Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

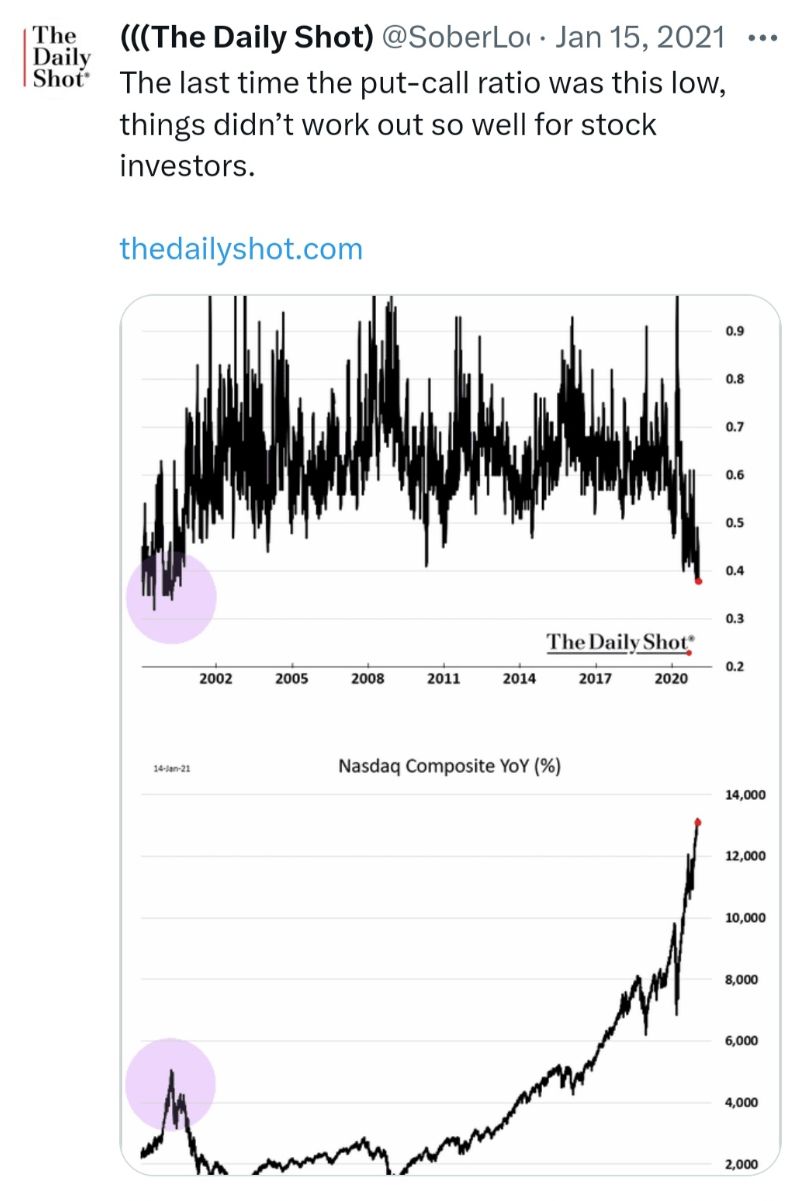

The put/call ratio is as low as at the DotCom peak

Source: The Daily Shot, WinSmart

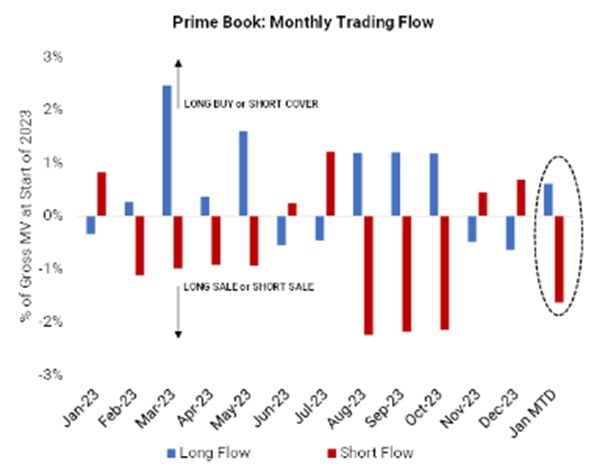

As stocks hit all-time highs, hedge funds are massively shorting stocks Goldman trading desk: "equity skeptics have piled on short bets

Per our Prime Team, shorts outpaced longs by 2:1 this past week, and 3:1 YTD. " Source: Goldman Sachs, www.zerohedge.com

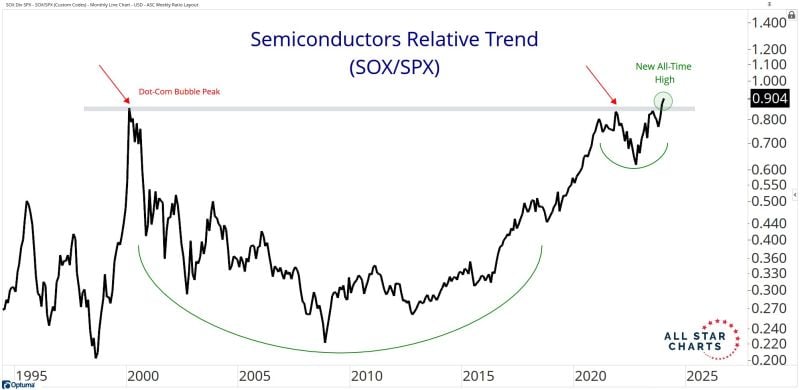

More to come for semiconductors? The chart below shows a 24-yr base breakout for semiconductors RELATIVE to the S&P 500 $SOX $SPX

Source: Steven Strazza

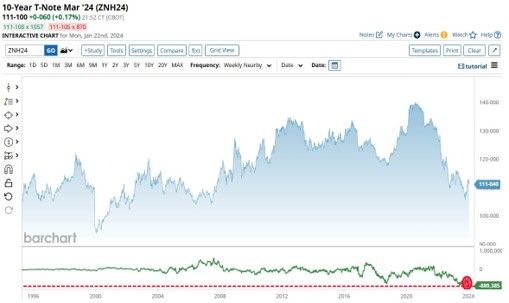

10-Year Treasury Largest Short Position in History 🚨: Hedge Funds are now short more than 889,000 contracts on the 10-Year Treasury, the largest 10-Year Treasury short position in history

Source: Barchart

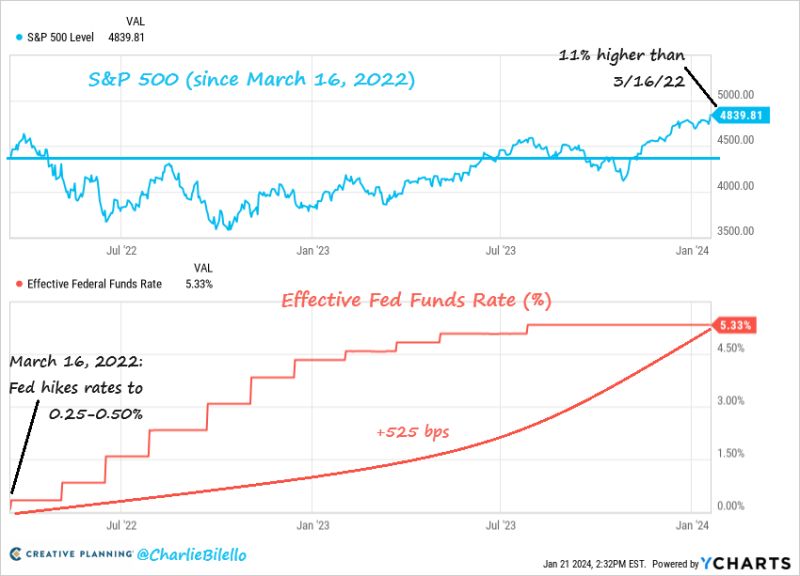

The S&P 500 is now 11% higher than where it was when the Fed started hiking rates in March 2022. $SPX

Source: Charlie Bilello

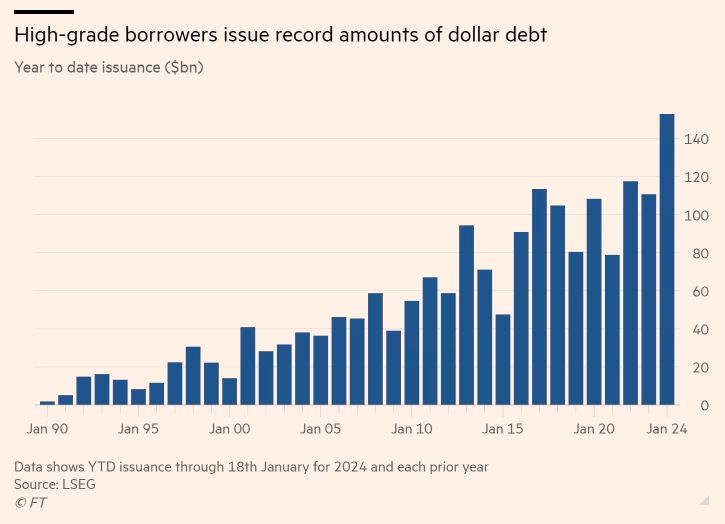

Corporate Borrowing Hits All-Time High 🚨:

Investment Grade Companies have issued more than $150 Billion worth of bonds through the first 18 days of the year, the highest amount in history at this point in the year. Source: Barchart, FT

India is set to overtake Hong Kong to become the world's fourth-largest stock market. It may happen this week assuming current trajectories hold

Source: David Ingles, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks