Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

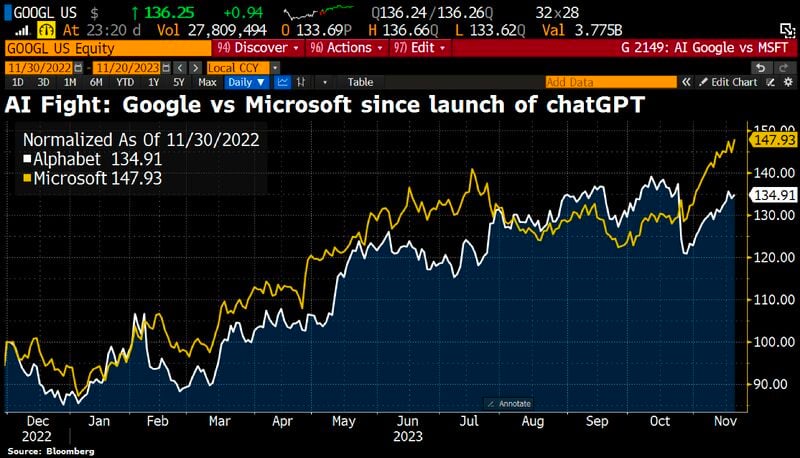

Microsoft is now clearly ahead of Alphabet again in the AI race on the stock market

Source: HolgerZ, Bloomberg

Today is the BIG DAY with Nvidia ($NVDA) earnings results after the bell

With the Nasdaq up more than 13% from the lows, $NVDA at all-time-high, 95% of sell-side analysts with a BUY rating on $NVDA (!) sentiment of AI probably at record optimistic level after Microsoft "aqui-hire" of openai and the $VIX historically low at 13.5, there is indeed room for a short-term pullback... Source: www.investing.com, kakashiii111

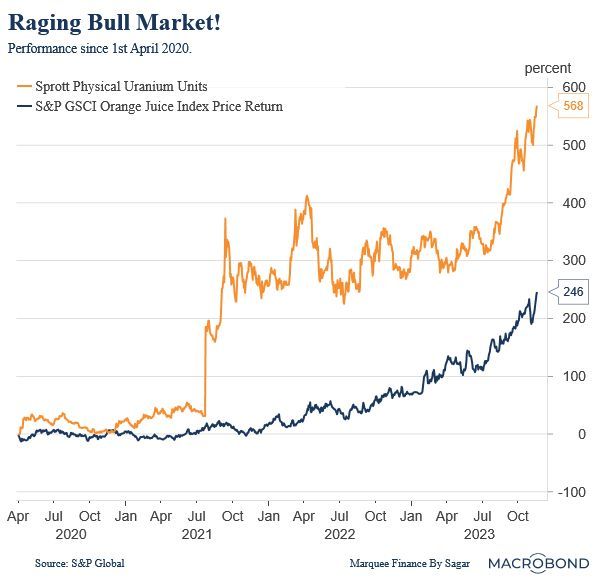

The biggest bull market post-COVID has not been in the Magnificent 7 or any other equity markets; it has been in these two commodities:

1) Orange Juice: 246% 2) Uranium: 568% Source: Macrobond, Sagar Singh Setia

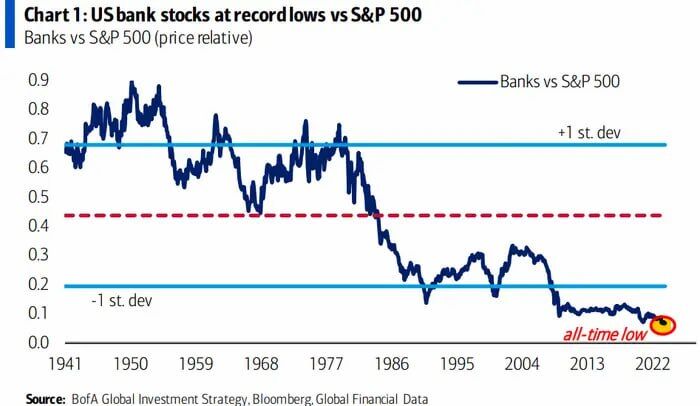

US bank stocks never recovered from the regional banking crisis. Currently, US bank stocks are at record lows relative to the S&P 500

According to Moodys, major US banks are sitting on $650 billion in unrealized losses. Meanwhile, the looming commercial real estate (CRE) crisis has small banks in question. Small banks currently hold ~70% of all CRE loans in the US, $1.5 trillion of which need to be refinanced by 2025. Source: BofA, The Kobeissi Letter

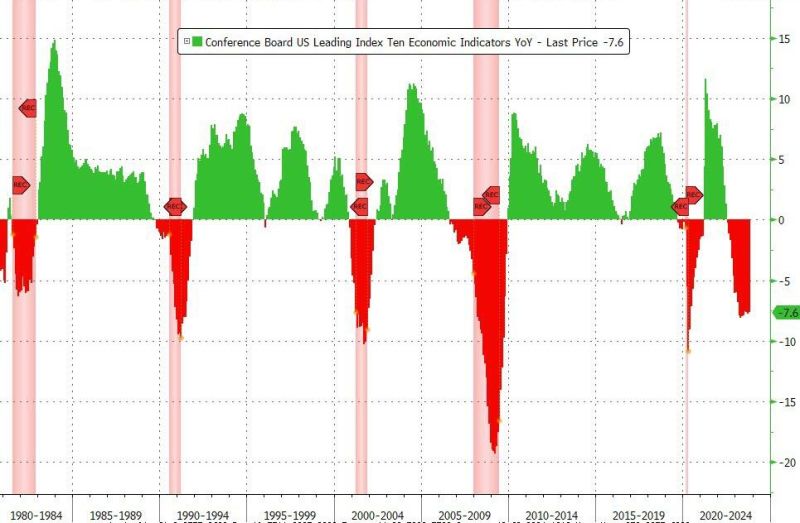

US Leading Indicators Tumble For 19th Straight Month

Worst Streak 'Since Lehman' on a year-over-year basis, the LEI is down 7.6% (down YoY for 16 straight months) - close to its biggest YoY drop since 2008 (Lehman) outside of the COVID lockdown-enforced collapse... Source: Bloomberg, www.zerohedge.com

BREAKING: Binance >>>

Department of Justice is seeking a penalty of $4 billion from Binance in order to settle a criminal investigation Crypto exchange Binance is nearing a settlement with the U.S. Department of Justice to resolve a criminal investigation into alleged money laundering, bank fraud, and sanctions violations, unnamed sources told Bloomberg. If the settlement deal goes through, it would be one of the largest-ever penalties in a crypto case. Negotiations have included the possibility of criminal charges against Binance's founder and CEO Changpeng Zhao, also known as CZ. However, as it currently stands the deal would allow the crypto exchange—the world's largest by volume—to keep operating while holding its leadership accountable. If finalized, Binance would likely pay the fine as part of a deferred prosecution agreement. This would require Binance to meet prescribed conditions like overhauling compliance programs, according to the report. Source: Decrypt, Altcoin Daily

Nvidia stock hits All-Time High ahead of earnings:

The stock has gained 24% in November, on pace for its best month since a blowout earnings report in May. Nvidia has gained 245% in 2023, pushing its market value above $1.2tn. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks