Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

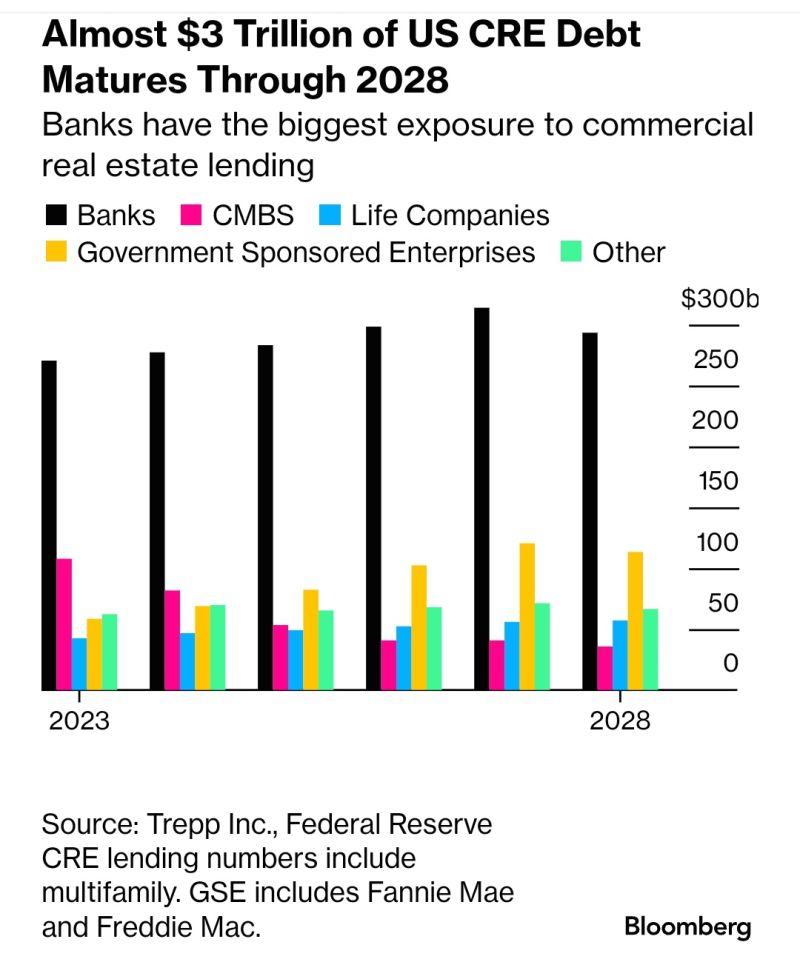

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

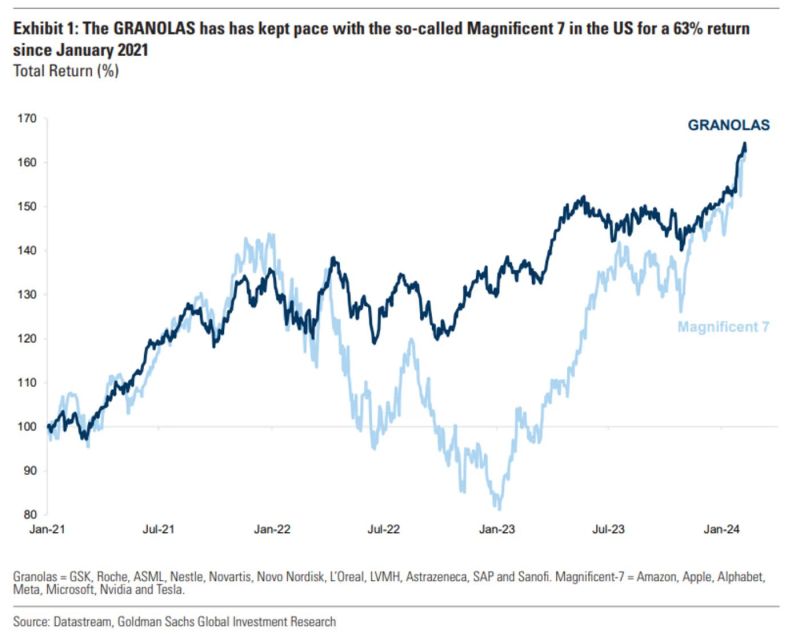

Did you know that there's another group of stocks that has kept pace with the Mag 7?

The largest companies in Europe have staged a rather impressive rally over the last three years as well! Source: Markets & Mayhem

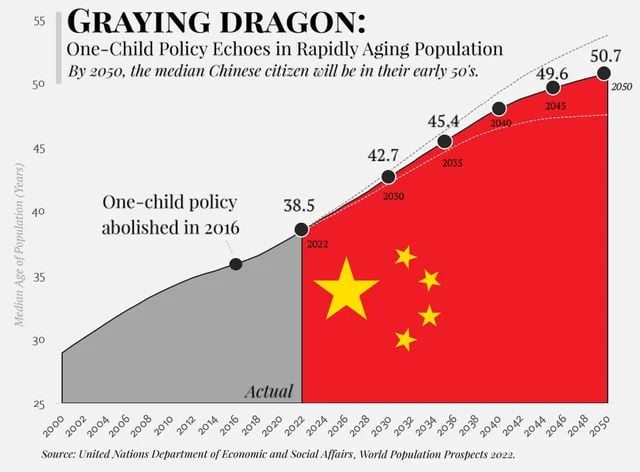

China's aging population: by 2050 the median age will be 50.7

Source: Markets & Mayhem

“Super Sick Monday"

16.1 million U.S. employees will be completely absent from work today following Super Bowl Sunday, according to this year’s research from UKG. In 2023, nearly 18.8 million employees said they planned on missing work on Super Bowl Monday. However, 6.4 million further employees plan to come to work late, another 11.2 million are unsure of whether they will come to work, and around 6.4 million will decide what to do on the day. The number jumps up for U.S. employees who plan to miss at least some work on Monday, reaching around 22.5 million employees – 14% of the U.S. workforce. The research also finds six million employees have not yet notified their employers and will call in sick on the day or simply ‘ghost’ their employer on Monday. source : The Harris Pol, UKG Workforce Institute

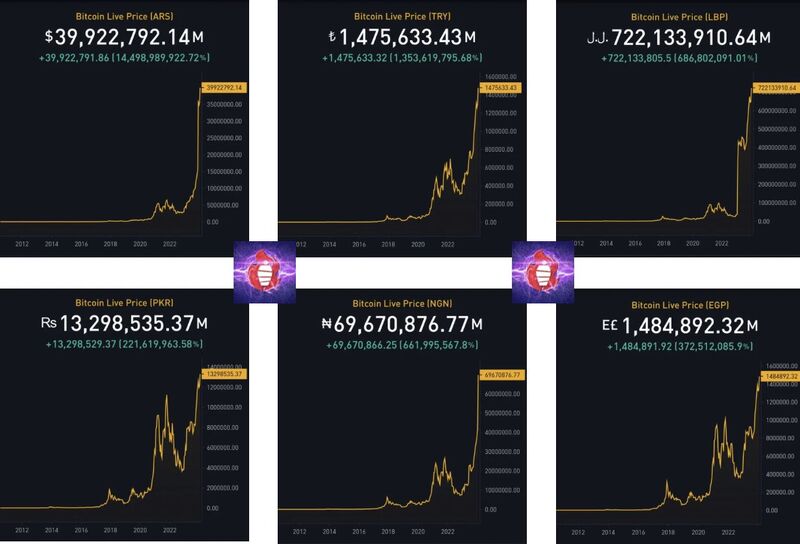

This is what Bitcoin looks like for the citizens of Turkey, Egypt, Nigeria, Argentina, Lebanon and Pakistan.

A combined population of 725 MILLION people. Nigeria and Argentina price more than doubled over the last 2 months ago Source: The Real Tahinis, Andrea Lisi

Jeff Bezos never focused on earnings, EPS, or "profit". Why? He knows those numbers are flawed.

Source: Brian Feroldi

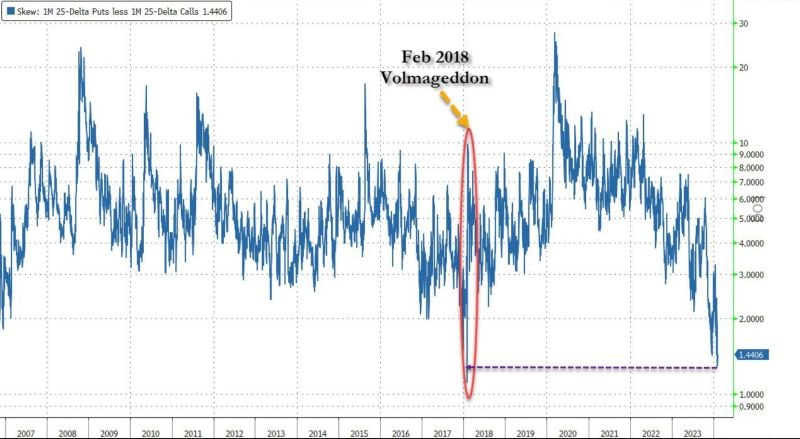

“Volmageddon” is not a Word in the Dictionary.

This term is a blend of "volatility" and "Armageddon," and it refers to a significant and sudden increase in market volatility. It specifically references an event on February 5, 2018, when the stock market experienced a sharp increase in volatility.The previous time the skew reached such a low level was on that exact day, mere hours before Volmageddon caused the VIX to skyrocket, moving it from a serene level of 14 to a heightened state of 40. source : zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks