Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

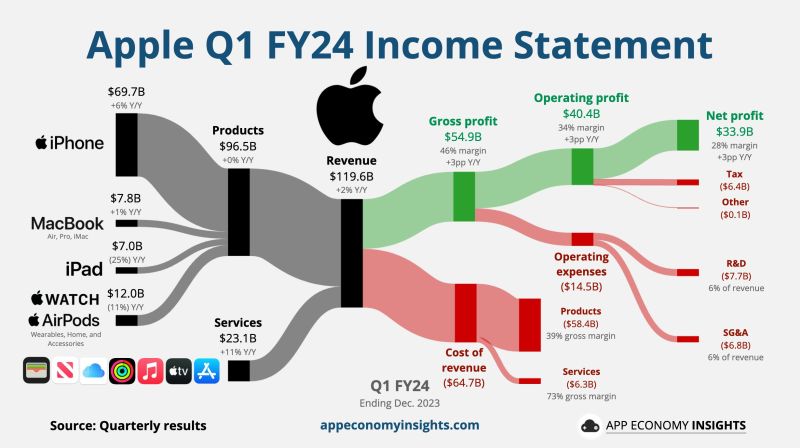

Apple reported fiscal first-quarter earnings on Thursday that beat estimates for revenue and earnings, but Apple showed a 13% decline in sales in China, one of its most important markets.

Apple shares fell over 1% in extended trading. Here’s how Apple did $AAPL Apple Q1 FY24 in a nutshell: • Revenue +2% Y/Y to $119.6B ($1.3B beat). Services +11% Y/Y to $23.1B. Products +0% Y/Y to $96.5B. • Operating margin 34% (+3pp Y/Y). • EPS $2.18 ($0.07 beat). • $20.1B in buybacks and $3.8B in dividends. Source: App Economic Insights

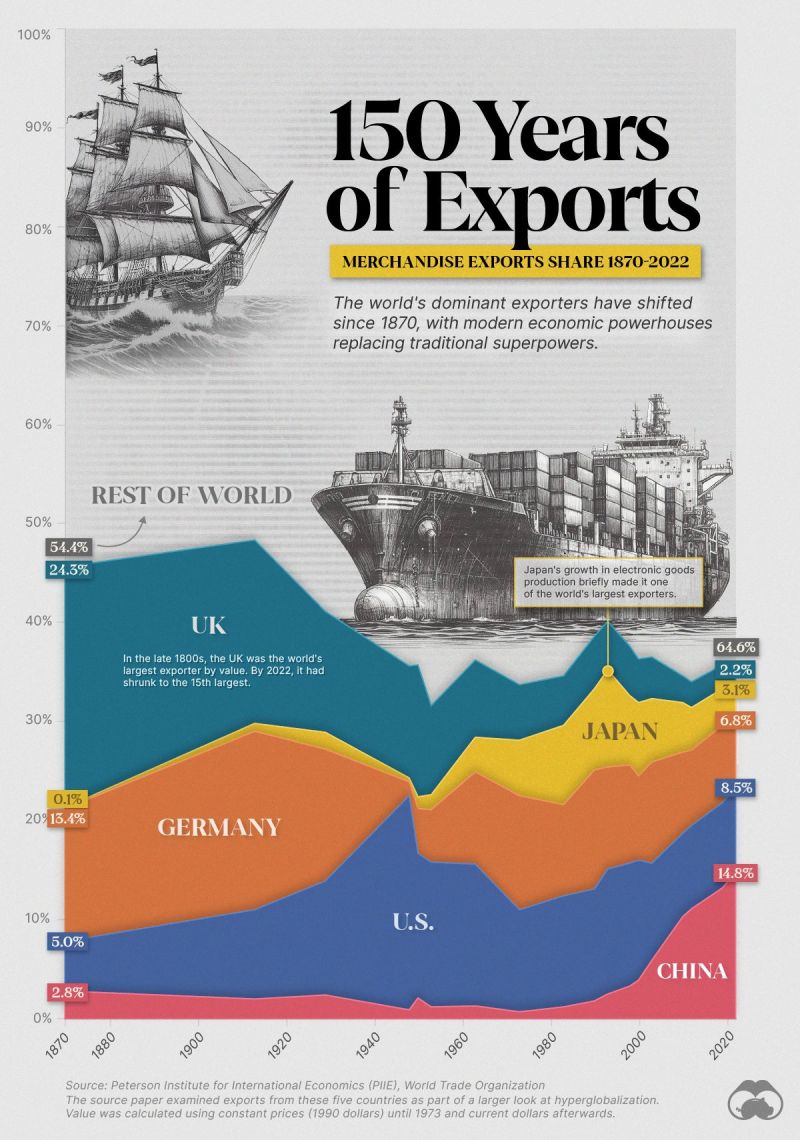

Visualizing 150 Years of Exports for Top Economic Superpowers

Source: Visual Capitalist

Steve Jobs said that the most powerful person in the world, is the storyteller.

Here are the 5 principles for telling an amazing story Source: Sachin Ramje

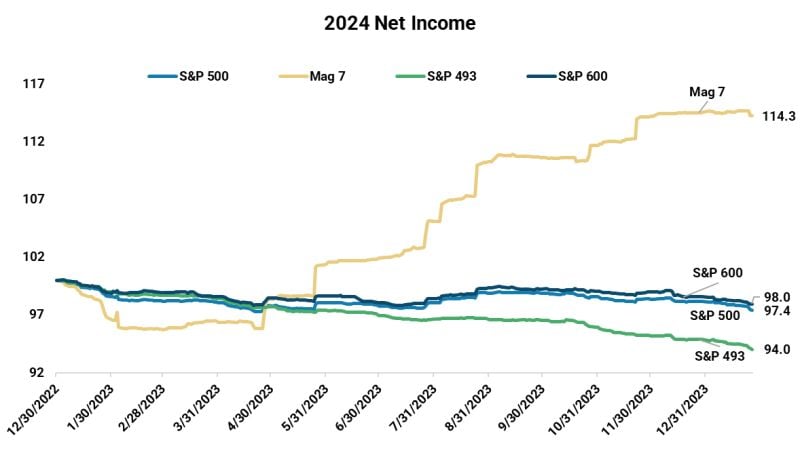

sp500 companies excluding magnificent seven.

Source: Daniel Lacalle

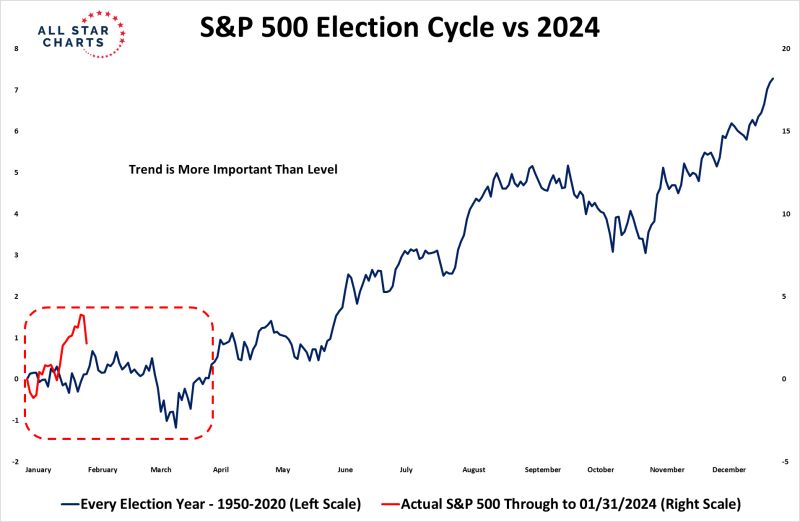

During the election year, the averages tell us that it's going to be sideways to lower for the next 2 months...

Source: Grant Hawkridge

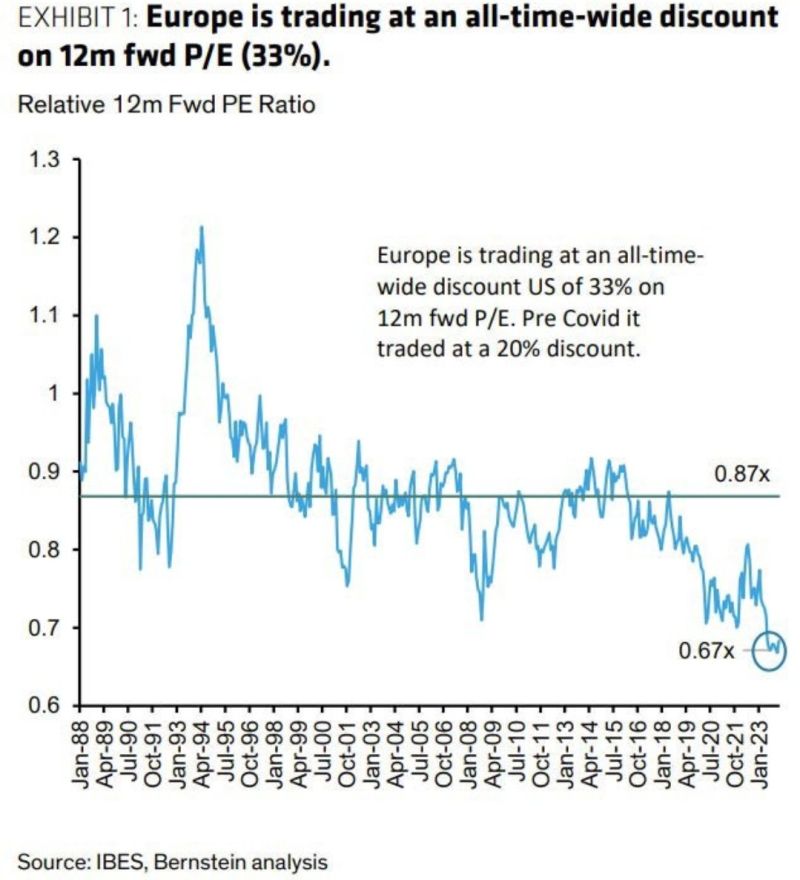

European stocks are currently trading at their lowest valuation relative to U.S. Stocks in history

Source: Win Smart, IBES

Investing with intelligence

Our latest research, commentary and market outlooks