Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Among the Top 10 surprises for 2024 by JP Morgan CIO: [Surprise #4] The driverless car backlash is coming. Here's why:

"In the few places where full Level 5 autonomous cars are being tested in real world conditions (San Francisco, Austin), they have blocked ambulances on their way to the hospital, hampered other emergency responders, caused accidents, increased congestion and run over pedestrians, one instance of which reportedly resulted in the resignation of Cruise’s CEO. Waymo has added technology to reportedly allow firefighters to take control of its vehicles if they stop moving. LiDAR (autonomous vehicle technology) stocks have collapsed by 85% from their peak - see chart below. A possible backlash might be coming from citizens who believe, as in the case of the despised urban scooter plague, that convenience for some results in dangers and inconvenience for others. Tesla is experiencing problems even at Level 2, which requires driver oversight. The NHTSA investigated a series of crashes involving Tesla autopilot and found that its methods of insuring driver compliance are inadequate and can lead to “foreseeable misuse”. In December, Tesla issued a recall of 2 million vehicles to update the software to require greater driver compliance". Source: JP Morgan, www.zerohege.com

Fidelity marks down X valuation by 71.5%

Source: Win Smart, CFA

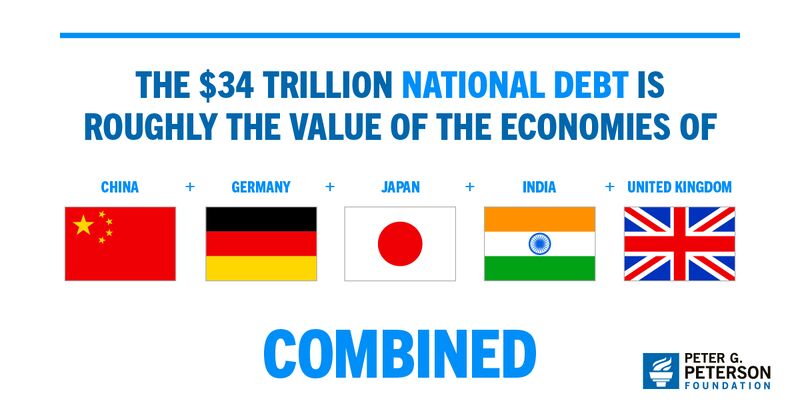

BREAKING: Total US debt hits $34 trillion for the first time in history, putting US debt up 100% since 2014

Since the debt ceiling "crisis" ended in June 2023, total US debt is up nearly $3 trillion. This debt balance is more than the value of the economies of China, Germany, Japan, India and the UK COMBINED. The US is now spending $2 billion PER DAY on interest expense alone. Debt per capita is at a record high of $101,000. Source: The Kobeissi Letter

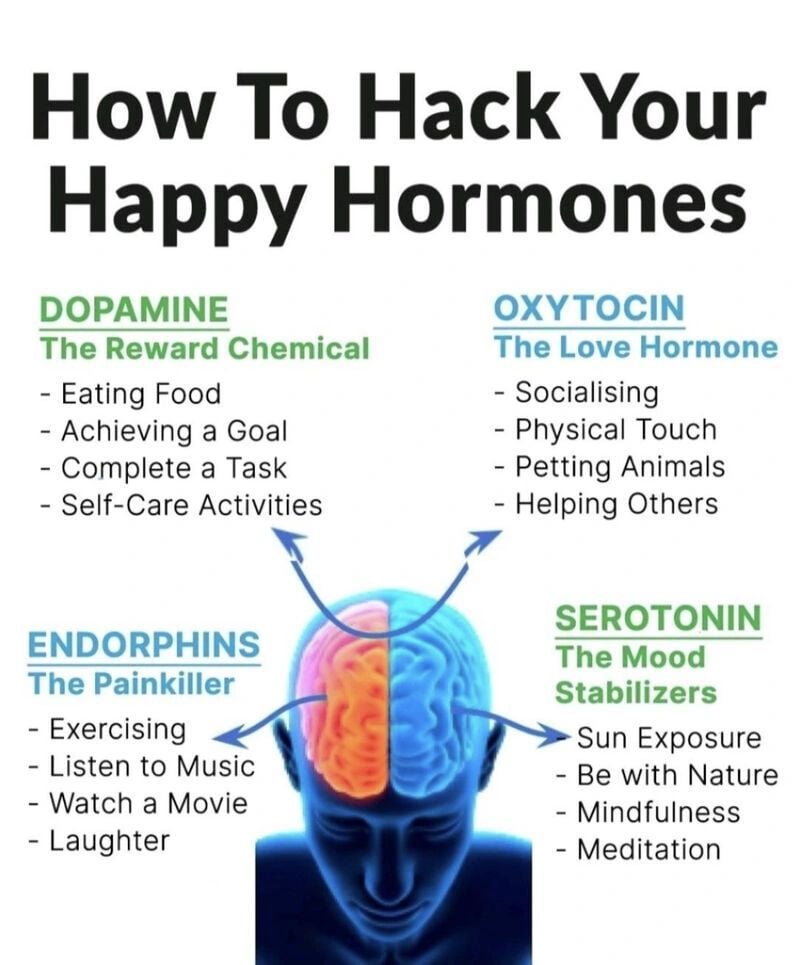

✨🎉Serotonin, Dopamine, Endorphins, and Oxytocin: The Neurotransmitters of Well-being

Source: SEEMA YADAVSEEMA YADAV

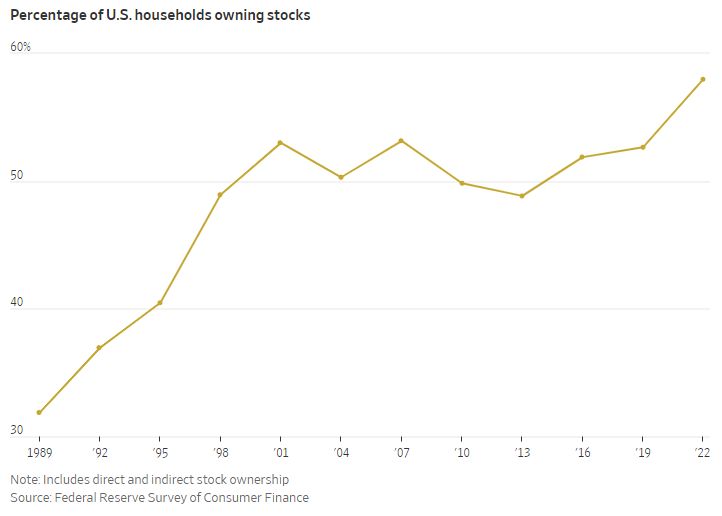

58% of US households own stocks, the highest percentage on record

Source: Charlie Bilello

The gap between the Magnificent 7 and the S&P 493 (remaining 493 companies) is now 63%

This year, the Magnificent7 is up a massive 75% while the remaining 493 companies are up just 12%. Combined, the S&P 500 is up ~25%, more than doubling the S&P 493's total return. In other words, the Magnificent 7 is up 3 TIMES as much as the S&P 500 and ~6 TIMES as much as the S&P 493. Just 7 weeks ago, the S&P 493 was DOWN 2% this year. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks

![Among the Top 10 surprises for 2024 by JP Morgan CIO: [Surprise #4] The driverless car backlash is coming. Here's why:](https://blog.syzgroup.com/hubfs/1704244127652.jpg)