Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Divided Bank of England boe leaves policy unchanged, says interestrates are ‘under review’

- Inflation is projected to fall temporarily to the Bank’s 2% target in the second quarter of this year before rising again in the third and fourth, due to the varying contribution of energy prices to annual comparisons. - Headline inflation is not expected to return to target again until late 2026, the Bank’s newest Monetary Policy Report projected. - Bank of England: 6 votes to hold rates, 2 votes to hike, 1 vote to cut This is the 6th time in the BoE's 295 meeting history that we've seen a 3 way split vote. On most occasions (except for '06) - the doves have won & BoE have gone on to cut rates sharply https://lnkd.in/e64nMDB6

Powell “stayed away from addressing the banking sector but the sharp decline in regional shares is certainly getting attention at the Fed.”

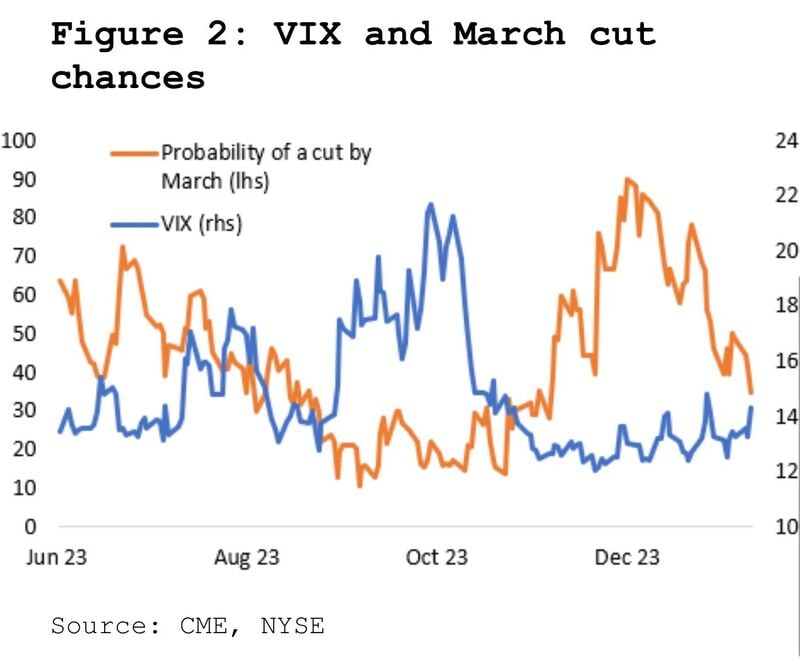

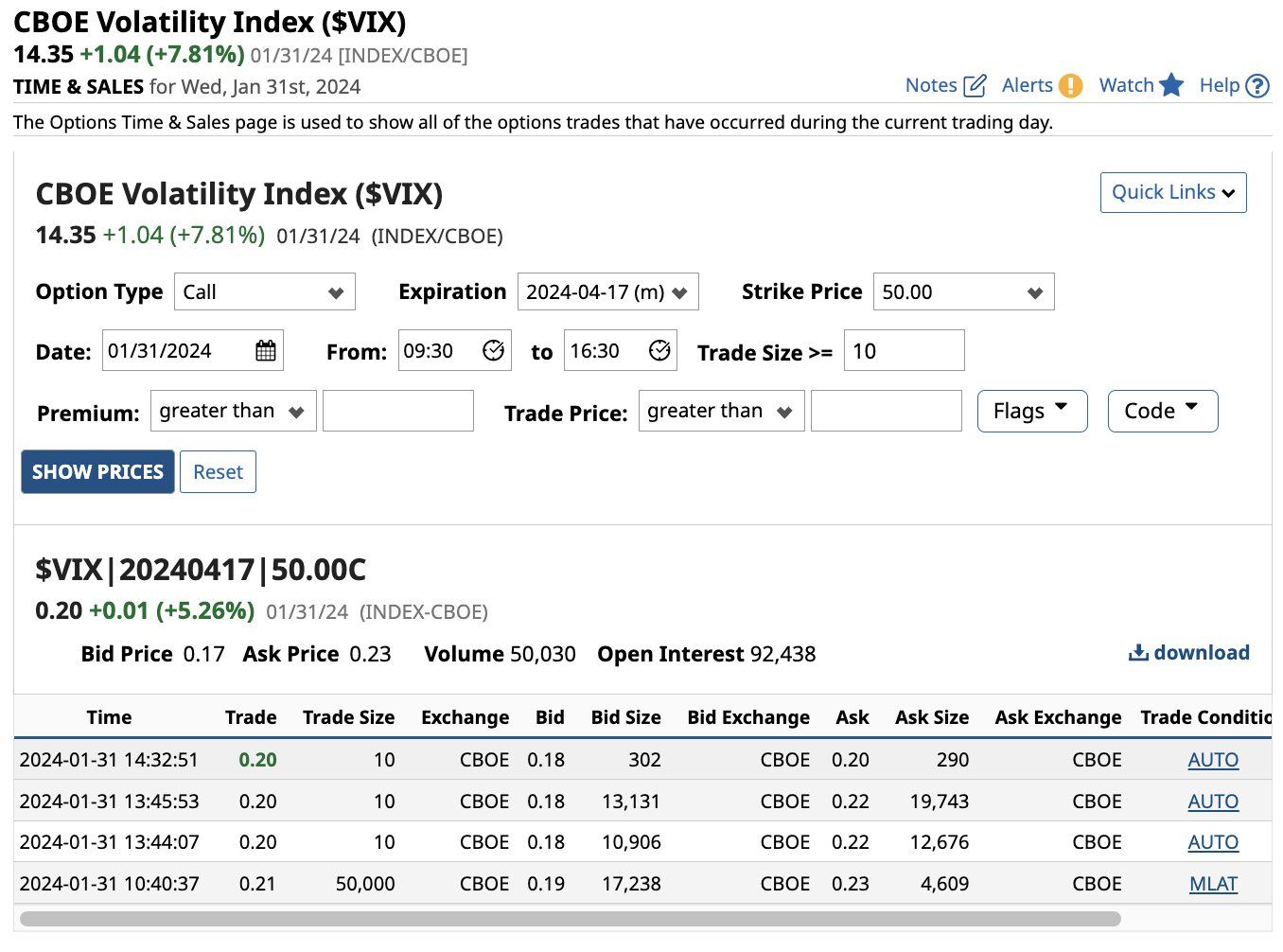

Could the combo "March cut is fully priced out + regional bank stress building" trigger a temporary spike of the VIX? Source: Carl Quintanilla

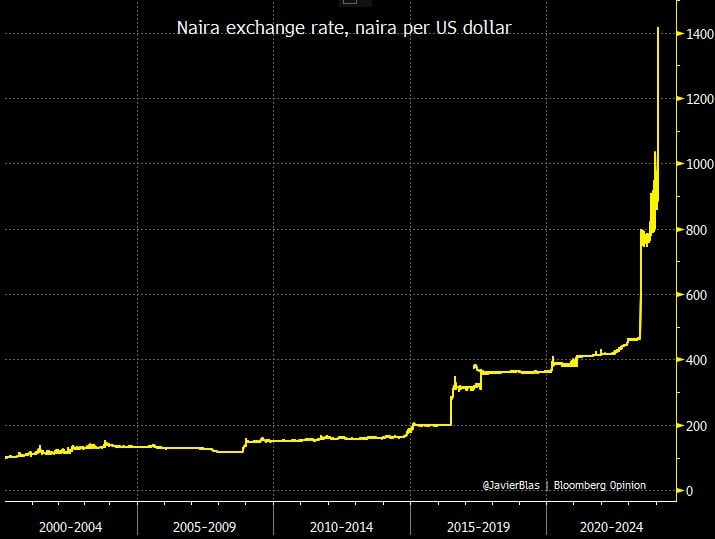

The two largest economies in Africa are under huge financial strain.

On Monday, Nigeria de facto devalued the naira by ~30% (after another ~30% devaluation in June). And Egypt is under pressure to devalue too, with the pound ~50% weaker in the black market. Source: Javier Blas Bloomberg

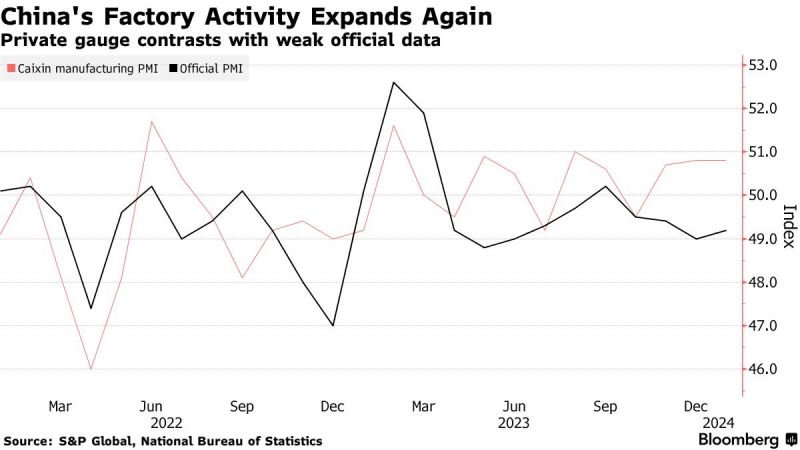

China Factory Activity Expands Again, Private Survey Shows

Source: Bloomberg, C.Barraud

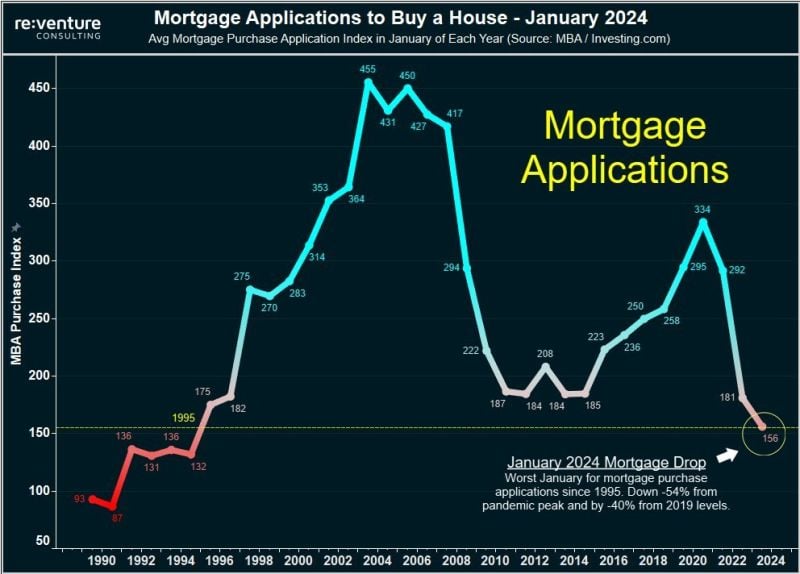

BREAKING: Mortgage demand fell to a new 30-year low in January 2024, down 54% from the pandemic peak, according to Reventure.

Mortgage demand is down 14% over the last year and 40% from pre-pandemic levels. Source: The Kobeissi Letter, re:venture

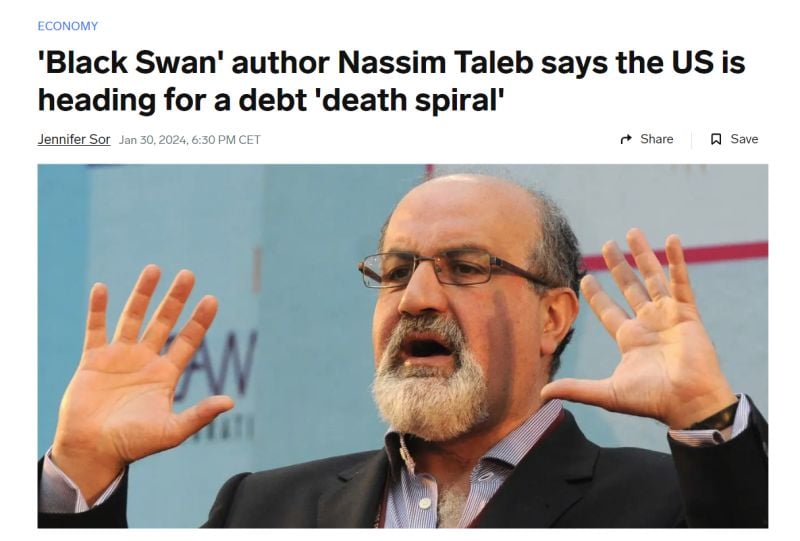

The US is facing a "death spiral" as a result of its mounting debt and the inability of politicians to confront the issue, according to "The Black Swan" author Nassim Taleb.

Per Bloomberg, the Universa Investments advisor who correctly called the 2008 financial crash cast a dire warning about the US debt situation, which has seen the federal debt balance notch $34 trillion for the first time ever to start the year. As long as Congress keeps up its rapid pace of spending, those debts are going to continue to pile up, which could have disastrous consequences for the US economy, Taleb said this week at an event held by Universa Investments. In fact, rising debt in the US is a "white swan," Taleb said, and is an event that poses an obvious risk to markets versus a "black swan" event, which can occur without much warning. That death spiral would necessitate "something to come in from the outside, or maybe some kind of miracle," Taleb said, when asked how the shock would play out, adding that the situation has made him more pessimistic about the political system in the West. Source: Business Insider

A Trader bought 50,000 CBOE Volatility Index $VIX April expiry 50 strike calls for $0.21 which is a total premium of just over $1 million.

Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks