Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

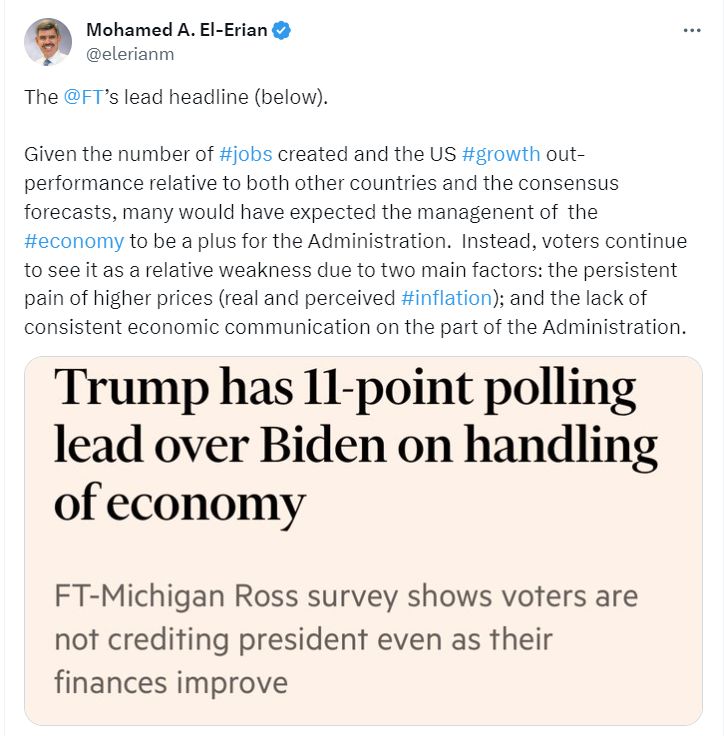

In an US election year, the spread between “Job Creation” and job “approval rating on the economy” has NEVER been wider...

Source: Mohamed A. El-Erian

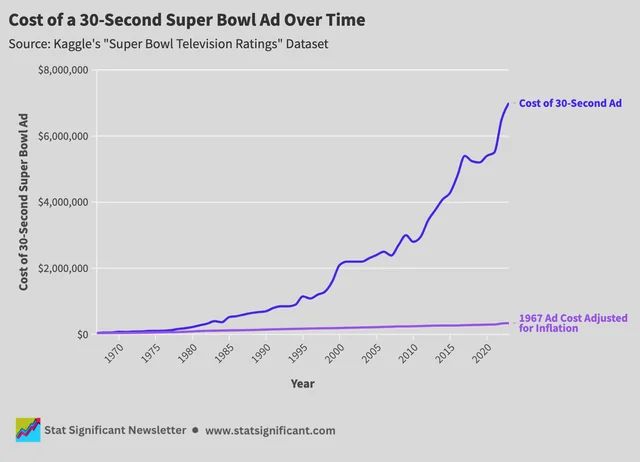

Happy Super Bowl Sunday!

Here's the cost of a 30-second ad over time, handily beating inflation over the last 50+ years Source: Markets & Mayhem

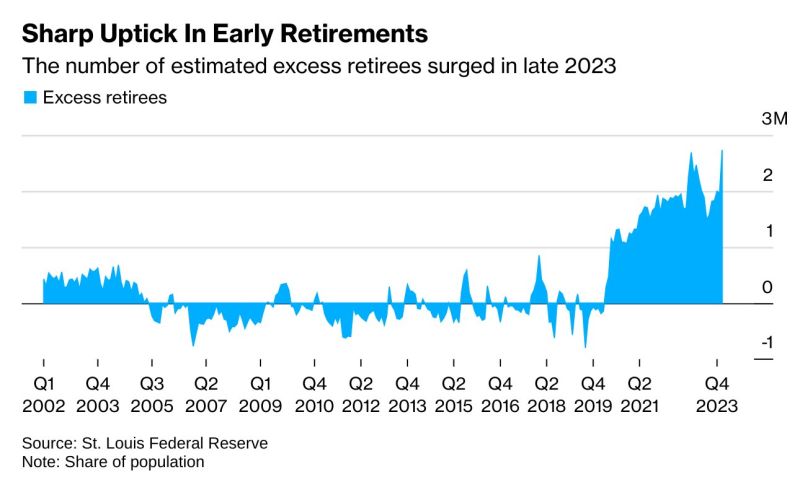

Another wave of early retirements is hitting as the stock market surges

This complicates the Fed's goals for the labor market to some degree, as it means there are more exiting the workforce. There's already 1.45 jobs available for every unemployed person seeking work. Source: Bloomberg, Markets & Mayhem

The negative correlation between the us dollar with stocks (and other risk assets) has been strong for quite some time.

Meanwhile, US Dollar Index Futures are up every single week this year. Has this relationship now changed, or is the unwind about to come? Source: JC Parets

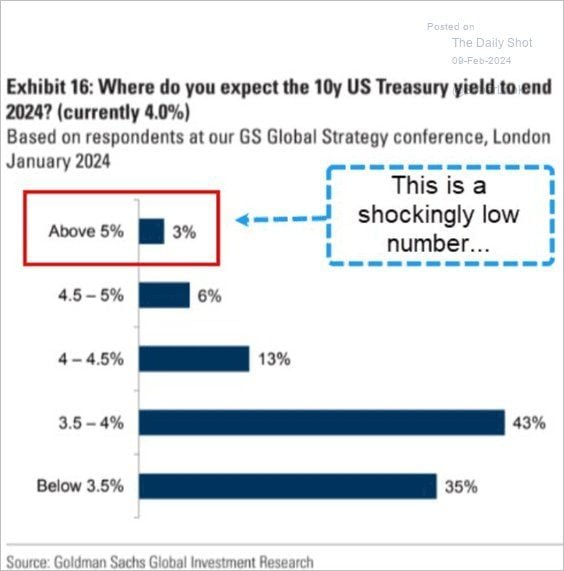

Are investors too complacent on the 10-year us treasury?

Investors expect 3% treasuries at year-end Source: Win Smart, CFA, BofA, The Daily Shot

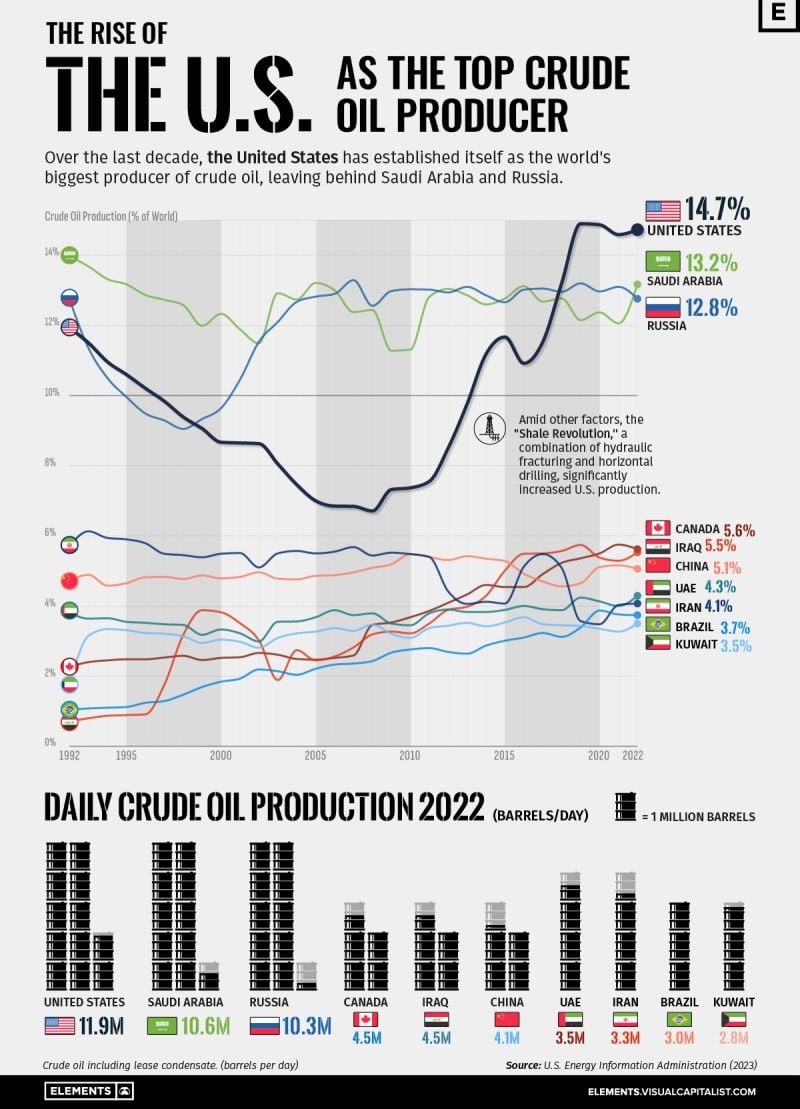

Visualizing the Rise of the U.S. as Top Crude Oil Producer 🛢️

Source: Visual Capitalist

Investing with intelligence

Our latest research, commentary and market outlooks