Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

TPU > GPU ???

Google's AI chips - TPUs, or tensor processing units - are having a moment. These semiconductors were used to train its latest genAI model, Gemini 3, which has received rave reviews, and are cheaper to use than Nvidia's offerings. 🚀 But here's the real reason Google invented the TPU Back in 2013, Google ran a simple forecast that scared everyone: If every Android user used voice search for just 3 minutes a day, Google would need to double its global data centers. Not because of videos. Not because of storage. But because AI was too expensive to run on normal chips. So Google made a bold move: 👉 Build its own AI chip - the TPU. 15 months later, it was already powering Google Maps, Photos, and Translate… long before the public even knew it existed. ⚡ Why TPUs Matter GPUs are great, but they were built for video games, not AI. TPUs were built only for AI. No extra baggage. No wasted energy. Just raw efficiency and speed. That focus paid off: TPUs deliver better performance per dollar Use less energy Are faster for many AI tasks And with each generation, Google doubles performance Even Nvidia’s CEO, Jensen Huang, openly respects Google’s TPU program. 🤔 Then why don’t more companies use TPUs? Simple: Most engineers grew up with Nvidia + CUDA, and TPUs only run on Google Cloud. Switching ecosystems is hard — even if the tech is better. ☁️ The Bigger Picture: Google’s Cloud Advantage AI is crushing cloud margins because everyone depends on Nvidia. Google isn’t. It owns the chip and the software stack. That means: ✔️ lower costs ✔️ better margins ✔️ faster innovation ✔️ and a defensible advantage competitors can’t easily copy Some experts now say TPUs are as good as or even better than Nvidia’s best chips. 🔥 The Punchline Google didn’t build TPUs to sell chips. It built them to survive its own AI growth. Today, TPUs might be Google Cloud’s biggest competitive weapon for the next decade. And the moment Google fully opens them to the world? The AI infrastructure game changes. Source: zerohedge, uncoveralpha

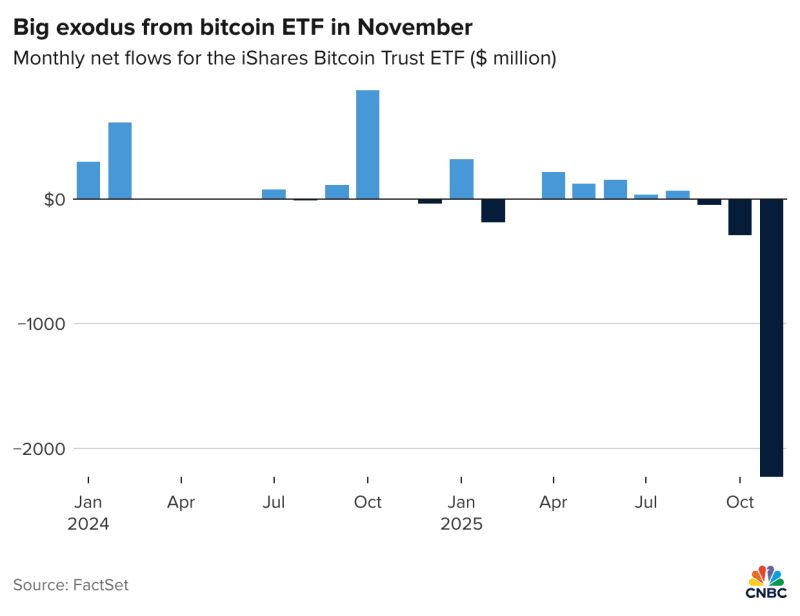

The iShares Bitcoin Trust ETF $IBIT has recorded $2.2 billion in outflows so far this month

Source: CNBC

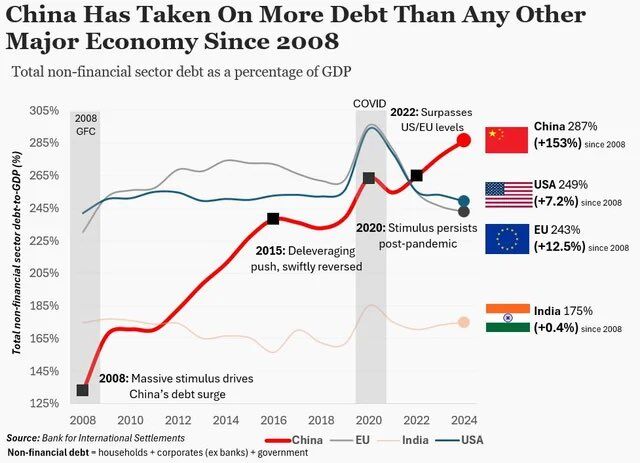

China’s $18.7T Debt Problem… Isn’t the Same as America’s

China’s government debt has exploded — up to $18.7 trillion in 2025, growing 13.6% a year. But here’s the twist: 👉 98% of that debt is owed to China’s own banks, companies, and citizens. Not to foreign governments. Not to global investors. Compare that to the U.S., where ~24% of public debt is held overseas. And that one difference changes everything. 🔍 Why China’s Debt Works Differently Because the debt is domestic: China can control its crisis responses Beijing can extend payments, adjust rates, restructure debt There’s no risk of foreign investors dumping Chinese bonds The currency is less exposed to sudden global panic In other words: China can fix China’s debt. The U.S. can’t always fix U.S. debt. 🇺🇸 The U.S. Advantage — and the Weak Spot The U.S. benefits because the dollar is the world’s reserve currency, so global demand keeps borrowing costs low. But the trade-off? America depends on continued trust from foreign buyers. If that confidence ever wobbles, financing gets harder — fast. ⚖️ The Trade-Off China = more control, less external risk… but must fix its own bubbles internally. U.S. = global trust, cheap borrowing… but more exposed if the world’s confidence cracks. Two superpowers, two debt systems, two very different risk profiles — and both will shape the next decade of global finance. Source: StockMarket.news

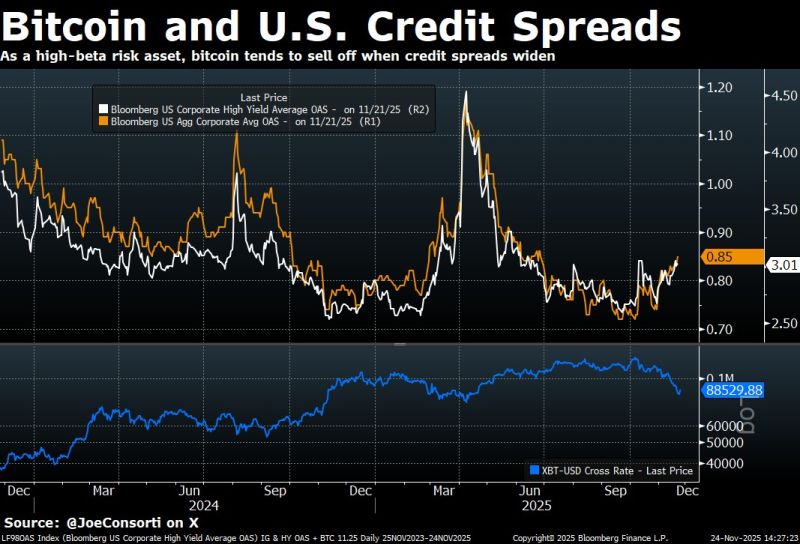

Bitcoin seems to be trading alongside credit spreads:

• Carry trade blowup → BTC -31% • Tariff tantrum → BTC -30% • October 6th through today → bitcoin $BTC -34% Source: Bloomberg, Joe Consorti

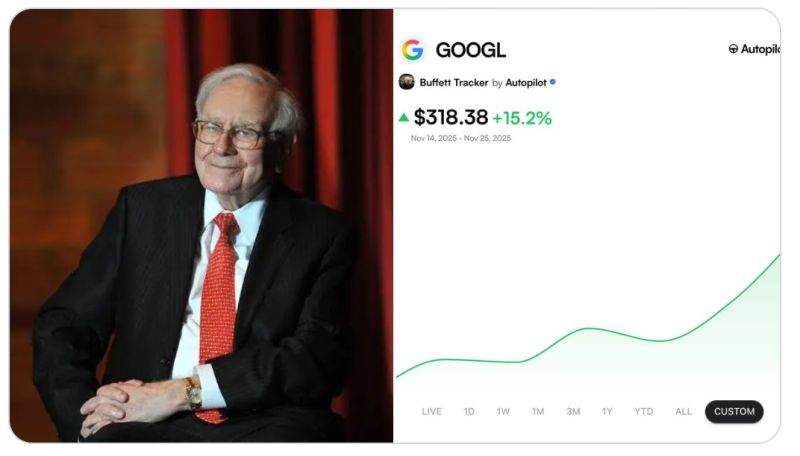

Google $GOOGL is now up 15% since Buffett's Berkshire disclosed a $4B stake

Source: Michael Burry Stock Tracker ♟ @burrytracker

🚨 THE REAL REASON BEHIND THE OCT 10 CRYPTO CRASH JUST DROPPED

For weeks, everyone kept asking: “Why did the market nuke on Oct 10 with ZERO news?” A thread on X by Bull Theory explains why it happened and how it changes the whole narrative. 1️⃣ MSCI quietly triggered a structural panic On the same evening the crash began, MSCI released a consultation note almost nobody in crypto saw. Their proposal: If a company holds 50%+ of its assets in Bitcoin/digital assets AND behaves like a digital-asset treasury… 👉 it can be excluded from MSCI global indexes. Translation? MicroStrategy and other BTC-heavy companies were suddenly at risk. 2️⃣ Why this is a big deal If MSCI excludes them: • Index funds must sell — instantly No debating. No picking. Pure forced liquidation. • MicroStrategy becomes a target If $MSTR is treated as “fund-like,” indexed funds would be required to reduce or exit. • And when MSTR sells → Bitcoin feels it immediately Weakness in MSTR = lower confidence = higher BTC correlation = more retail panic = liquidation wave. 3️⃣ The Oct 10 cascade suddenly makes sense The market was already fragile: Trump tariffs, a weak Nasdaq, overcrowded BTC leverage, cycle-top fear. MSCI’s note added a new fear: 👉 “If index funds dump MSTR, BTC could get hit next.” That was enough to trigger one of the largest liquidation waves in crypto history. 4️⃣ Then JPMorgan poured gasoline on the fire Three days ago, JPMorgan dropped a bearish note echoing the same MSCI risk — right when: • MSTR weak • BTC weak • Liquidity thin • Sentiment fragile A classic Wall Street playbook: Bearish at the bottom. Bullish at the top. Never random. 5️⃣ Saylor finally enters the chat As fear peaked, Saylor publicly clarified: “We are NOT a fund. We are an operating software company with an innovative Bitcoin treasury strategy.” He highlighted new credit products, ongoing software revenue, and billions in structured instrument issuance. Message received: 👉 MicroStrategy ≠ passive BTC holder. 👉 Index labels don’t define innovation. 6️⃣ What this means going forward ✔ The Oct 10 crash wasn’t random — it aligns perfectly with MSCI’s announcement. ✔ Forced-selling fears created a liquidity shock. ✔ JPMorgan amplified it at the worst possible moment. ✔ Saylor restored confidence, but… ✔ Final MSCI decision comes January 15, 2026. Volatility until then? Highly likely. 🔍 Final Take Oct 10 wasn’t a fundamental breakdown. It was a structural shock hitting a fragile market — and institutions used it to shape sentiment. But the long-term picture hasn’t changed: • Bitcoin adoption strong • Corporate interest rising • Saylor building • Institutions accumulating • ETFs stabilizing • Liquidity cycles returning MSCI isn’t stopping Bitcoin. It just created volatility that smart money is already exploiting. Source: Bull Theory @BullTheoryio zerohedge

Investing with intelligence

Our latest research, commentary and market outlooks