Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

The US Treasury will hold some of its largest-ever debt auctions in the coming three months in an effort to fill the yawning federal budget deficit.

The Treasury said on Wednesday it would increase the size of auctions at most maturities for the next three months, with two-year and five-year auctions hitting record sizes. The five-year auction in April, for $70bn, would be the biggest ever for debt with a maturity of two years or more. The US has been increasing its borrowing over the past few quarters, as the gap between government spending and tax revenue has grown. The federal deficit stood at $1.7tn last year. Source: FT https://lnkd.in/eSyQHXu9

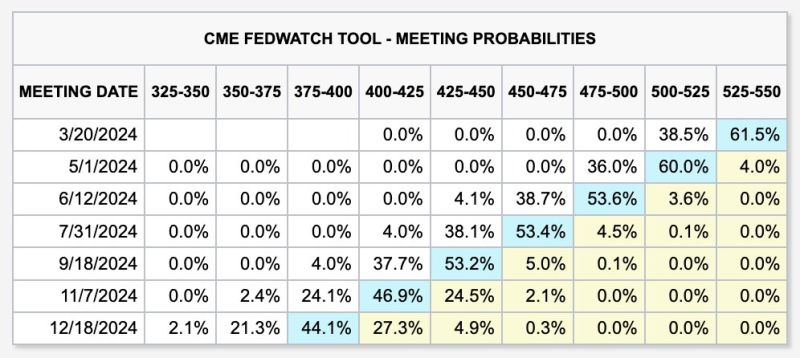

The Fed said that a March rate cut is "unlikely," yet futures are still pricing in a 39% chance it happens

Even as the Fed said they cannot cut rates until inflation is comfortably moving to 2%, markets still see 6 cuts in 2024. There's even a growing 23% chance of 7 interest rate cuts this year. Markets are pricing in a rate cut at EVERY remaining Fed meeting this year. As highlighted by the Kobeissi Letter, if the Fed is on track for a "soft landing," why do we need to many rate cuts? Source: The Kobeissi Lette

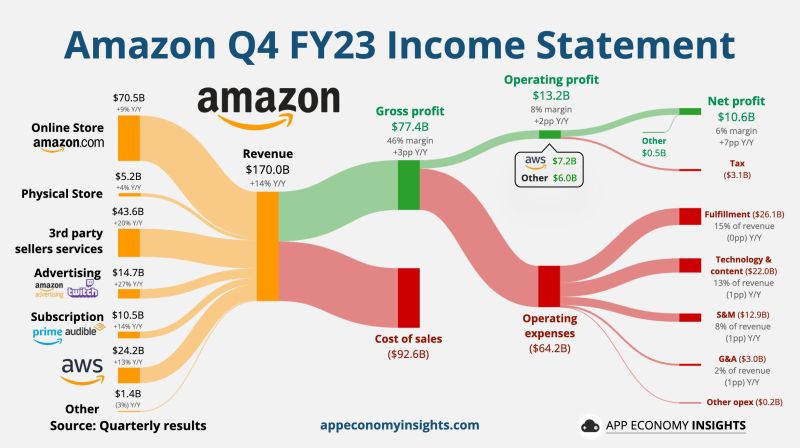

Amazon on Thursday reported fourth-quarter results that sailed past analysts’ estimates, and gave strong guidance for the current quarter.

The stock climbed more than 8% in extended trading. $AMZN Amazon Q4 FY23: • Revenue +14% Y/Y to $170B ($3.7B beat). • Operating margin 8% (+2pp Y/Y). • FCF $37B TTM. AWS: • Revenue +13% Y/Y to $24.2B. • Operating margin 30% (+5pp Y/Y). Q1 FY24 Guidance: • Revenue ~$138-$143B ($142B expected).

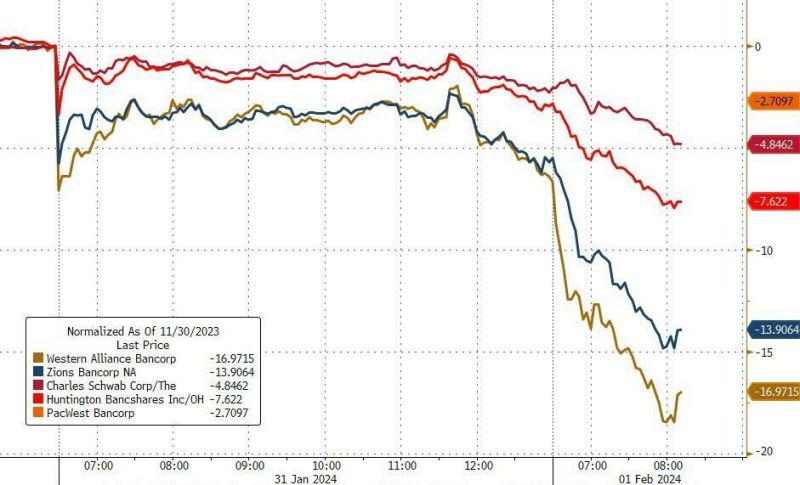

Multiple small us banks tumbled high-single and double digits.

There is a silver lining though -> the market quickly remembered that it was precisely the bank crisis last March that sparked a powerful Fed response (BTFP), and a violent rally, and we got the same thing today as stocks slingshot sharply higher closing 1.1% higher... Source: www.zerohedge.com

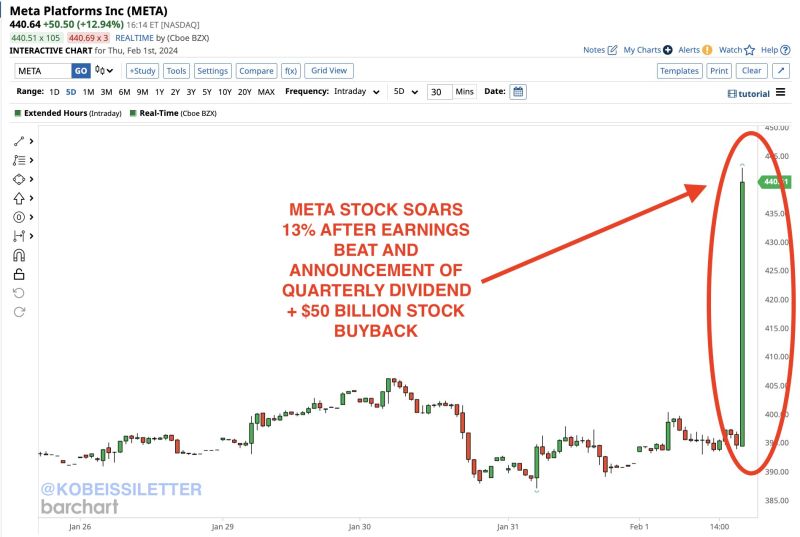

BREAKING: Meta stock, $META, soars 13% after beating earnings expectations and announcing a quarterly dividend with a $50 billion stock buyback.

The stock has added $130 billion in market cap in just 15 minutes. For the first time in history, $META now has a market cap of $1.1 trillion. It is officially the 7th largest public company in the world. Source: Barchart, The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks