Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

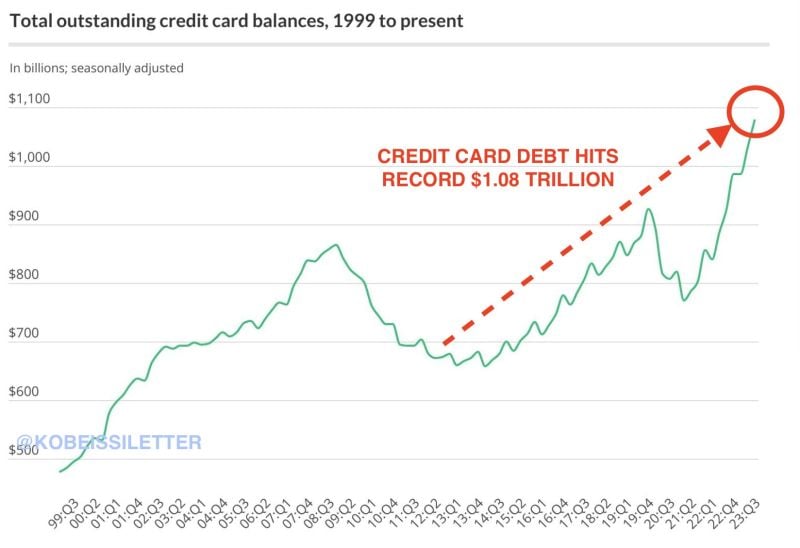

As highlighted by The Kobeissi Letter >>> Buy Now Pay Later spending soars 20% compared to last year on Black Friday

It's also expected to jump 19% on Cyber Monday to a record $782 million. As excess savings in the US have gone from $2 trillion to zero, Americans are relying on debt more than ever. In other words, "deals" that are 20% off are being financed with credit card debt that has a 30% interest rate...

Fun Fact: Bill Gates Could Be A Trillionaire Today If He Had ‘Diamond-Handed’ His Original $MSFT Shares

If he maintained his 45% stake, it would equate to $1.23 Trillion today... Source: Cheddar Flow

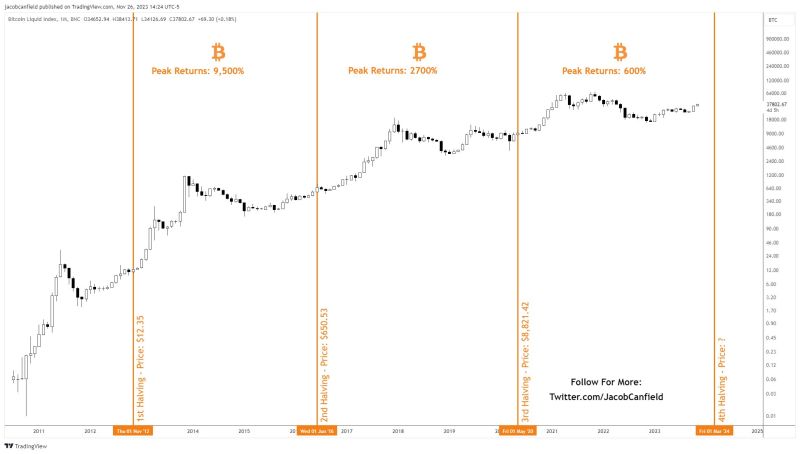

97% Of All Bitcoin Will Be Mined In April of 2024 For the 4th Halving...

As a reminder: The single most important event for Bitcoin is the halving. Satoshi Nakamoto coded Bitcoin to half the reward payouts to miner's every 210,000 blocks. This event occurs approximately every four years and is a form of artificial inflation control, similar to a central bank printing less money. The halving ensures that the total supply of Bitcoin caps at 21 million, making it a deflationary asset. In simpler terms, as more time goes on, less and less Bitcoin are created. Every other fiat currency in existence is inflationary in nature. As more time goes on, more are created, thus making the currency you hold less valuable. This is what separates Bitcoin from everything else and why many believe that is is a digital store of value. As a function of economics and as Bitcoin's adoption rate grows, this means that demand will most likely outpace supply by a wide margin. The chart below shows past halving events and their market impact. Source: Jacob Canfield

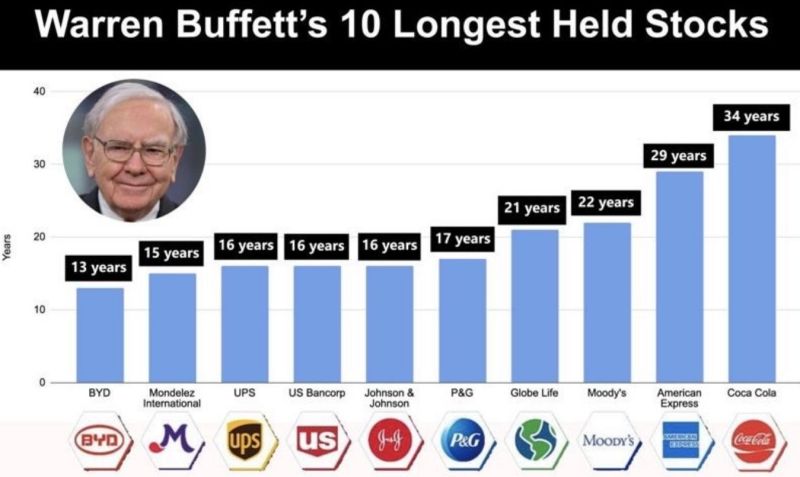

The way to build wealth, is over the long-term:

Source: Invest In Assets | Stock Market Investing 📈

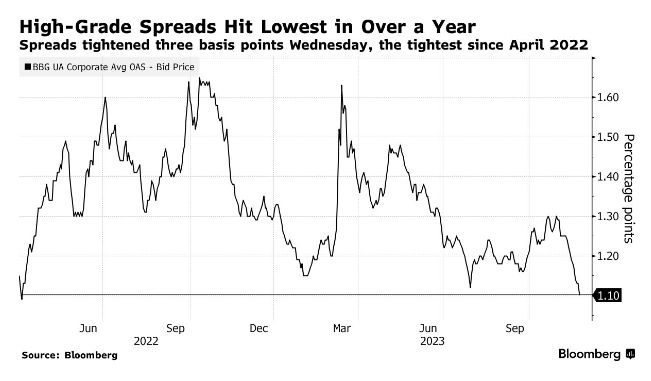

U.S. Investment Corporate Bond Spreads hit lowest level since April 2022 signaling that the Federal Reserve is likely done raising rates

This visual measures the additional yield investors need to own bonds rather than treasuries. Source: Barchart, Bloomberg

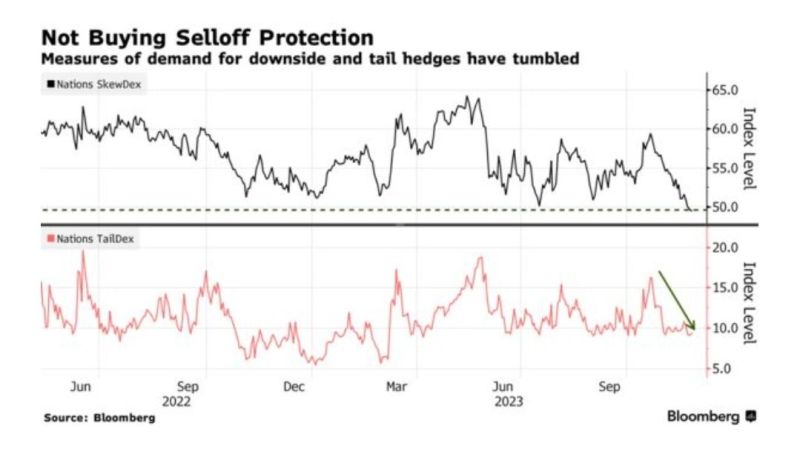

Hedging demand has fallen sharply with the cost to protect against a market selloff down by around 10%, or one-standard deviation, tumbling to the lowest ever in data starting in 2013

Demand for tail-risk hedges that pay out in an equity fall as precipitous as 30% has also dropped and is hovering around the lowest level since March.- Bloomberg

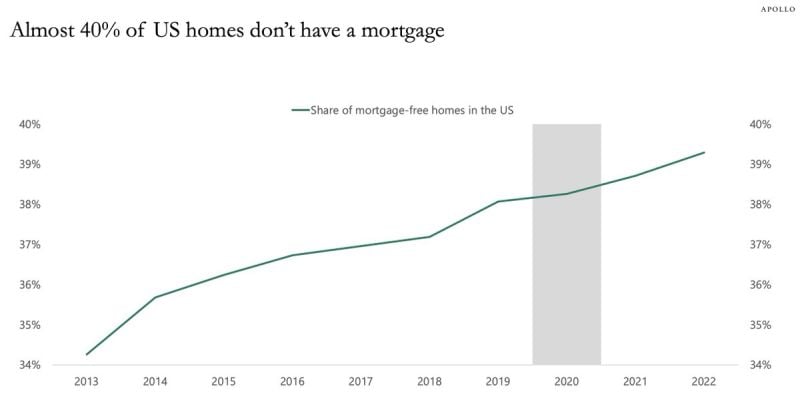

As highlighted by The Kobeissi Letter, a record ~40% of all US homes currently do NOT have mortgages

At first, this seems like great news, but it really just emphasizes how UNAFFORDABLE this market is. Currently, a record ~35% of housing market transactions are all cash purchases. In other words, this market is becoming ONLY affordable for those who are buying with CASH. As interest rates hit 20-year highs and home prices are up 30%+ since 2020, affordability is only getting worse. This is called an affordability crisis. Source: The Kobeissi Letter

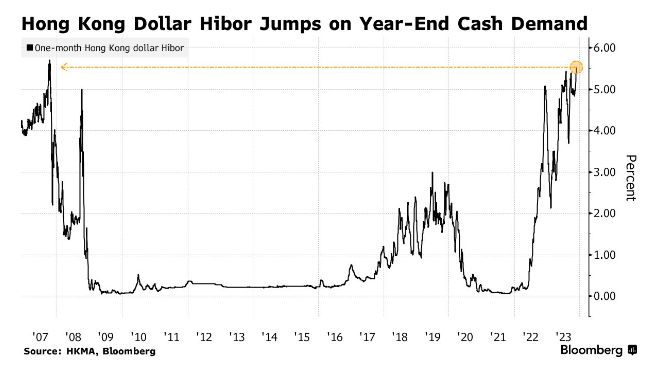

Hong Kong local bank rate (HIBOR) jumped to its highest level in 16 years

Source: Barchart, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks