Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

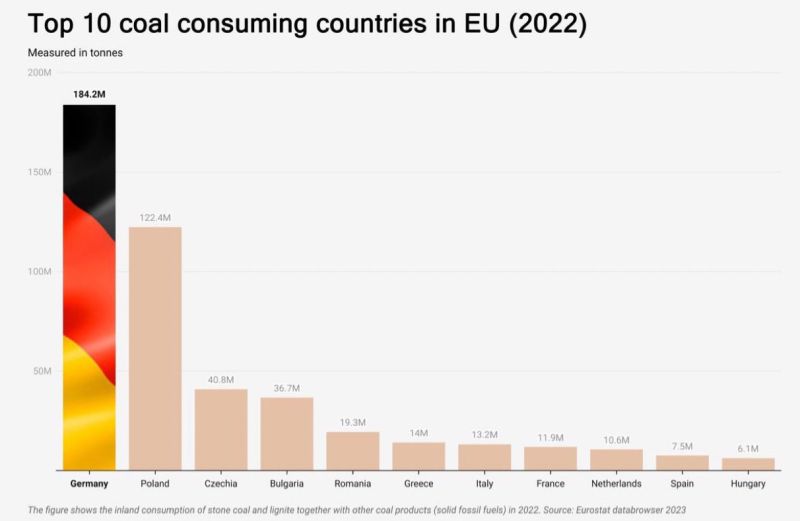

Believe it or not, Germany is the Number 1 coal consuming country in the EU...

If one really cared about climate, would one shut down nuclear or coal power plants first? Source: Michael A. Arouet

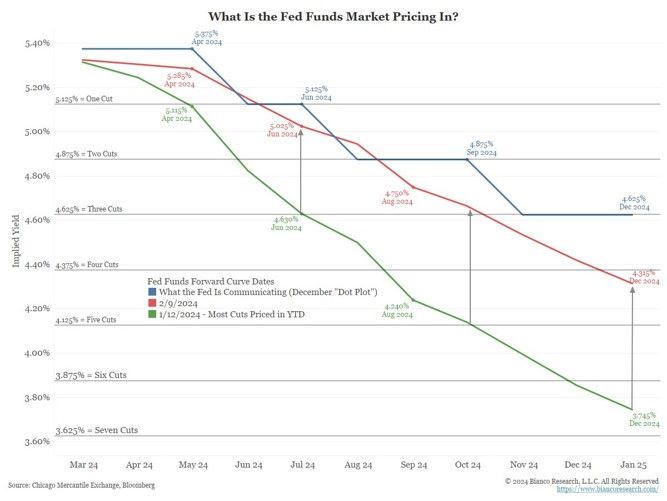

Four rate cuts are now priced in for 2024 (red), the LEAST number of cuts YTD.

This is down from seven rate hikes on January 12 (green), the MOST number of cuts (YTD). Source: Bianco Research

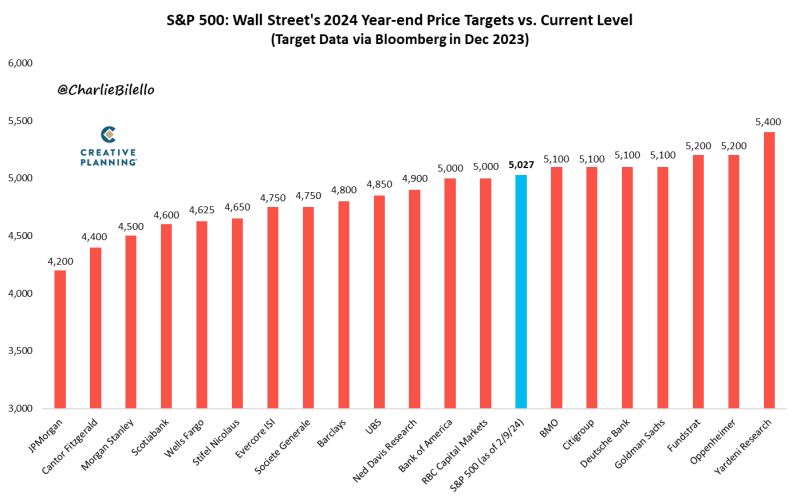

The SP500 is already up 5.4% on the year, well above the 1.9% average gain Wall Street strategists were predicting for all of 2024. $SPX

Source: Charlie Bilello

Deutsche Bank AG's provisions for losses in US Commercial Real Estate were more than four times bigger in the last quarter

Source: Laurentiu B., Bloomberg

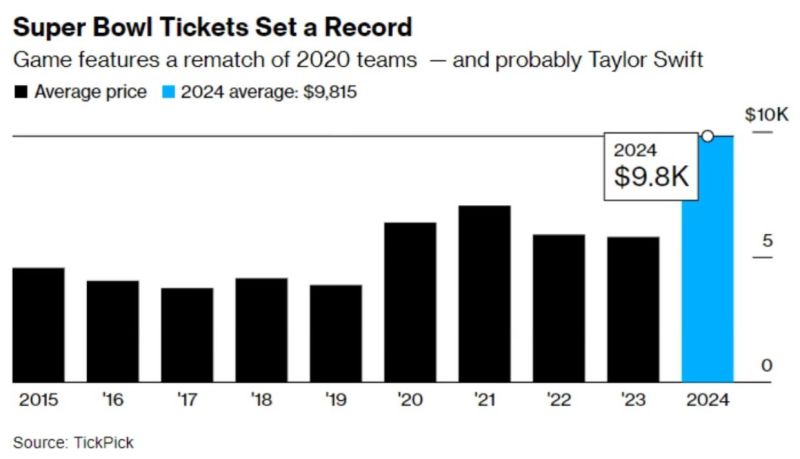

SuperBowl tickets have never been more expensive.

Source: Ryan Detrick, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks