Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

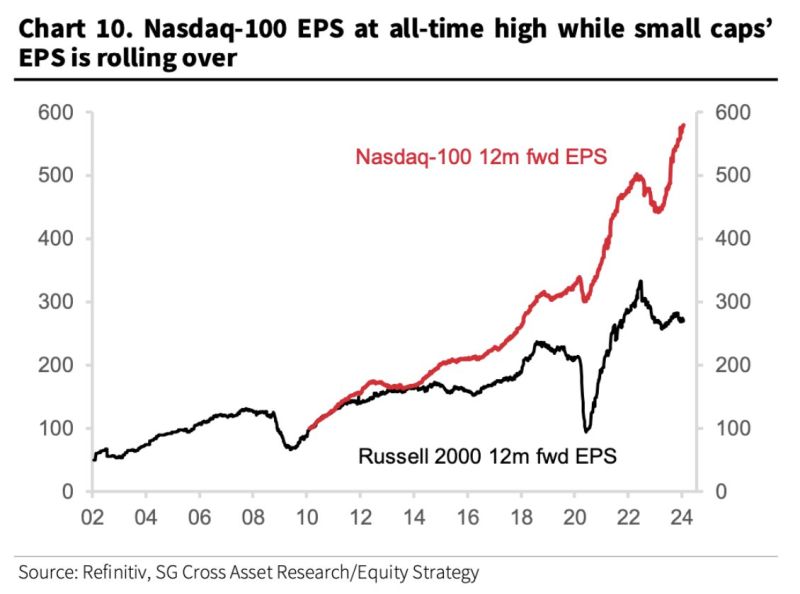

The performance differential between Nasdaq 100 (Tech) and Russell 2000 (us small-caps) is extreme.

Yet the earnings gap between Mega Cap Tech Stocks and Small Caps has widened to all an all-time high. Source: Barchart

$TSLA is the only Magnificent 7 Stock to be in the red over the last 12 months.

Not only that, Tesla is getting absolutely trounced by the rest of the group. Should we rename this group the Magnificent 6 going forward? Source: barchart

From Facebook to Meta...

Swith the benefit of insight the renaming wasn't that bad after all... More seriously, it seems that the shift from metaverse to ai and the focus on shareholder value have been working very well. What a turnaround by Zuck... By the way, he will receive a $175 million quarterly dividend, on track for making $700 million annually in dividend... Is Mark Zuckerberg the mist underrated tech CEO. Source chart: Mac10

Adaptability is an underrated skill.

Source: The Investing for Beginners Podcast

To put things into perspective

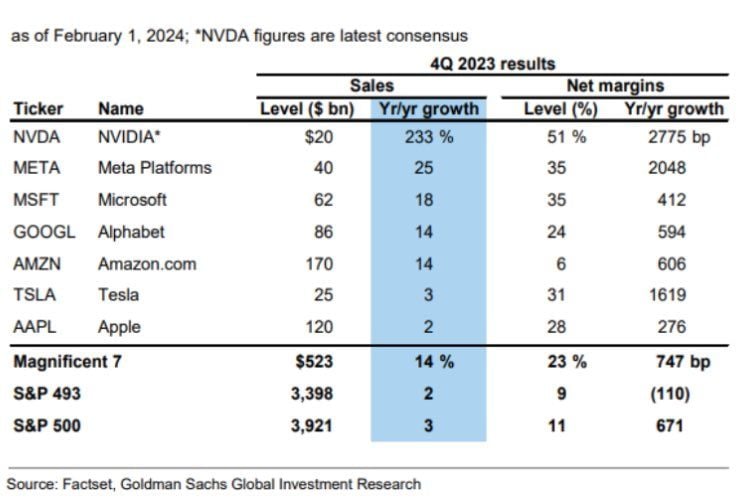

Assuming Nvidia meets estimates, the Mag 7 generated $523bn in sales during 4Q, +14%YoY. Revenue growth for remaining 493 S&P 500 stocks was a comparatively paltry 2%. Margins for the mag 7 expanded by ~750 bp YoY to 23% vs. a 110 bp contraction to 9% for remaining 493 stocks in the S&P 500, Goldman has calculated. Source: HolgerZ, Goldman Sachs

Friday's market action tells a lot about what's currently going on

1) US large-caps equities index recorded strong gains ($SPX +1.07%; $NDX +1.69%) thanks to huge advance by $META (+20%) and $AMZN (+7%); 2) Underneath the surface, there is some selling taking place - the S&P 500 equally weight is DOWN -0.08% on the day. We need to see decent market breath for the equity bull market extend as the mag7 (or rather the "mag 4" as leadership is even more narrow than in 2023) will not be able to carry the market forward for ever... Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks