Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

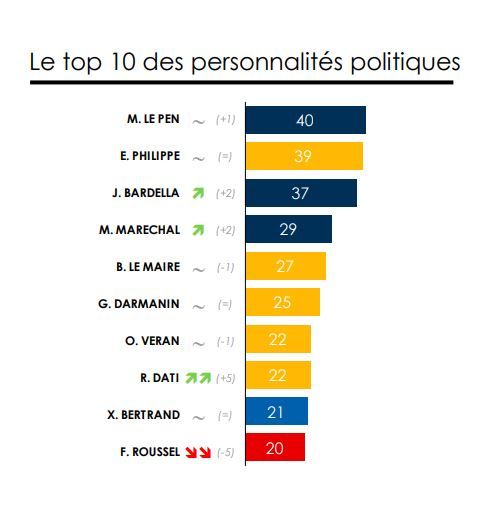

In France, 3 out of the 4 favorite political leaders are from the far right...

1) Marine Le Pen (RN) 40%; 3) Jordan Bardella (RN) 37%; and 4) Marion Marechal Le Pen (Reconquête) 29%. Source: Le Figaro Verian - EPOKA / February poll

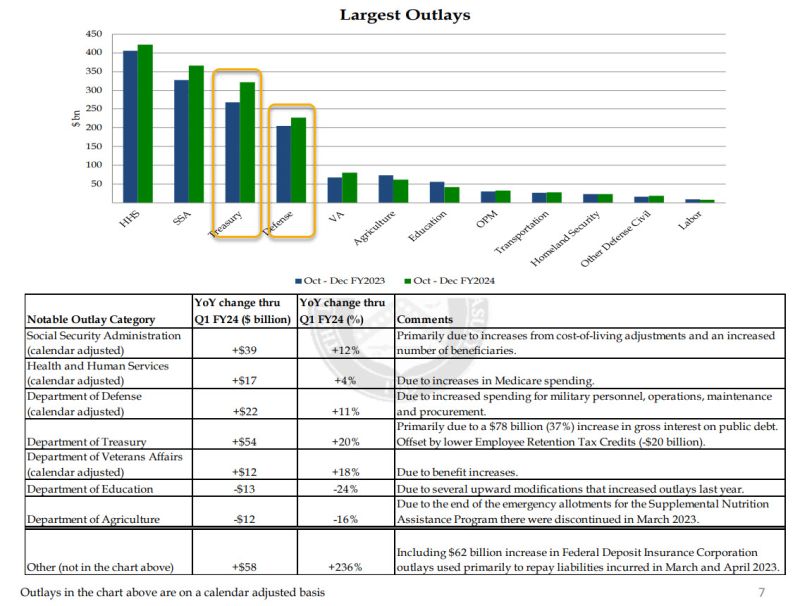

US Treasury confirms spending on debt interest now larger than entire Defense Budget.... and will soon surpass entire Social Security budget.

Source: www.zerohedge.com

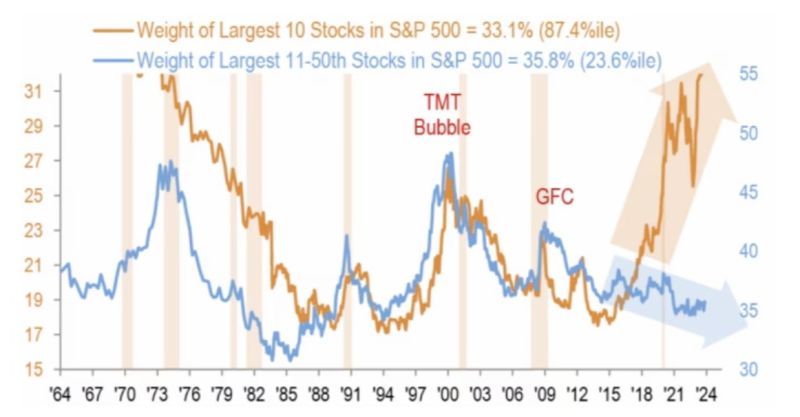

The weight of the 10 largest sp500 stocks is now 33.1% of the total $SPX, the highest level in almost 5 decades.

Source: Barchart

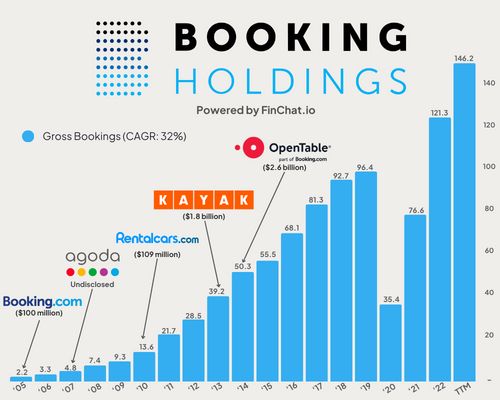

In 2004, Priceline $BKNG acquired Booking.com for $100 million.

Over the last 12 months, http://Booking.com generated ~$20 billion in revenue! Source: Finchat

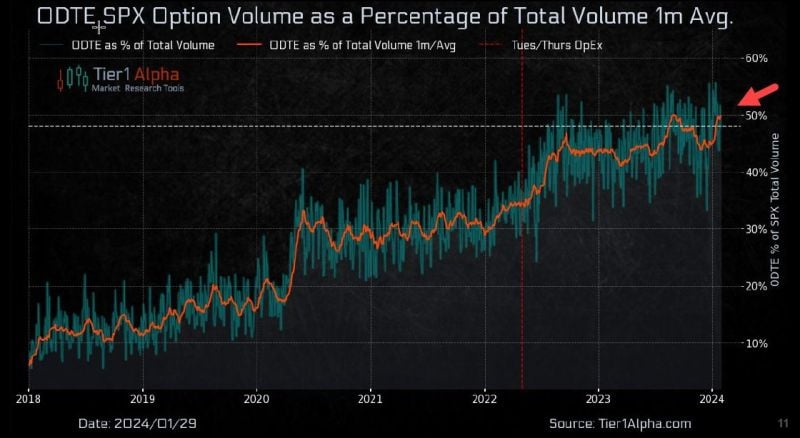

BUBBLES = Super-short-term gambling (zero days to expiration options)... is now running at 50% of the daily flow

Source: Keith McCullough, Bloomberg

Saudi Arabia has announced that it will stop pursuing the expansion of its oil production capacity, reversing a key goal in the oil's superpower strategy

Supporters of the energy transition are celebrating, but geopolitics may be more important than what meets the eye. In a nutshell, Saudi Arabia manages together with Russia a very complex political and economic arrangement within the OPEC+ alliance. Riyad and Moscow are coordinating with other producers around the world in order to revive the global oil market, prevent production surplus and keep oil prices higher than non-OPEC producers' policies would. Source: Francesco Sassi

Egypt: The currency is in free-fall

Black market rate: 1 dollar = 70 pounds Official rate: 1 dollar = 30.9 pounds The pounds has weakened by nearly 24% in the market in 2024. Egyptian billionaire Naguib Sawiris criticized delays in enacting a long-awaited devaluation of the pound, suggesting authorities match the spiraling black market rate to end the nation’s chronic foreign-currency shortage. Postponing reforms is “a disaster that will increase the extent of the critical situation we are in,” Sawiris said in an Arabic-language post on social media platform X. Egypt’s pound has plunged on the parallel market to 68-70 per dollar in recent days, leaving it more than 50% weaker than the official rate of about 30.9. Source: Bloomberg, Ziad M Daoud

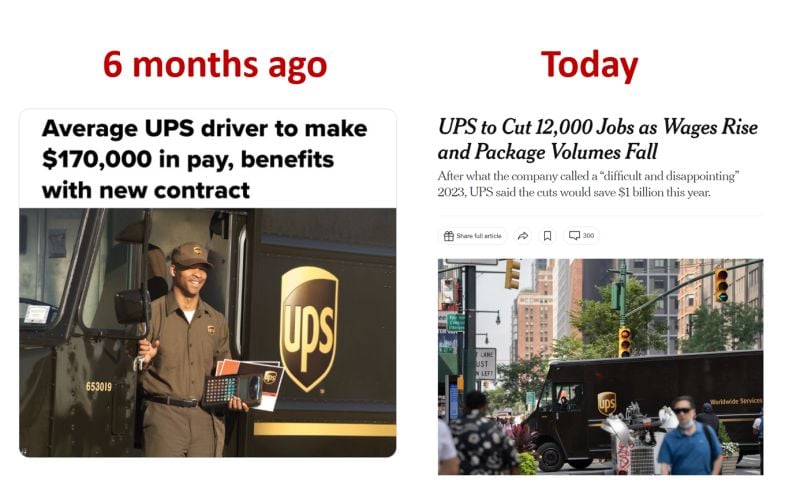

BREAKING: UPS, $UPS, to cut 12,000 jobs after what its CEO called a "difficult and disappointing" year

The company has stated that they are looking to cut $1 billion of annual costs. UPS stock was down 6% after the announcement. Over the last 3 months, layoffs have quickly spread from technology companies to just about every industry. Shipping is now the latest industry to feel the pain. Note that UPS announcement takes place 6 months after the famous 170k salary package announcement by UPS who was at the time desperate to find new drivers. Time flies... Source: The New York Times, The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks