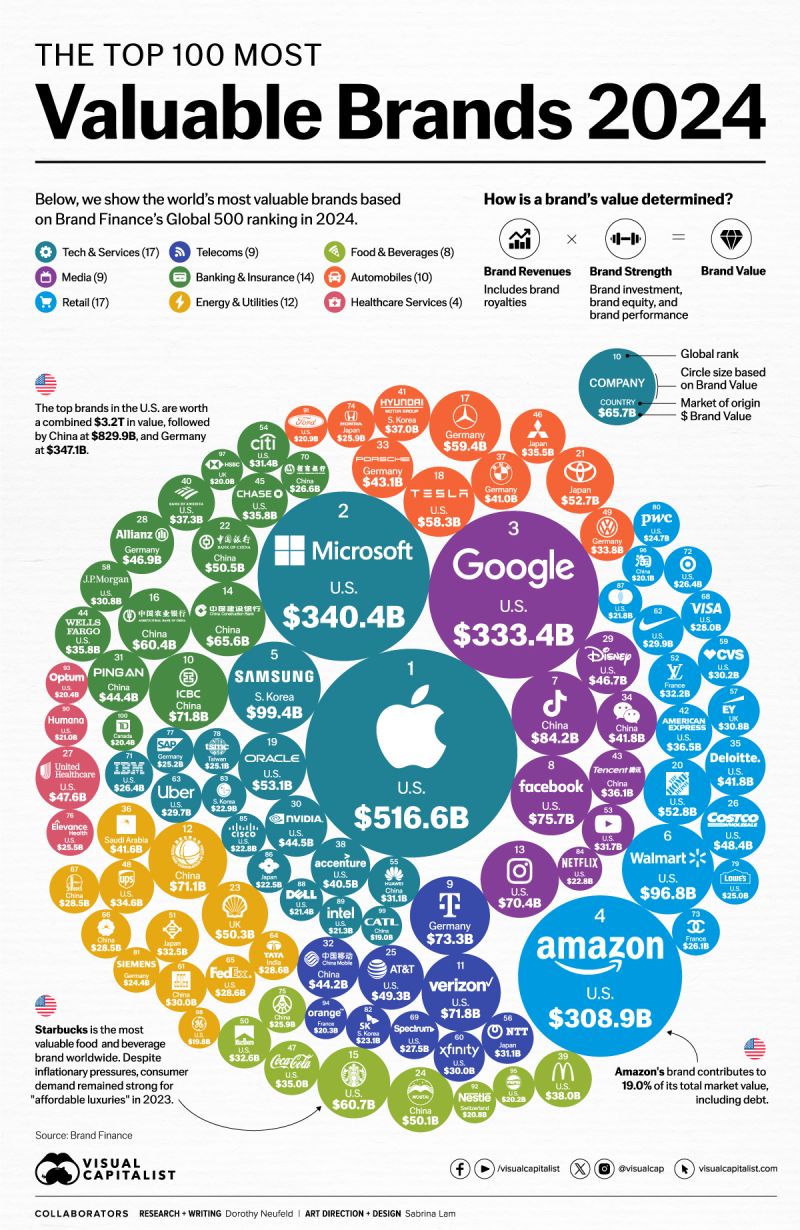

The 100 Most Valuable Brands in the World are Worth more than $5 Trillion

source : visualcapitalist

Freedom's Triumph

On February 11th, 1990, after spending 27 years in prison for his anti-apartheid activities, Nelson Mandela was freed. His release marked a pivotal moment in South African history, foreshadowing the end of a system of racial discrimination in the country. Mandela's leadership and commitment to equality led to his election as South Africa's first black president in 1994, laying the foundation for the country's democratic transformation.

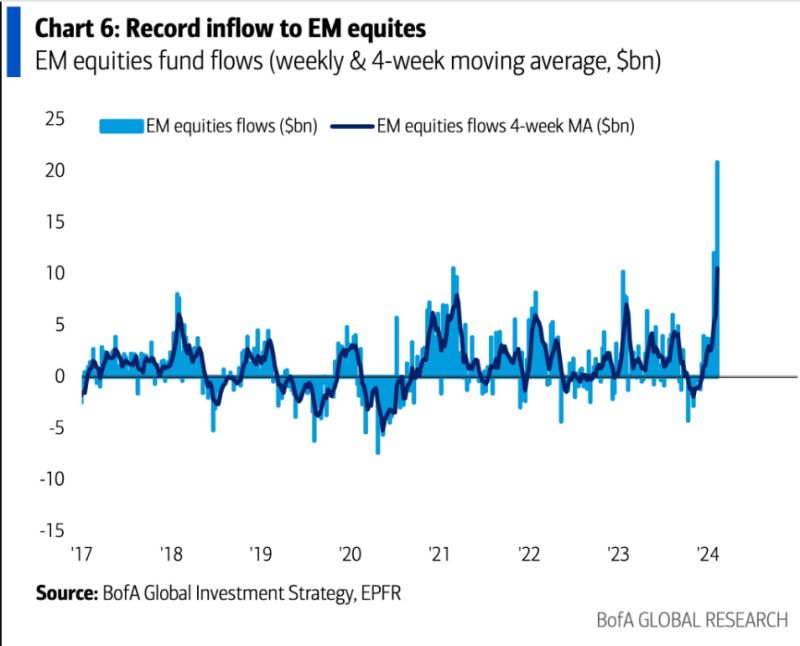

Record inflow to EM equities

Emerging Market Stocks see a weekly inflow of $20.8 billion, the most in history source : BofA, barchart

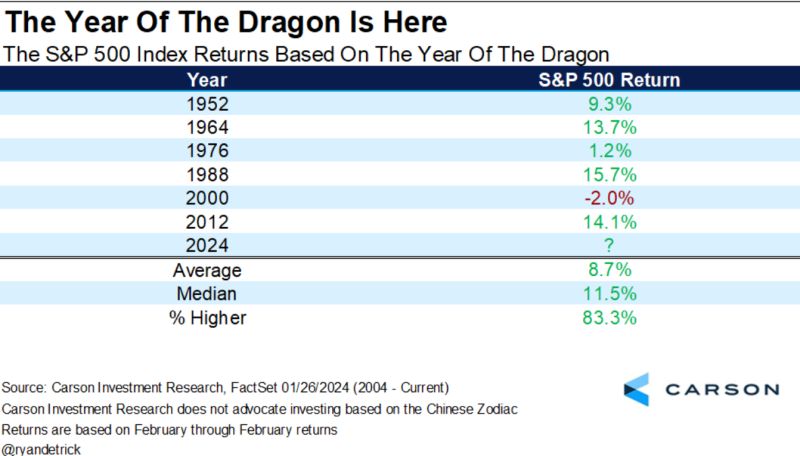

The S&P500 Index Returns Based on the Year of the Dragon

source : carson

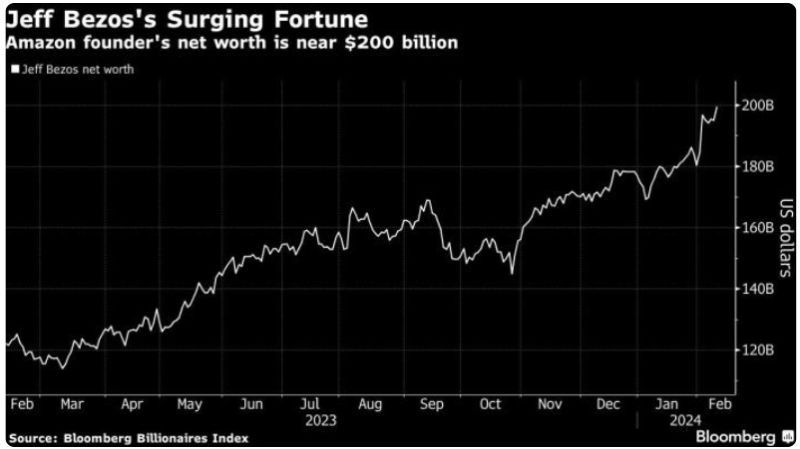

Bezos Sells $2 Billion of Amazon Shares in First Major Stock Sale Since 2021

Jeff Bezos unloaded 12 million shares of Amazon.com Inc. this week, the first time the billionaire has sold the company’s stock since 2021. The Amazon founder has sold over $30 billion in shares since records going back to 2002, including about $20 billion combined in 2020 and 2021. He has primarily been gifting stock, including shares worth roughly $230 million that were given to nonprofit organizations in November. source : yahoo!finance, bloomberg

All-Time Highs

BRK.A and BRK.B both hit new all-time highs on Monday, Tuesday, and Wednesday. The Class A shares also rose above $600,000 for the first time ever. source : keja

Investing with intelligence

Our latest research, commentary and market outlooks