Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Morgan Stanley analysts project that global AI-related capex will approach $3 trillion

~$1.5 trillion needing to be financed across public and private credit markets.

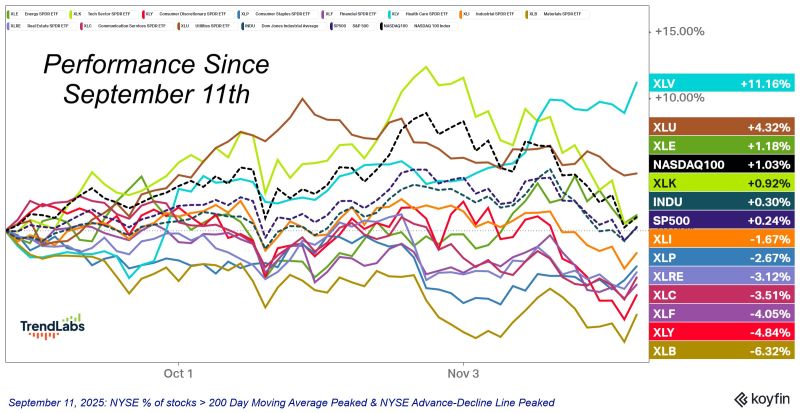

The correction of the US equity market turned 10 weeks old on Thursday.

Here's what the sector rotation we've seen looks like underneath the surface. Source: J-C Parets

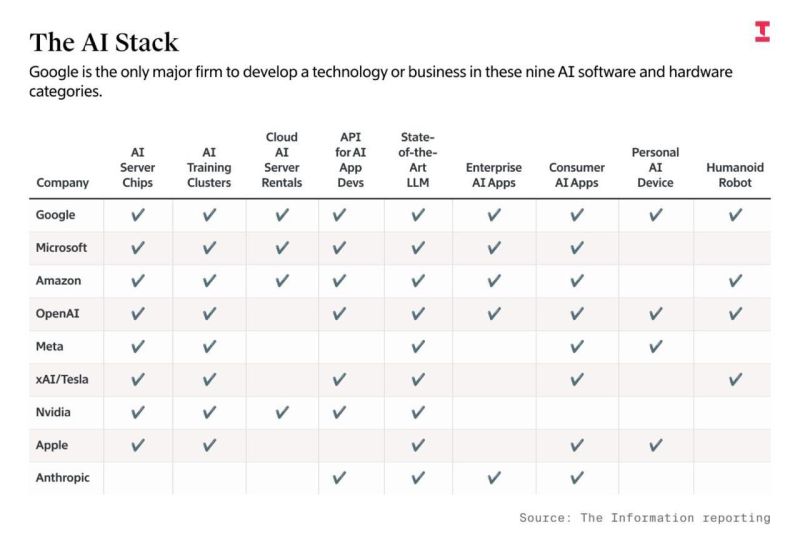

Very interesting chart by Jen Zhu @jenzhuscott showing that Google has the most comprehensive stacks in AI compared to all peers/competitors.

It means they have more defensibility against the incestuous financing games that’s now the core of the “AI bubble”. She also notes that Gemini’s market share has grown rapidly from 5.6% 12 months ago to 13.7% now, mostly at the expense of ChatGPT - this was before the launch of Gemini 3. Source: The information reporting

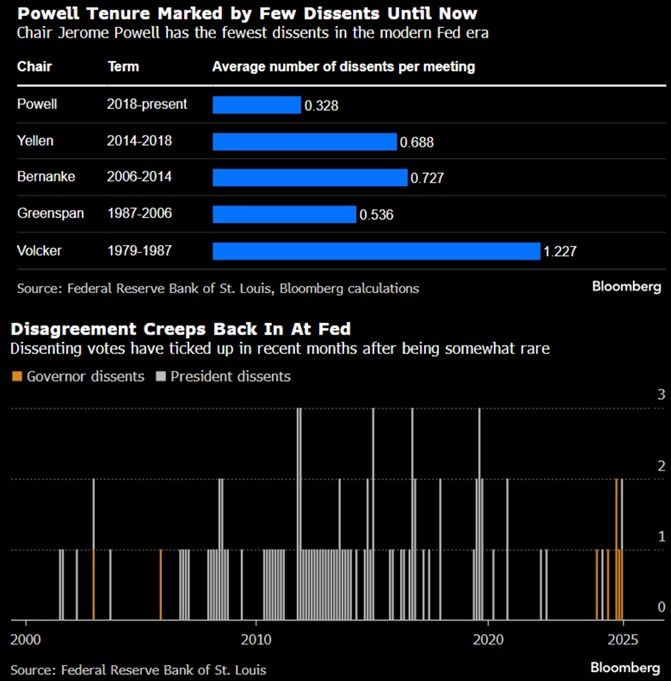

Powell tenure has been marked by few dissents... until now.

Dissenting votes have ticked up in recent months after being somewhat rare. Source: Bloomberg, RBC

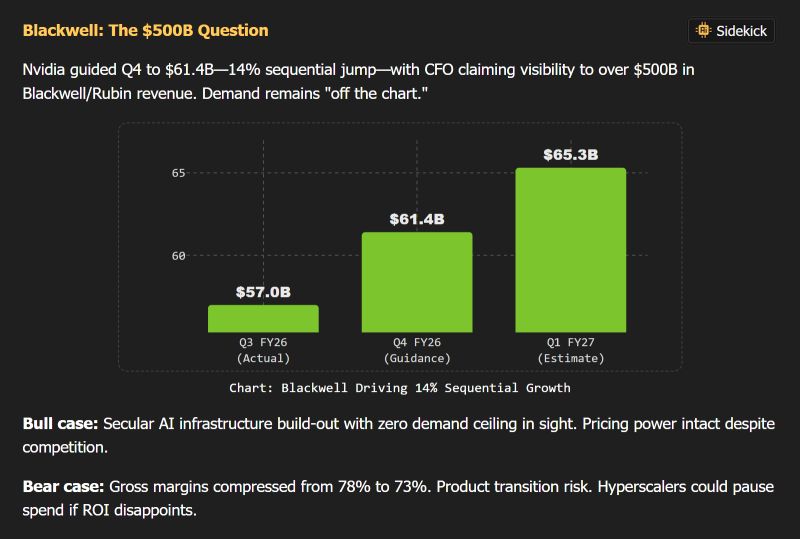

Nvidia: What’s the Bull Case? What’s the Bear Case?

🐂 Bull Case: The AI infrastructure boom is still in its early innings. Demand has no visible ceiling, and Nvidia continues to command extraordinary pricing power despite new entrants. Every major hyperscaler, enterprise, and startup is still rushing to deploy more compute. 🐻 Bear Case: Gross margins have slipped from 78% → 73%. The product transition introduces execution risk. And if hyperscalers don’t see the ROI they expect, they could slow down spending — even temporarily. What does Nvidia say? On the earnings call, the CFO addressed it directly: ➡️ AI demand remains extremely strong — strong enough that Nvidia is raising Q4 guidance again. Source: Bloomberg Activate to view larger image,

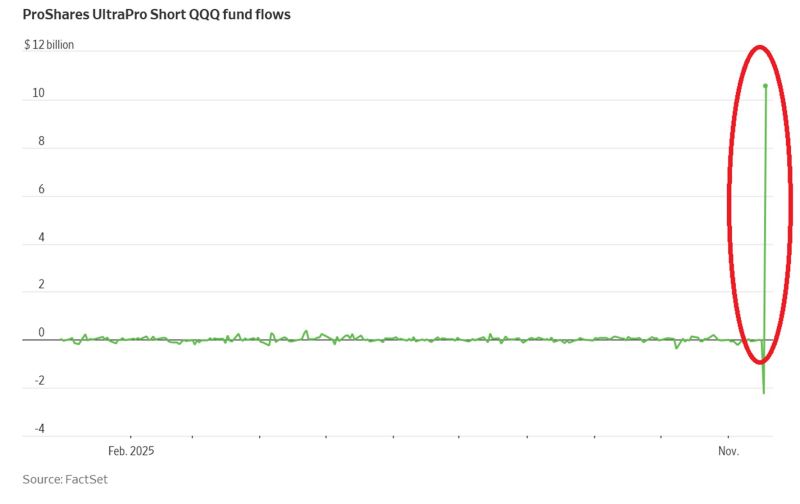

🔴The 3x leveraged short Nasdaq 100 ETF, $SQQQ, saw +$12 BILLION in net inflows on Thursday, the largest daily inflow on record in data going back to 2010.

This means some investors bet hugely that the tech stocks will decline. Many retail investors are piling into investment products they do not understand.. This will not end well. Source: Global Markets Investor

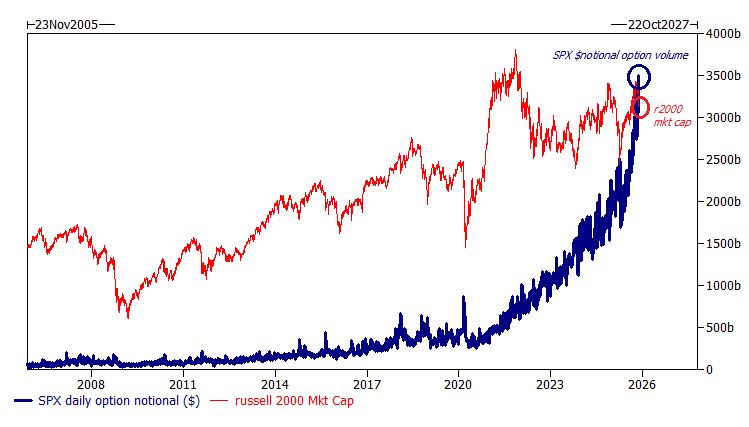

Goldman: As Panic Index Nears Record, Chase For Downside Protection Is Off The Charts

After an early post-Nvidia rebound, markets reversed sharply on Thursday, and the demand for hedges became obvious. Goldman reported “a massive bid for puts,” with option activity staying extremely elevated. As the chart shows, total put volume hit its third-highest level of the year, while overall option volume climbed to one of the highest readings on record. The scramble for downside protection has pushed normalized put/call skew to one of its highest levels in the past three years. Another way to illustrate the sheer surge in activity: average daily trading volume in SPX options has now reached $3.5 trillion. That’s an all-time high—and, remarkably, larger than the entire market capitalization of the Russell 2000 (RTY). Source: zerohedge

Crude oil trading near 4.5 year lows as U.S. hails progress in Russia-Ukraine peace talks 👀📉

Low oil prices could be another stimulus for US consumers in 2026(in addition to rate cuts, tax cuts, cheques, more lending by banks dur to financial deregulation, etc.) Source: Barchart

Investing with intelligence

Our latest research, commentary and market outlooks