Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

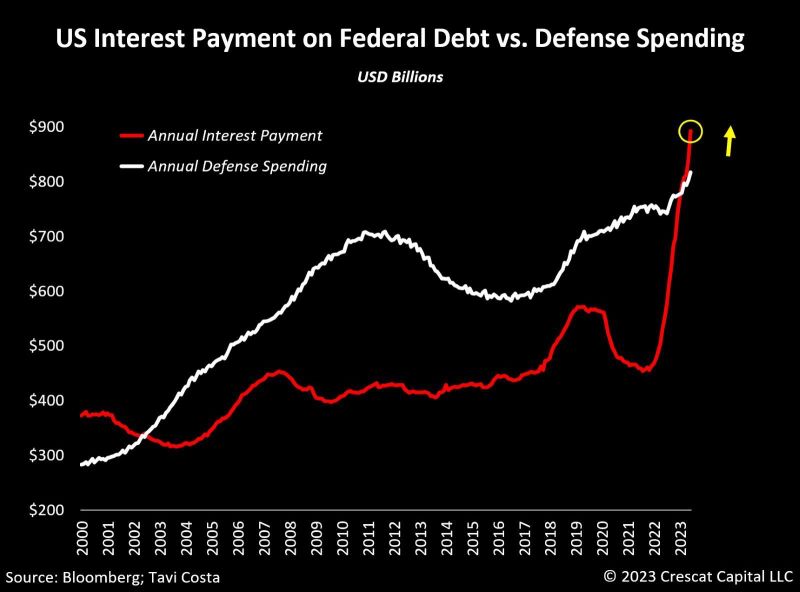

As highlighted in the Kobeissi Letter and in the chart below from Tavi Costa >>> Annualized interest expense on US Federal debt is nearing $1.1 TRILLION

To put this in perspective, 2023 defense spending was $821 billion. This means the US is on track to spend 34% MORE on interest expense than defense spending. In 2023, the US government produced $4.4 trillion in revenue. This means that 25% of receipts in the entire 2023 are equivalent to Uncle Sam's annual interest expense. Rising rates and falling tax revenue are both occurring at the same time. A tricky combination

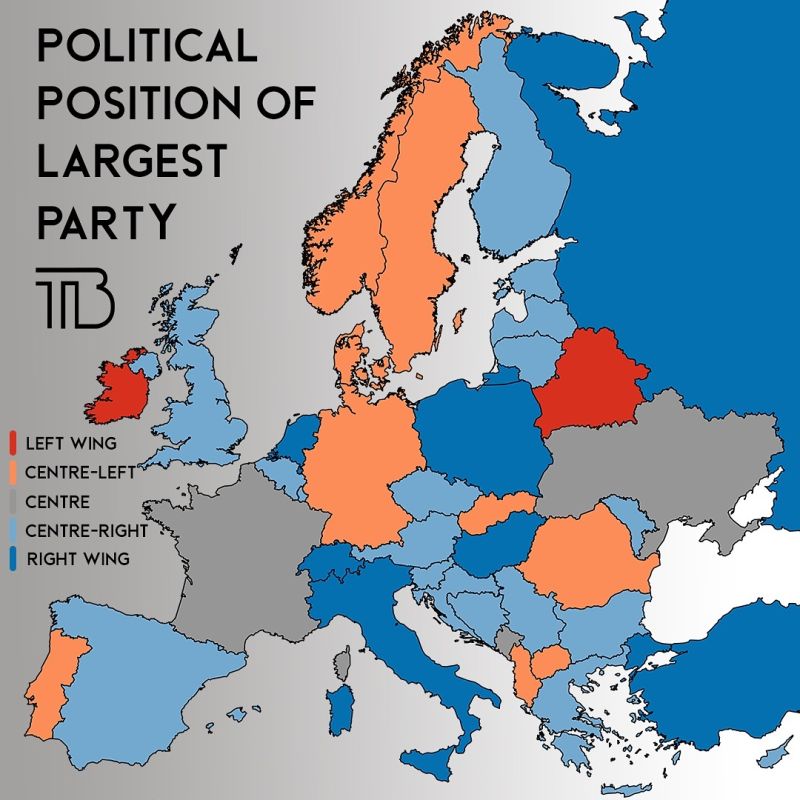

Political position of the largest party in each European country

(map by try.balkan/instagram) Source: OnlMaps

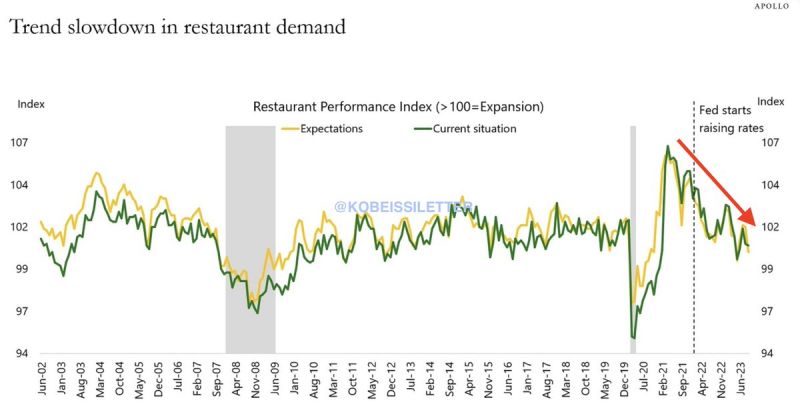

Interesting development highlighted by The Kobeissi Letter:

Is the slowdown in restaurant activity signalling that a FED pivot Indicators of restaurant activity continue to show signs of weakness in the US. Interestingly, this has been almost perfectly correlated with the Fed raising rates. Restaurant activity in the US hit an all time high in August 2021. Since the Fed started raising rates in March 2022, restaurant activity has moved in a straight line lower. As excess savings are depleted and inflation remains an issue, consumers are cutting back. And more credit card debt is not the solution here.

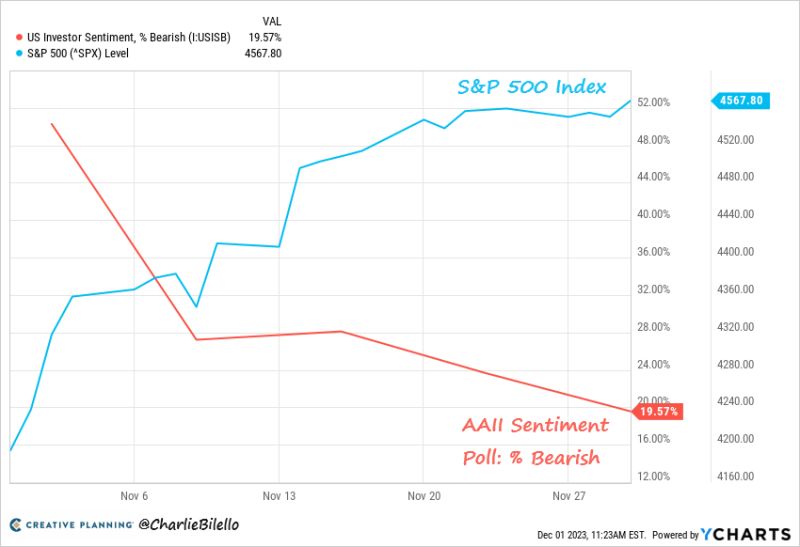

Sentiment is turning bullish. Bears in the AAII sentiment poll moved from over 50% to under 20% during November

This is the lowest bearish % since Jan 2018 (which followed 2017's record 12 straight up months). What changed? Prices. The S&P 500 gained 8.9% in November, one of its best months ever. $SPX Source: Charlie Bilello

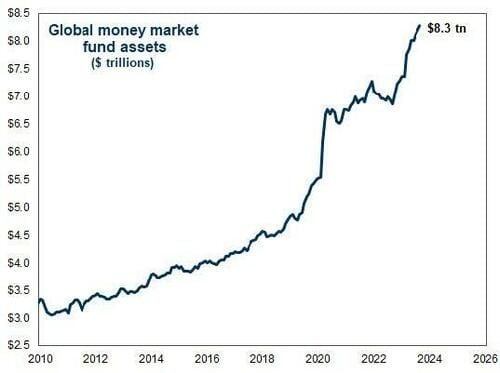

Global Money Market Funds All-Time High 🚨:

A record high $8.3 Trillion is parked in global money market funds according to Goldman Sachs. $5.73 Trillion of this are U.S. based funds. As global central banks cut rates, could this capital find its way back into equities? Source: Barchart

A wake-up call to start the week with Gold trading above $2,100 and digital gold aka bitcoin trading above $41,000

I do see 2 messages here: 1) Short-term: Mr Market believes Mr Powell is bluffing, i.e rate cuts are coming; 2) Long-term: dollar debasement is inevitable. Investors and central banks are looking for reserve status

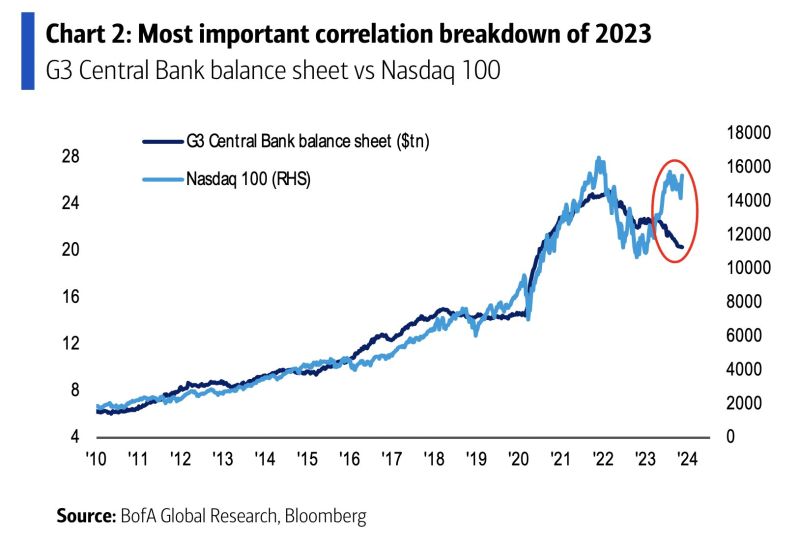

Most important correlation breakdown of 2023, according to BofA:

The S&P 500 soared >19% YTD led by "Magnificent Seven" (now 30% of market cap). Tech stocks hit 100-year relative high (despite global liquidity (G3 Central Bank Balance sheet) -$1.8tn.

Investing with intelligence

Our latest research, commentary and market outlooks