Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

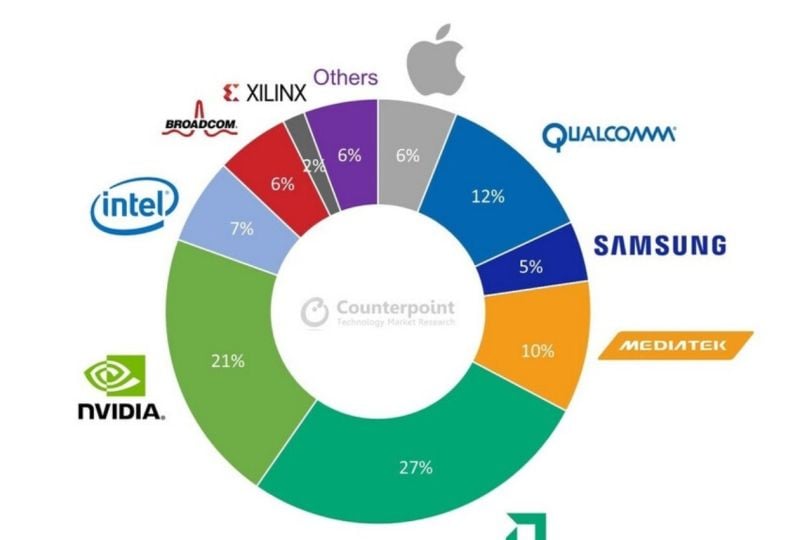

Taiwan semiconductor $TSM, the world's largest contract chip manufacturer, forecast 2024 revenue to grow more than 20% thanks to booming demands for high-end chips used in AI applications

Taiwan Semi's main customers include AMD $AMD, Nvidia $NVDA, Qualcomm $QCOM, Intel $INTC, Apple $AAPL, and Broadcom $AVGO. Source: Jesse Cohen

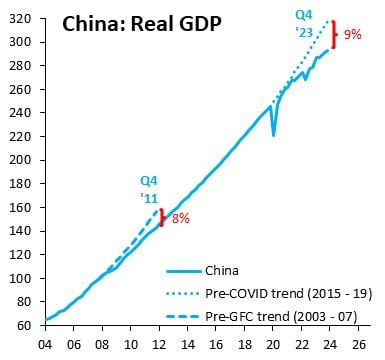

China's real GDP is now further below its pre-COVID trend than after the 2008 crisis

Will they be tempted to opt for more mercantilism (and expansionism)? Source chart: Robin Brooks

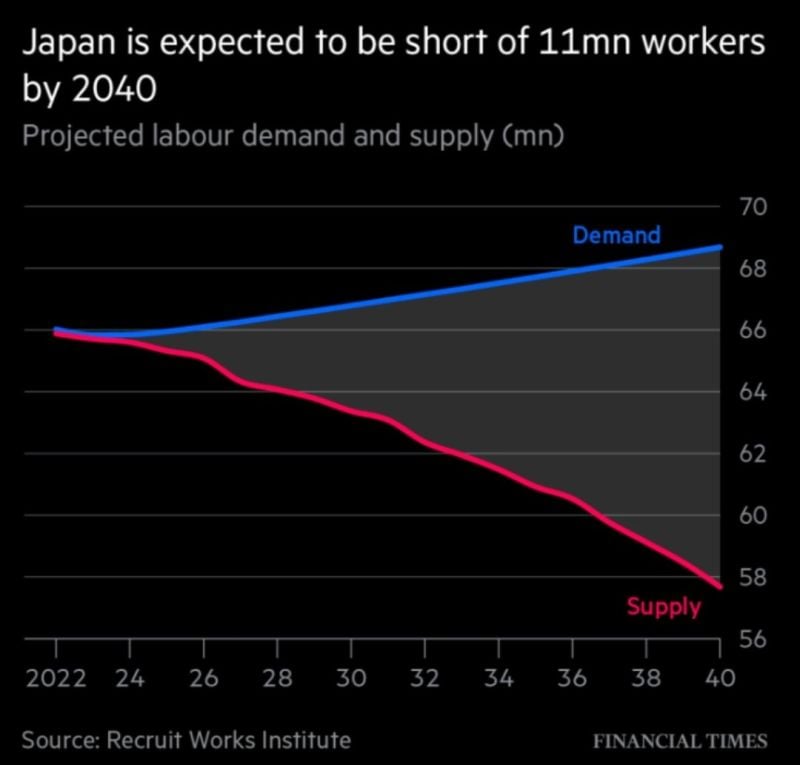

Japan is expected to be short 11 million workers by 2040

Source: Win Smart, FT

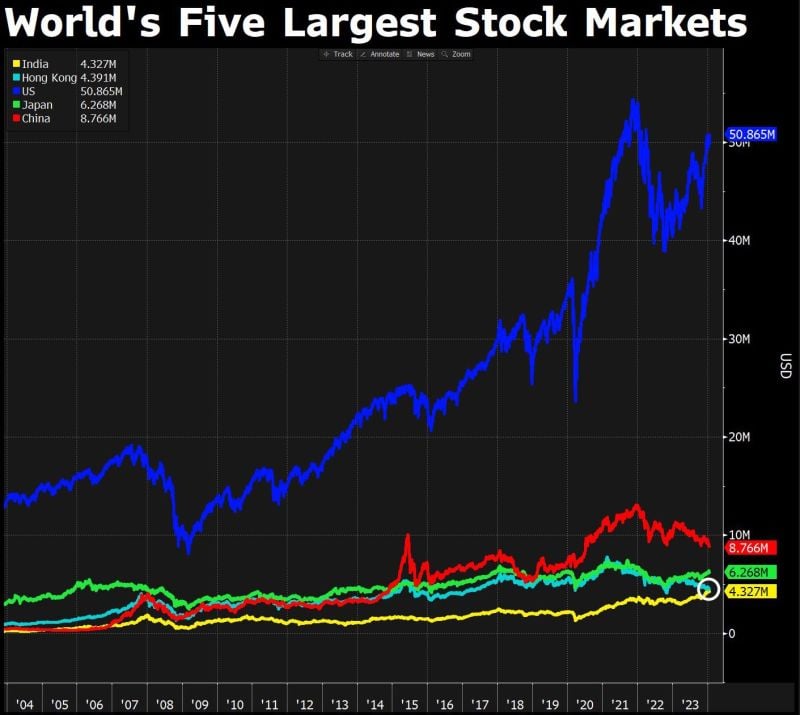

India’s stock market has overtaken Hong Kong’s for the 1st time in another feat for the South Asian nation whose growth prospects & policy reforms have made it an investor darling

Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks