Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

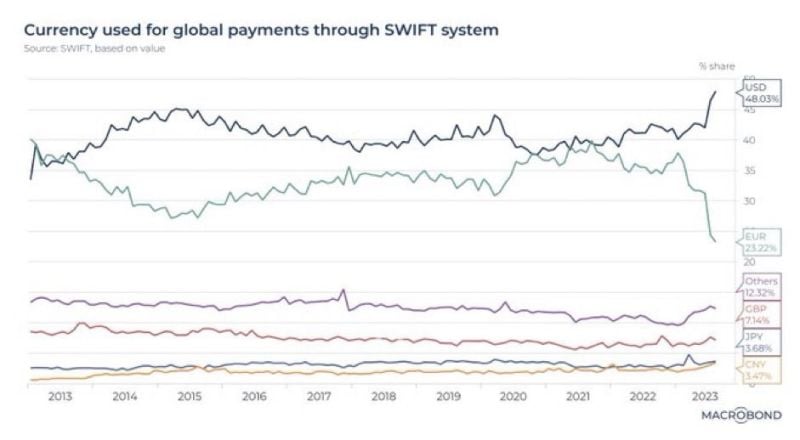

The U.S. Dollar is currently used in more than 48% of international payment transactions, the highest level in more than a decade.

USD isn’t going away anytime soon 🇺🇸. Source: Barchart, Macrobond

The rally on Wall Street has meant that US equities now have a weighting of ~70% in the popular MSCI World index.

That is a record. The risk is correspondingly high if US equities go out of fashion. Source: Bloomberg, HolgerZ

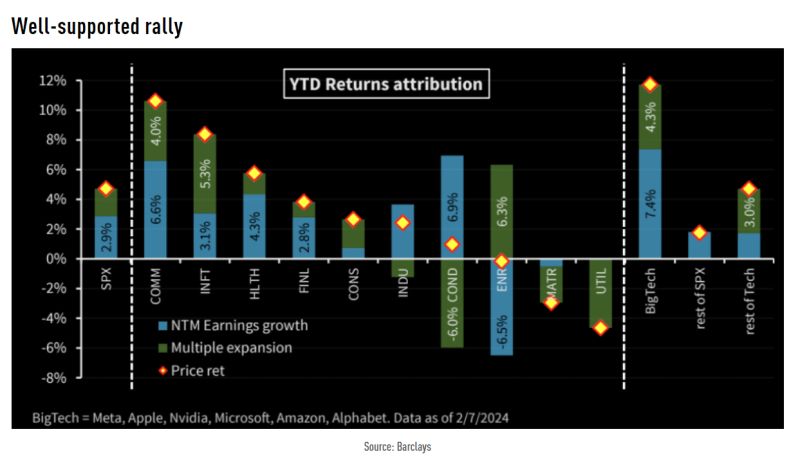

The us equity rally is being supported by better NTM earnings as well as multiple expansion, the latter driven mostly by Tech.

Source: Barclays, TME

Only 6 weeks into 2024, and the S&P 500 and other indexes have already reached new ATH's.

With the S&P up 5.38% YTD and the Nasdaq showing a 6.75% increase, let's see which stocks are the outperformers so far 1. $SMCI - Super Micro Comp - 160.4% 2. $ARM - ARM - 53.3% 3. $NVDA - Nvidia - 45.7% 4. $PLTR - Palantir - 42.0% 5. $CLFT - Confluent - 35.6% 6. $APPF - AppFolio - 34.9% 7. $META - Meta - 32.2% Source: KoyfinCharts Note: only companies with Mcap >$5B and an Altman Z-Score >3. No biotech companies.

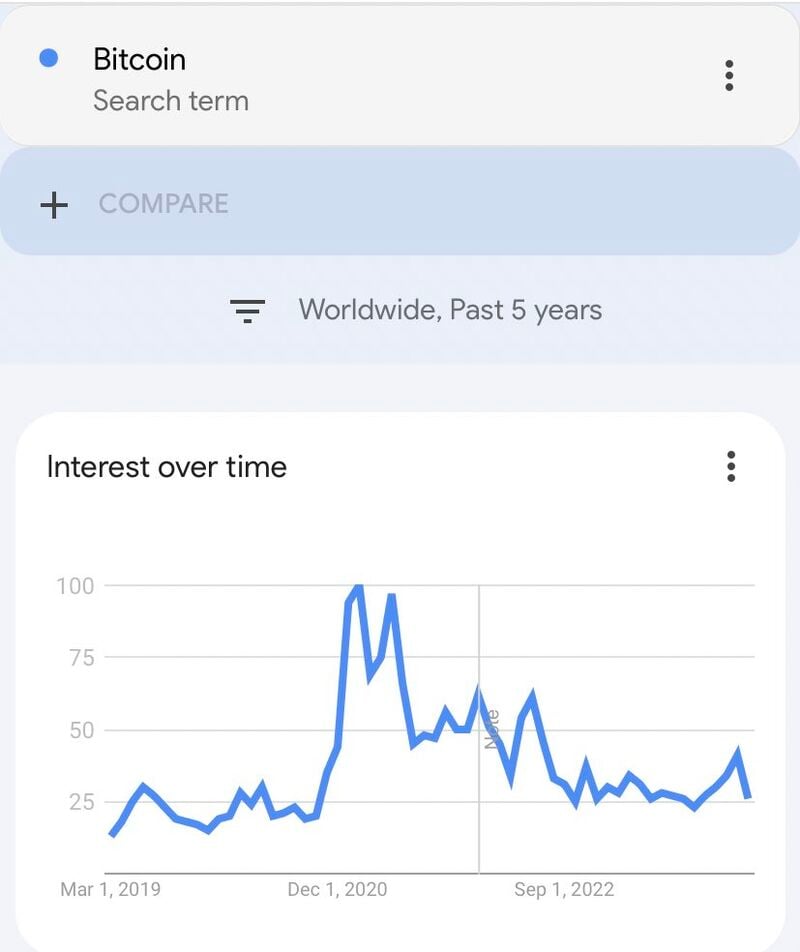

Google trends is without a doubt one of the best retail indicators.

We are a 25% of the interest of 2021, but only 30% off the all time high for Bitcoin. FOMO may not even begin until ATH. Source: James Van Straten

Investing with intelligence

Our latest research, commentary and market outlooks