Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

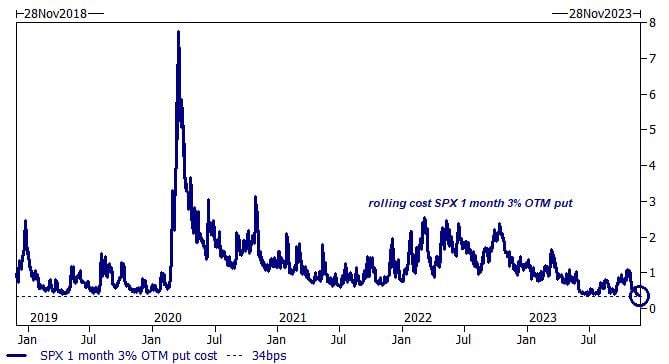

Goldman: Hedging against a market crash is the cheapest in more than five years...

The chart below shows the cost of a rolling SPX 1 month 3% OTM put: the current cost is 34 basis points, the lowest level in 5 years. Source: Goldman Sachs, TME

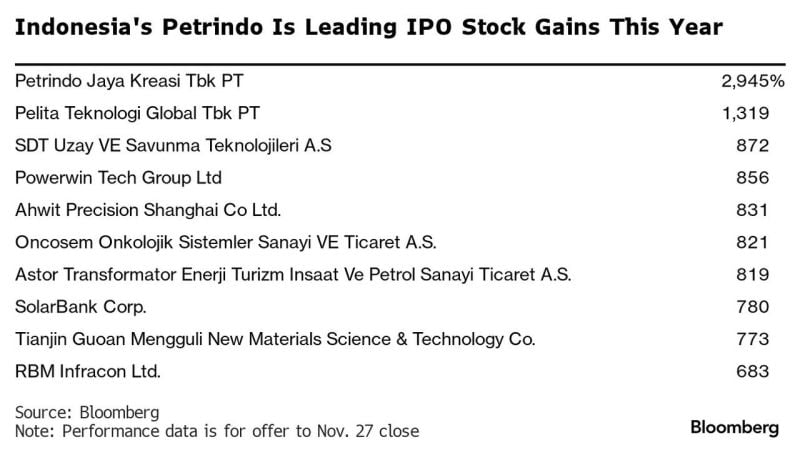

Here's the list of the best performing IPO in the world so far in 2023 YTD

The world’s best-performing IPO stock this year is a little known Indonesian coal mining company that’s backed by one of Southeast Asia’s richest men. PT Petrindo Jaya Kreasi has soared more than 2,900% since it listed in March following a $25 million offering. Yet it still has no analyst coverage, is richly valued and has relatively low trading volumes. Counting Indonesian billionaire Prajogo Pangestu as its main shareholder, the company’s market value has grown by more than 25 times to $5.4 billion in just nine months. Indonesia has been one of the most vibrant markets for initial public offerings globally this year, partially helped by a boom in demand for renewable energy stocks. Petrindo, in particular, is among a cohort of Indonesian stocks that have posted unexplained gains and wild swings this year, reaping fortunes for their backers and leading to regulatory scrutiny. Source: Bloomberg, www.zerohedge.com

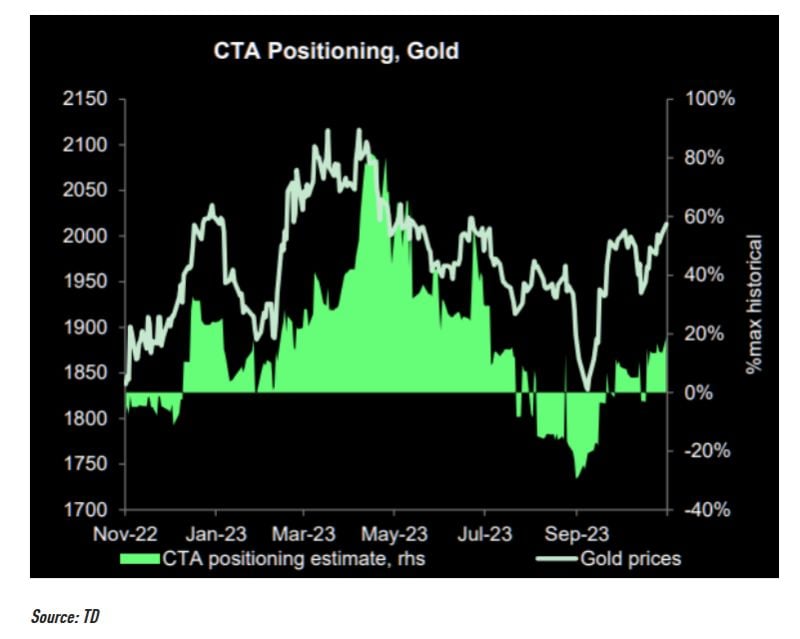

They just started buying gold...

CTAs have reversed the gold short into a long, but they could be buying much more on the back of this break out. They are more than happy to play this momentum move... Source: Bloomberg, TME

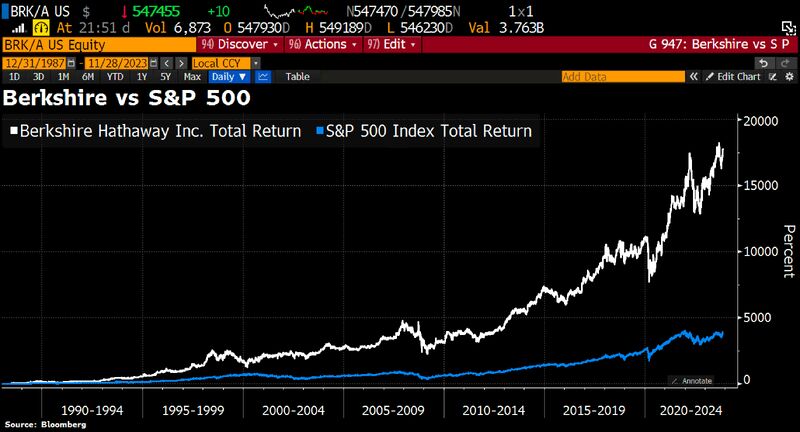

Charlie Munger, Warren Buffett's Partner and 'Abominable No-Man,' dies at 99

Munger helped Buffett, who was seven years his junior, craft a philosophy of investing in companies for the long term. Under their management, Berkshire avg an annual gain of 20.1% from 1965 through 2021 — almost twice the pace of the S&P 500 Index. Source: Bloomberg, HolgerZ

Per Bloomberg, US Treasury issuance next year is expected to reach $1.9 trillion...

Excess supply of US Treasuries remains a key downside risk for bonds (and thus for equities given the still high correlation between the 2). Note that every Treasury auction is now very closely monitored by investors with some immediate consequences on market returns (e.g last week: strong auction triggered a drop in US Treasury yields on Wednesday and a rise in sp500). Source picture: Markets Mayhem

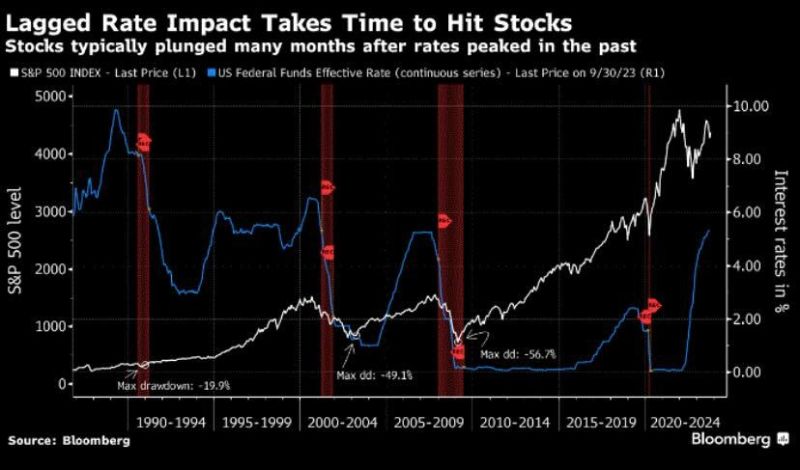

As we moved into 2024, one downside risk needs to be kept in mind:

tightening monetarypolicy cycle often operates with a lag. As shown on the chart below, stocks typically plunged many months after rates peaked in the past. Source. Bloomberg, Cheddar Flow

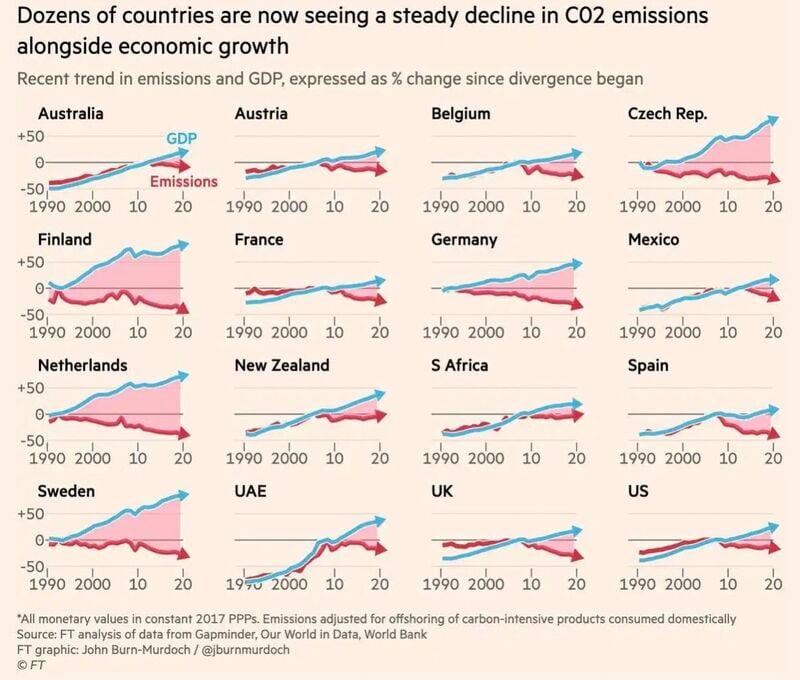

Dozen of countries are now seeing a steady decline in C02 emissions alongside economic growth

Another tangible proof that being green (or at least greener) does not mean de-growth Source: FT

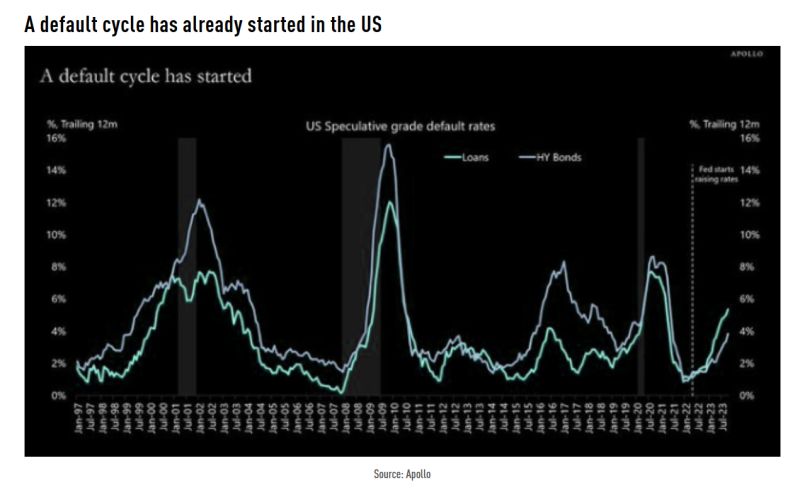

Since the Fed started raising rates in March 2022, default rates have gone from 1% to 5%+

Source: Apollo, TME

Investing with intelligence

Our latest research, commentary and market outlooks