Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

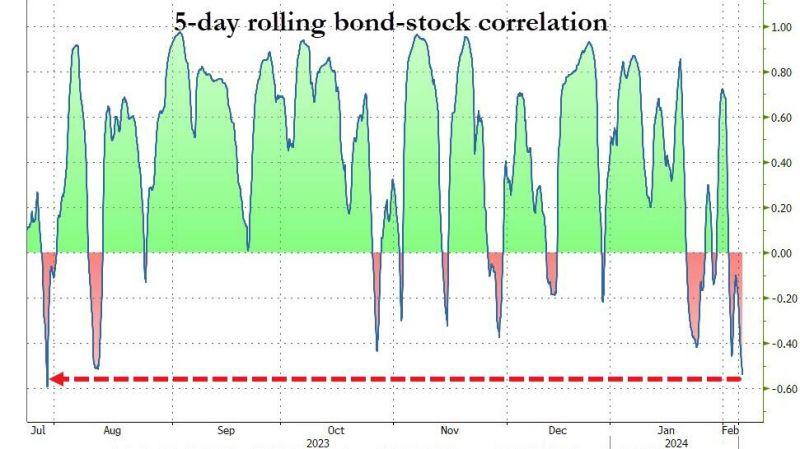

The bond-stock correlation is crashing to its lowest level in months...

Source: www.zerohedge.com

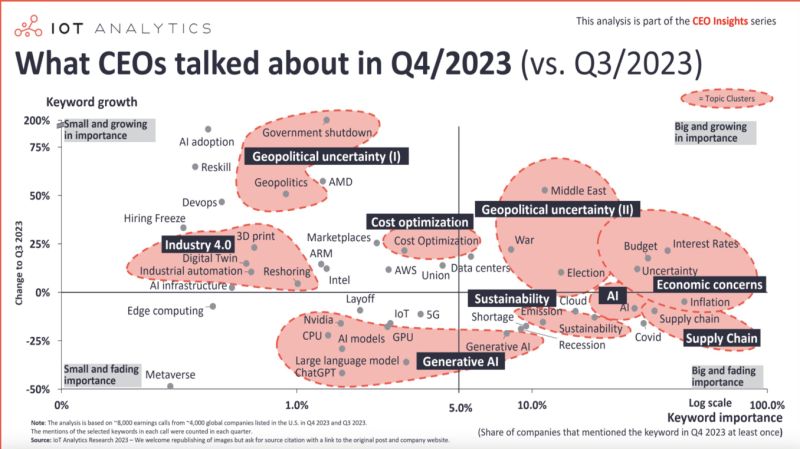

What CEOs talked about in Q4, 2023 (vs Q3, 2023)

Economic concerns, Geopolitical uncertainty, and Cost Optimization; AI drops for first time. Source : iot analytics, cb insights

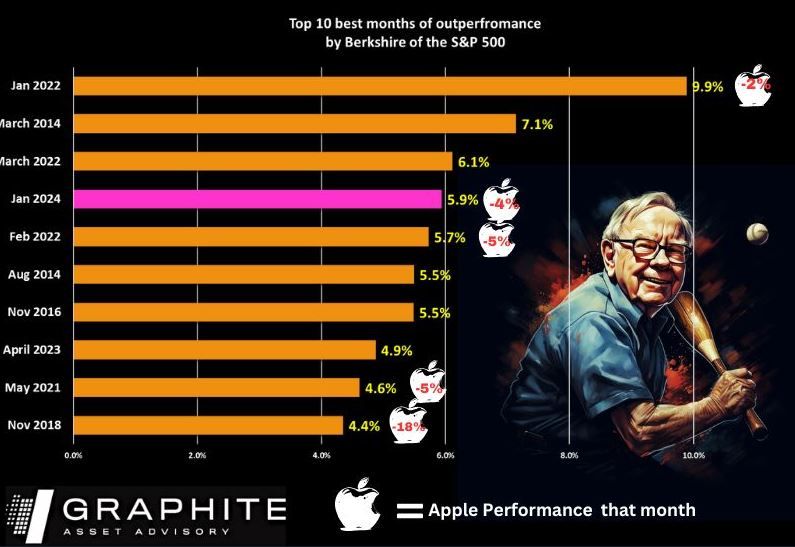

Buffett's Berkshire Beats the S&P 500 in Jan 2024 by 6%

Berkshire Hathaway outperformed the S&P 500 by an impressive 6% in January 2024, marking the fourth highest monthly outperformance over the last decade. Despite Apple, which represents 50% of Berkshire's portfolio, being down more than 3% (indicated by white bars), Berkshire's value soared. In an extraordinary display in November 2018, despite Apple's plunge of over 18%, Berkshire Hathaway saw an increase of more than 4%. source : John Haslett, CA(SA), FRM, Graphite Asset Advisory

German factory orders unexpectedly advanced at year end

GERMANY DEC. FACTORY ORDERS RISE 2.7% Y/Y; EST. -5.3% - BBG *GERMANY DEC. FACTORY ORDERS RISE 8.9% M/M; EST. -0.2% That jump —defying a median economist estimate of a 0.2% decline — was thanks to major orders, without which there would have been a 2.2% drop , Destatis said. Source: Bloomberg, C.Barraud

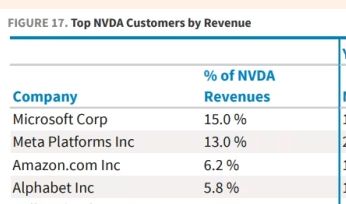

$NVDA's top 4 customers account for 40% of revenues, and every one of them is actively working on their own custom AI silicon.

AI capex will keep flowing to NVDA in the short run, but what will happen when initial training is done and inference is done locally? Source: Supreme Bagholder

Investing with intelligence

Our latest research, commentary and market outlooks