Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Despite the Russell 2000 remaining in a bear market, down 20% from its peak in 2021, the S&P 500 reached a new milestone by trading above 5,000 points intraday for the first time ever yesterday.

source: bloomberg

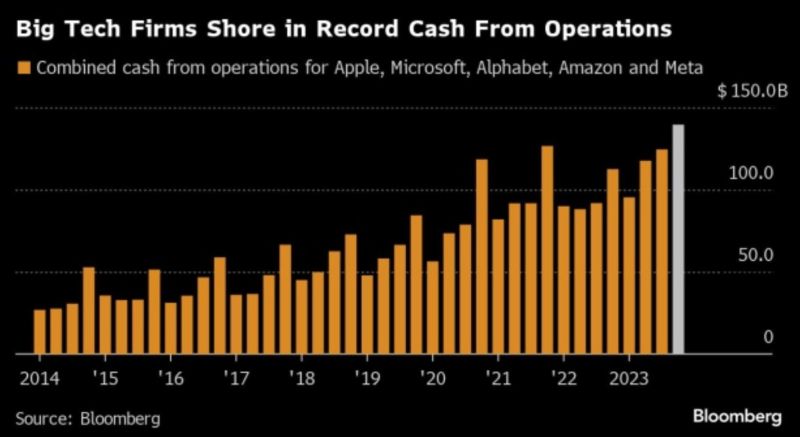

Over the past twelve months, Microsoft, Alphabet, Amazon, Apple, and Meta have produced a combined operating cash flow of $476.9 billion.

For three consecutive quarters, from Q2 to Q4, these five companies collectively generated over $100 billion each quarter. source : bloomberg

Here's the current expectation on Wall Street regarding the actions of the US Federal Reserve in 2024.

source : wsj, ntimiraos

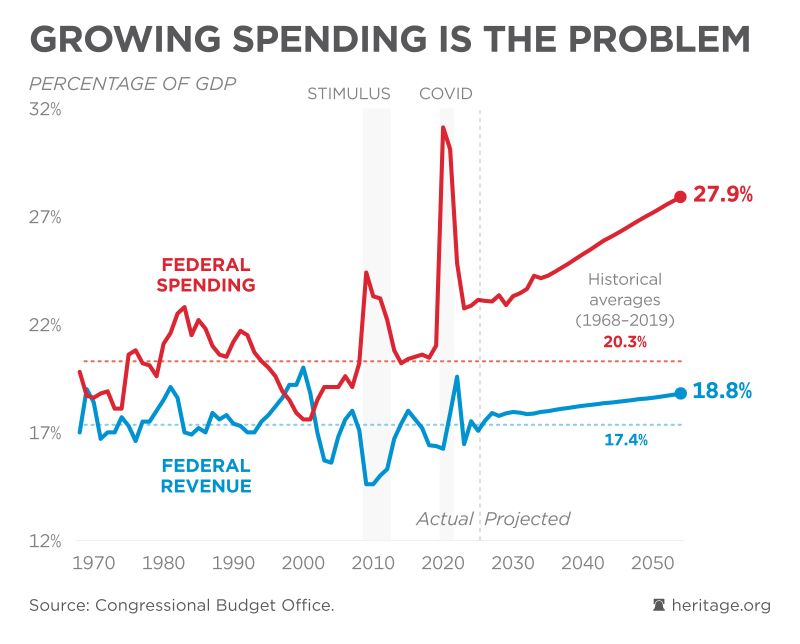

A very important chart to understand for America's future, both economically and politically.

Source: David Ditch, CBO

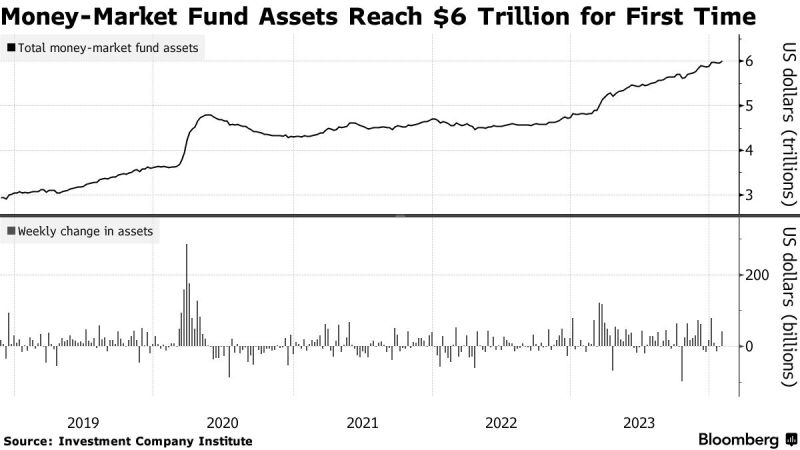

Money-Market Fund Assets Reach $6 Trillion for First Time

Source: Bloomberg

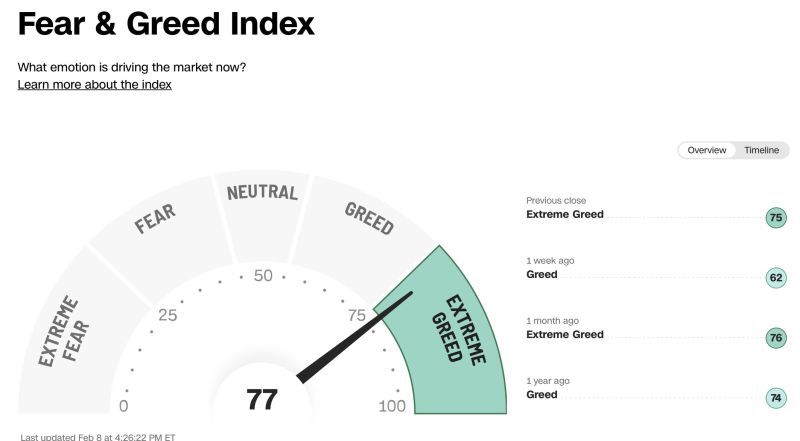

Asset Managers are the most long U.S. Equity Futures in at least the last 15 years.

Source: barchart

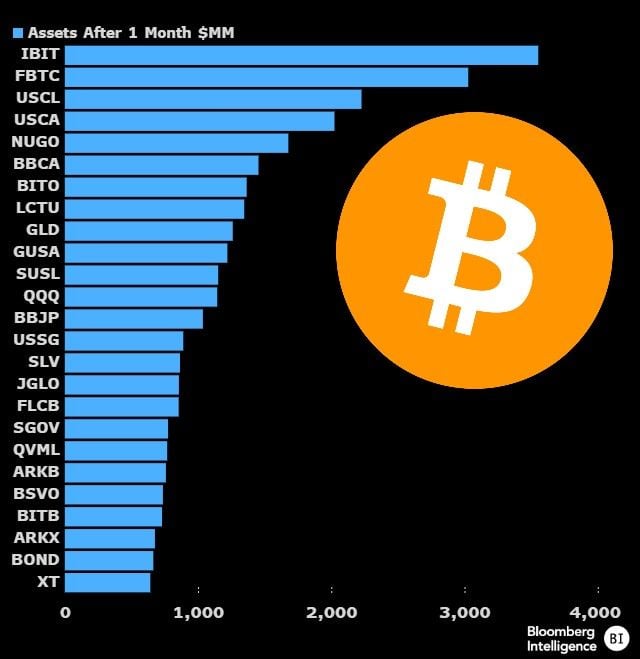

JUST IN: BlackRock and Fidelity spot Bitcoin ETFs dominate the top 25 ETFs by assets 1 month after launch

Here's a look at the Top 25 ETFs by assets after 1 month on the market (out of 5,535 total launches in 30yrs). $IBIT and $FBTC in league of own w/ over $3b each and they still have two days to go. $ARKB and $BITB also made list. Bloombergs Eric Balchunas

Investing with intelligence

Our latest research, commentary and market outlooks