Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

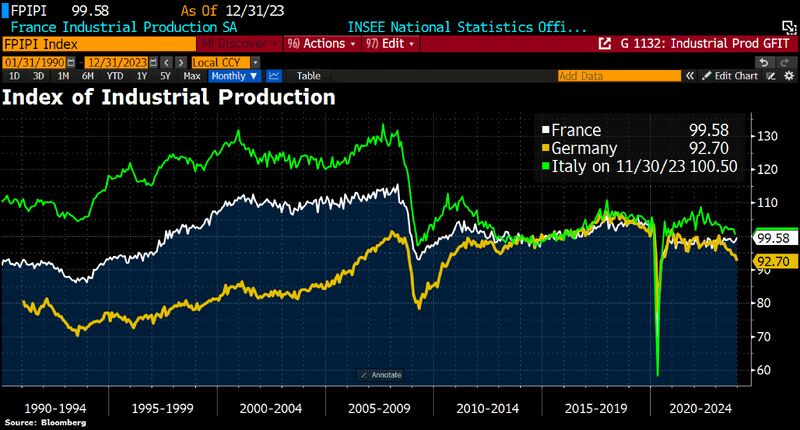

Europe deindustrialization continues

German industrial production fell for 7th consecutive month in December, the longest decline in the history of the data series. The 1.6% MoM decline came as a huge downside surprise. Source: Bloomberg, HolgerZ

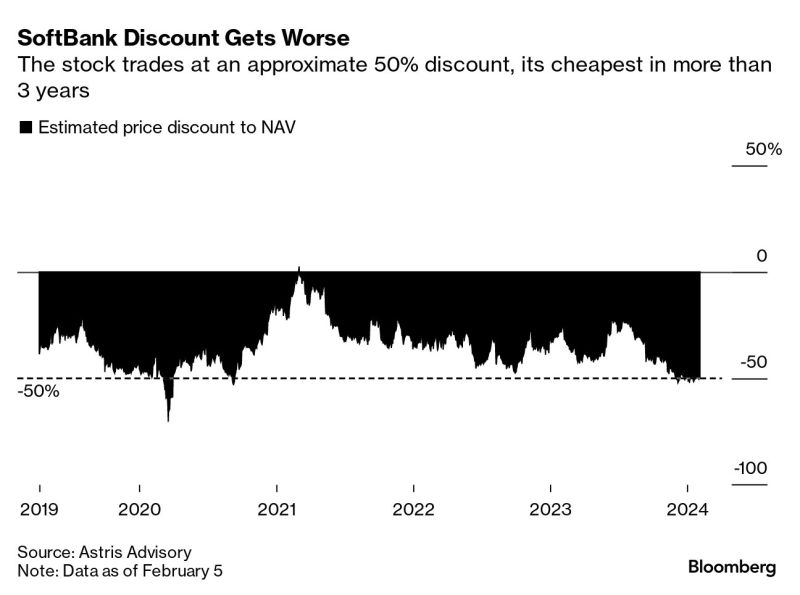

SoftBank Group shares jump more than 10% in Tokyo trading, heading for their strongest finish since July 2021.

An upbeat sales forecast from Arm Holdings bolstered sentiment. Question is whether the steep discount to its net asset value could narrow. Source: Bloomberg, Min-Jeong Lee

JUST IN: China's consumer prices declined at the fastest speed in 15 years in January.

CPI fell 0.8% in January on an annual basis, more than the median estimate for a 0.5% decline in a Reuters poll. This was its fourth straight decline and its biggest drop since 2009. Meanwhile, China’s PPI fell 2.5% in January from a year earlier, the National Bureau of Statistics reported Thursday, slightly better than expectations for a 2.6% decline.

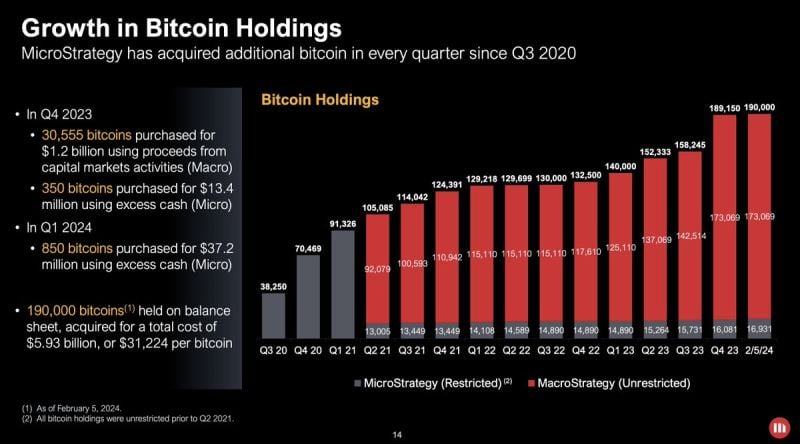

MicroStrategy holds almost 1% of all bitcoin that will ever exist.

Source: Altcoin Daily

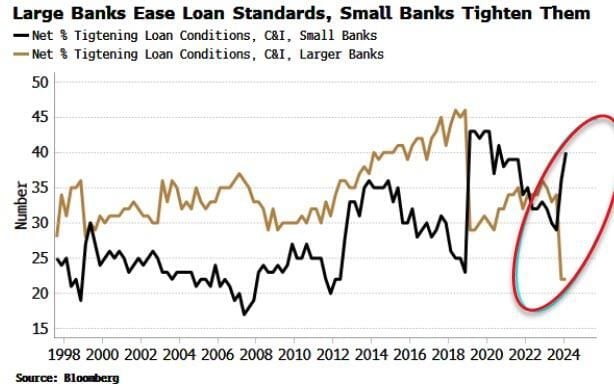

Large banks are easing lending standards while small banks tighten them Another sign of a K-shaped recovery, albeit in the financial sector

Source: Markets & Mayhem

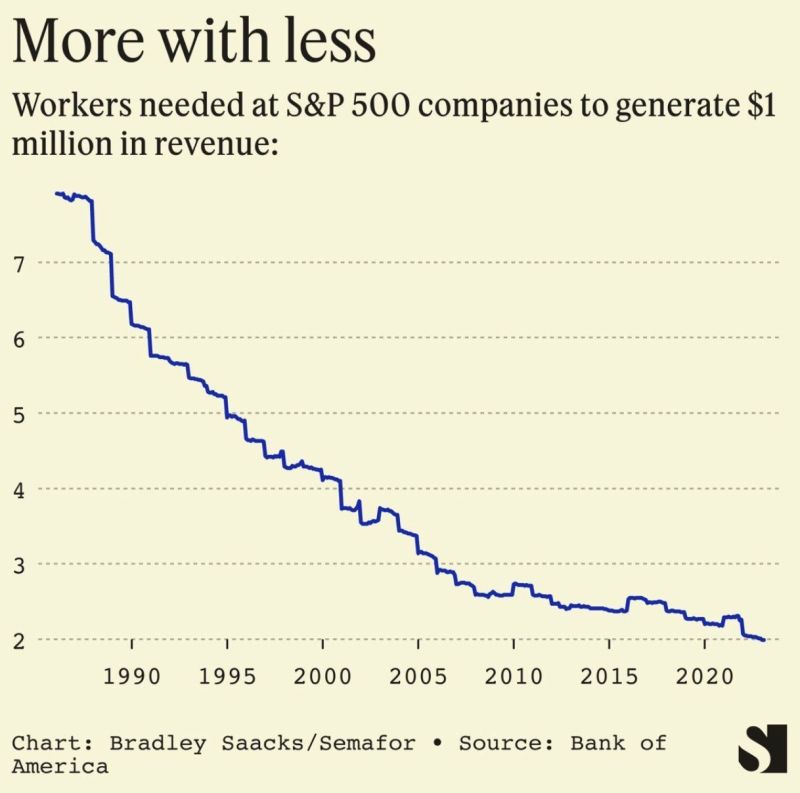

LESS IS MORE... or MORE WITH LESS.

This data is eye-opening. The number of workers needed at S&P 500 companies to generate $1 million in revenue has gone from: 7+ in pre-1990 period to only 2 in 2024 With AI developments, this metric is likely to continue declining Source: Game of Trades

Investing with intelligence

Our latest research, commentary and market outlooks