Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

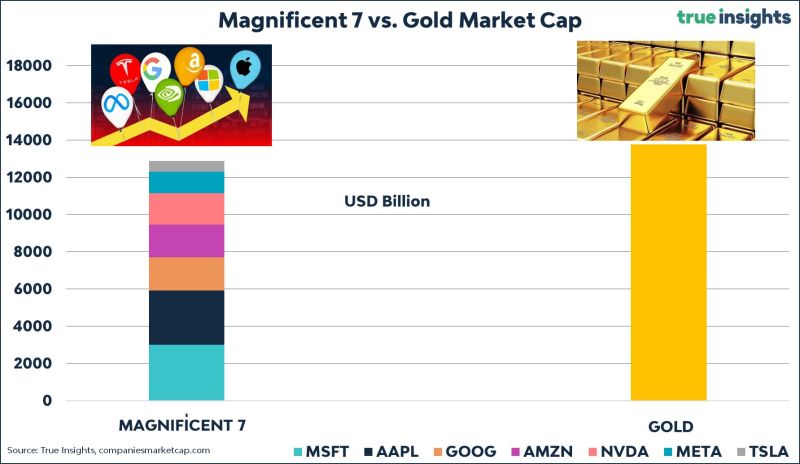

The Magnificent 7 are almost as big as… Gold!!

Source. Jeroen Blokland, True Insights

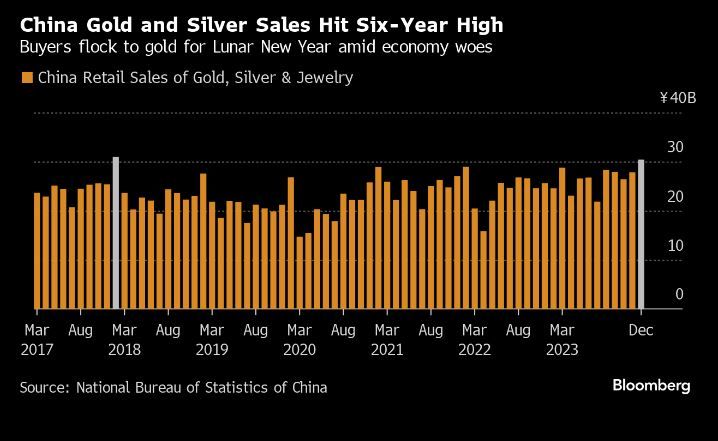

China Gold and Silver Sales Hit Six Year High

Sales of gold, silver and jewelry have been brisk for months, defying wobbles in the Chinese economy centered around the protracted crisis in the property market. Retail salesin December, the last month for which data is available, were at a six-year high. source : bloomberg

Cocoa is now trading at a new 46-year high after 8 consecutive green days.

In fact, 18 of the last 20 days have been green for Cocoa. It really wants an all-time high! Source: Barchart

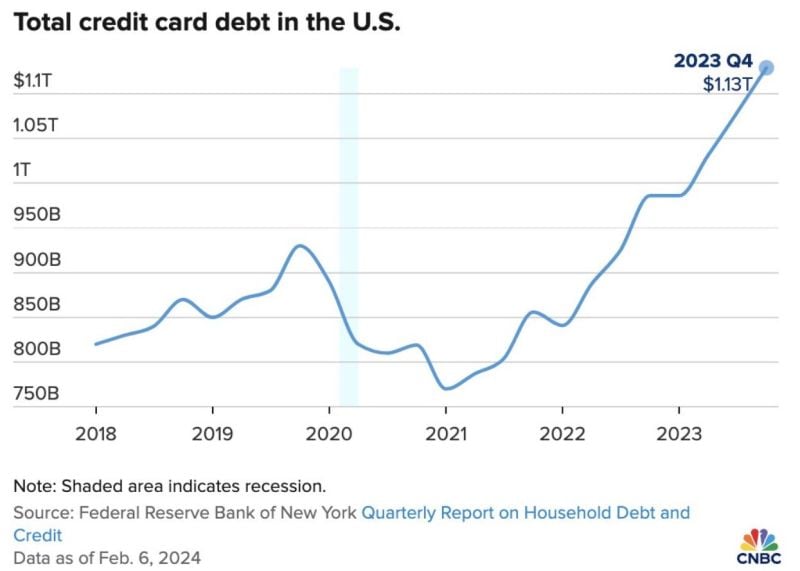

Americans now have a combined $1.13 Trillion of credit card debt, according to a new report from the Federal Reserve Bank of New York

source : cnbc

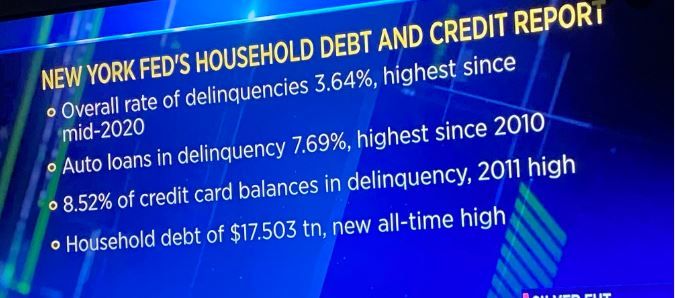

New York Fed's Household Debt and Credit Report

Total household debt climbed by $212 billion in the fourth quarter of 2023 to $17.5 trillion, the New York Federal Reserve said in its latest quarterly Household Debt and Credit Report. Amid the rise in debt, delinquency rates and the transition into troubled status were both higher. source : cnbc

Who would have thought? Toyota Motor $TM is soaring (up another +7% on Tuesday) while Tesla TSLA is down -37% since July '23 high.

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks