Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

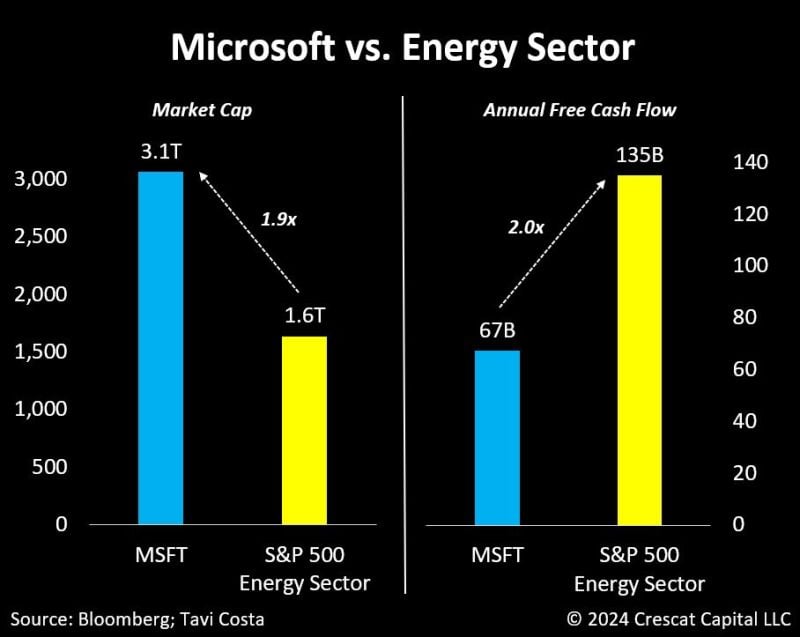

With a $3 trillion market cap, Microsoft is twice the size of the entire energy sector in the S&P 500, which generates double Microsoft’s annual free cash flow.

Source: Tavi Costa

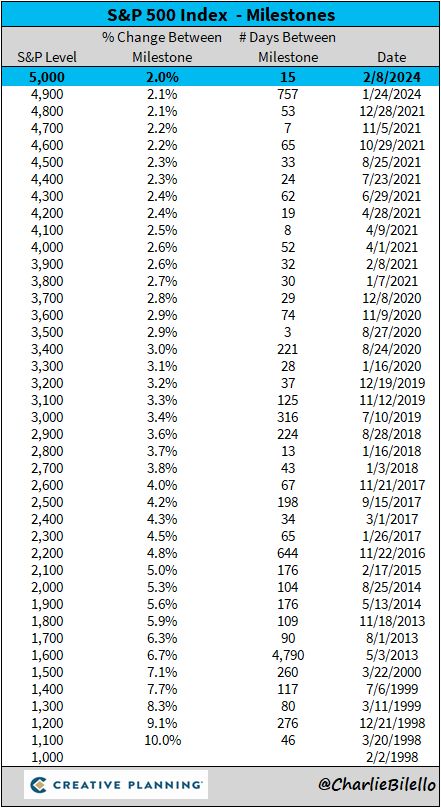

The S&P 500 crossed above 5,000 today for the first time. It took 757 days to go from 4,800 to 4,900 and just 15 days to go from 4,900 to 5,000.

Source: Charlie Bilello

Construction spending has surged on late cycle government stimulus, helping to drive economic growth in the US

But it is coming at a cost as the US government is running an enormous deficit for a non-recessionary period $1.5 trillion for 2024 alone, down slightly from 2023 Source: Bloomberg, markets & Mayhem

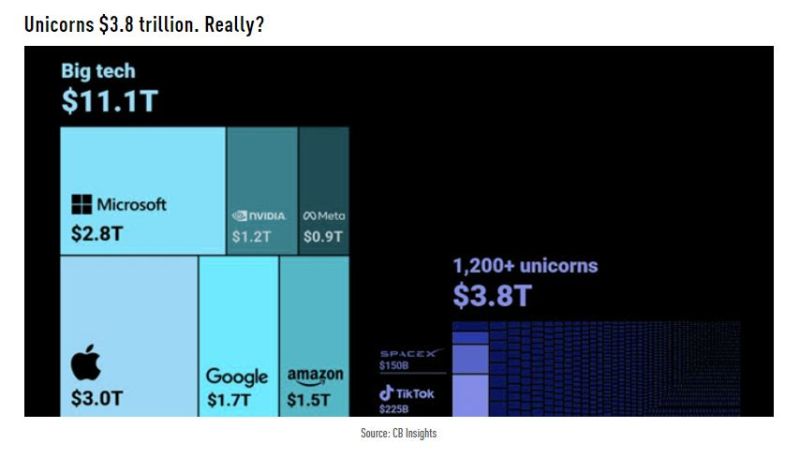

Big Tech of course "dwarfs" unicorn total market cap, but that 3.8T number still feels a little on the high side

Source: TME, CB Insights

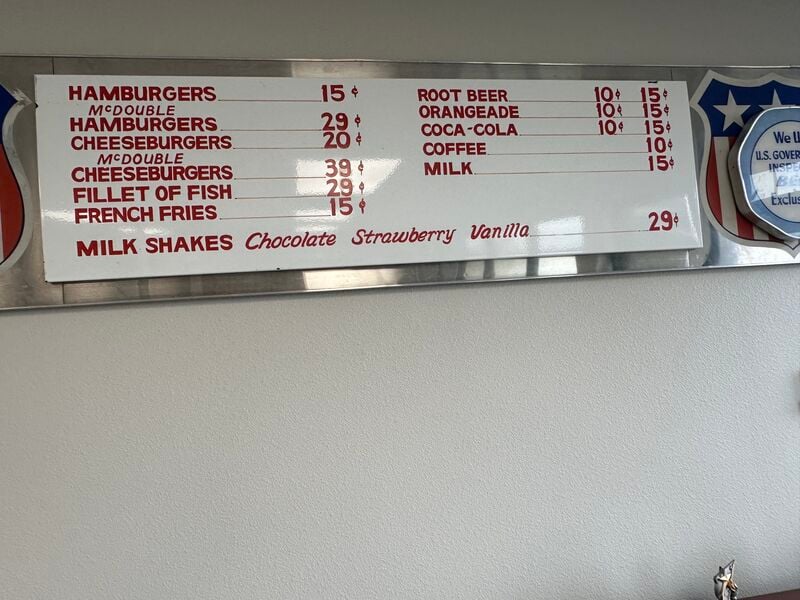

Inflation explained to a 5 years old kid: here's a 1960s McDonald’s menu.

Source: Peter Mallouk

Coke’s first new permanent flavor in years adds a spicy twist

Coca-Cola announced the new Spiced flavor Wednesday, saying it blends the traditional Coke flavor with raspberry and spiced flavors. It will be available both in full sugar and zero-sugar varieties when it hits store shelves in the US and Canada in the coming weeks. Coke doesn’t often add new permanent flavors to its lineup: Spiced joins just a few other flavors it always sells, including its flagship flavor, cherry and vanilla. Why Coca-Cola doesn’t want to tell you what’s in those weird flavors Spiced was selected because it’s “all about being on category trend and responsive to our consumer preferences,” who are craving bolder and punchier flavors, Coke’s vice president of marketing for North America, told CNN. source : cnn

Investing with intelligence

Our latest research, commentary and market outlooks