Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

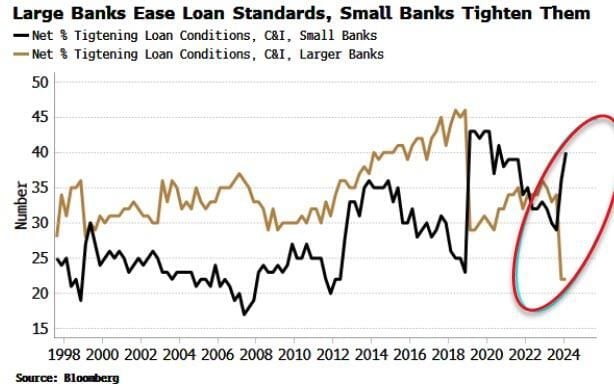

Large banks are easing lending standards while small banks tighten them Another sign of a K-shaped recovery, albeit in the financial sector

Source: Markets & Mayhem

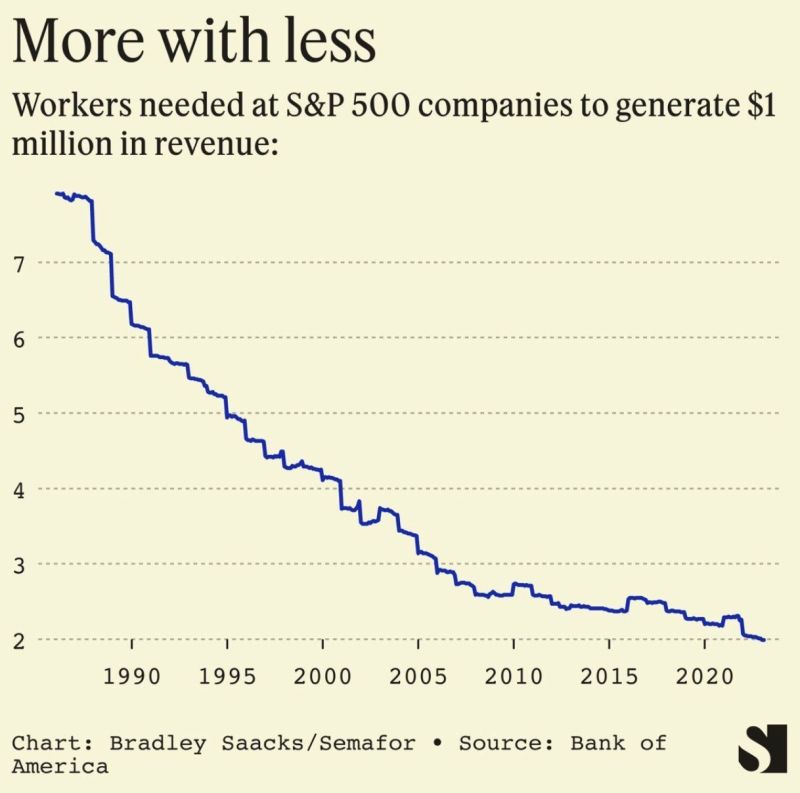

LESS IS MORE... or MORE WITH LESS.

This data is eye-opening. The number of workers needed at S&P 500 companies to generate $1 million in revenue has gone from: 7+ in pre-1990 period to only 2 in 2024 With AI developments, this metric is likely to continue declining Source: Game of Trades

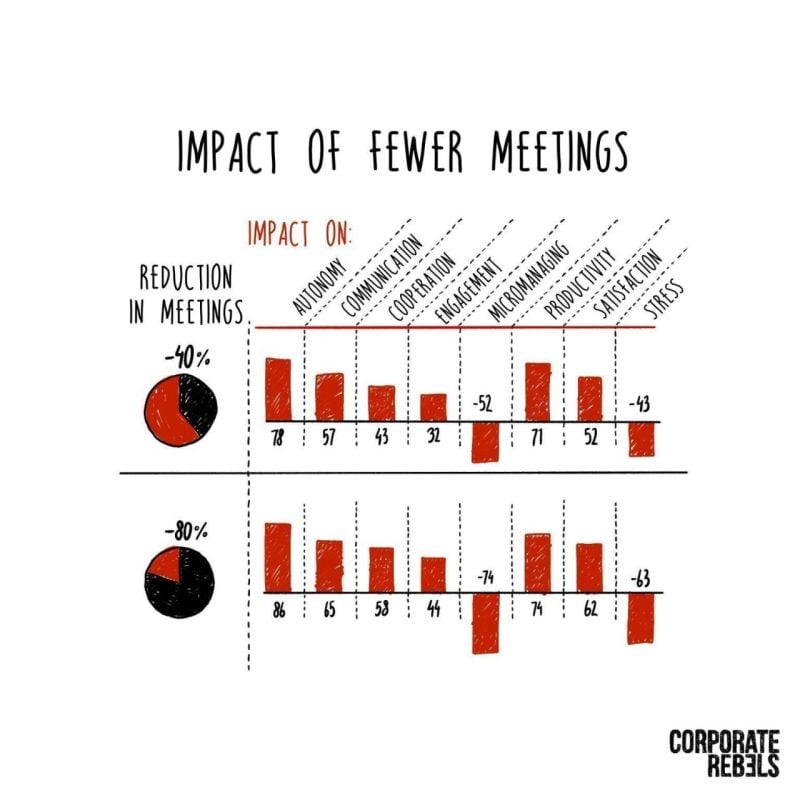

Uncover the sweet spot for meeting reduction.

Find out why ditching all meetings may not be the best solution: https://buff.ly/41U3U2b Source: corporate rebels

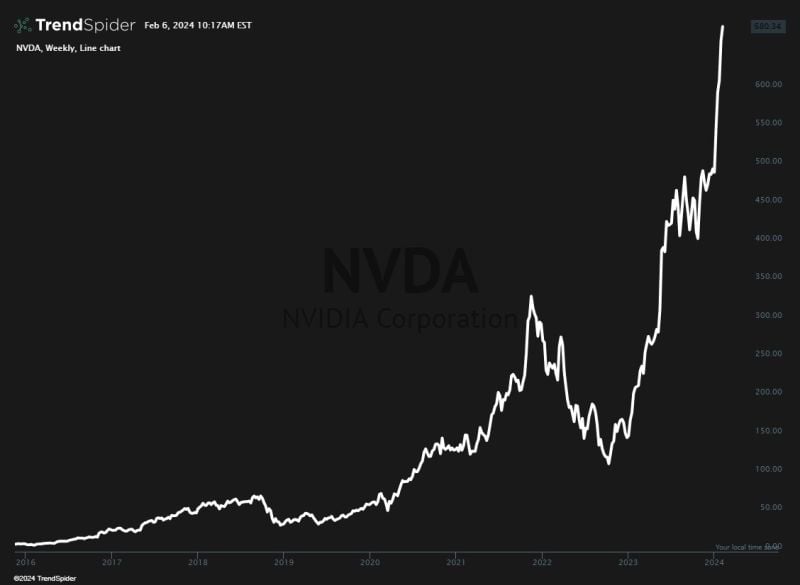

$NVDA has rallied $222 per share in 2024.

Nvidia has 2.47 Billion shares outstanding. That's $222/share × 2.47B shares = $548B USA's largest bank, JP Morgan $JPM, has a total market cap of $504 Billion Said another way, Nvidia has added 1.1 x $JPM to its market cap in one month. Source: Trend Spider

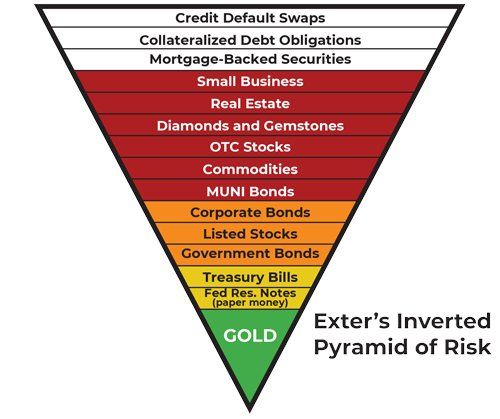

Exter's Inverted Pyramid of Risk

Organized from the most illiquid and highest counterparty risk assets to the least risky and most liquid, the layers of the inverted pyramid provide a unique perspective that builds from the mindset of a counterparty-risk sensitive investor. A swift glance at the pyramid reveals that the removal of any assets on the lower end (the more narrow base), will lead to the downfall of everything associated with it on the higher end, akin to a collapsing Jenga tower. Link to the article: https://lnkd.in/ekK3Nkby Source: www.schiffgold.com

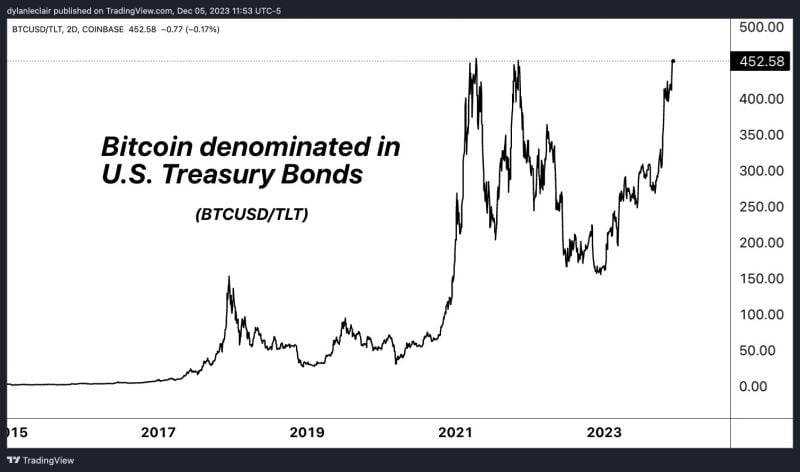

In case you missed it... bitcoin ($BTC) denominated in 25y+ US Treasuries ($TLT) is back to all-time-high...

Source: Smeet Bhatt

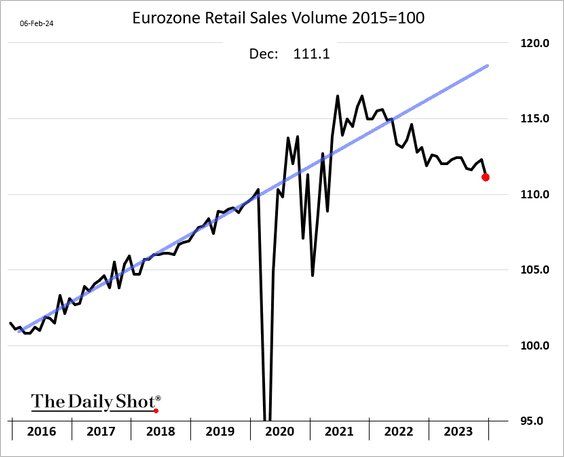

In the last week - Commercial Real Estate Stress

- New York Community Bank (USA) - Aozora Bank (Japan) - and now: *Deutsche Pfandbriefbank, under pressure in Europe, more real estate cracks, banking concern, etc" Source: Bloomberg, Lawrence McDonald

Investing with intelligence

Our latest research, commentary and market outlooks