Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Sam Altman ousted by OpenAI and moving to Microsoft:

Microsoft has hired Sam Altman and Greg Brockman to lead a team conducting artificial intelligence research, days after the pair were pushed out of OpenAI, the company they co-founded. Writing on X on Monday, Microsoft chief executive Satya Nadella said that Altman and Brockman, “together with colleagues, will be joining Microsoft to lead a new advanced AI research team”. “We look forward to moving quickly to provide them with the resources needed for their success,” he added. Altman retweeted Nadella’s post on Monday, adding: “the mission continues”. Source: FT

BREAKING NEWS by FT >>>

Microsoft has hired Sam Altman and Greg Brockman to lead a team conducting artificial intelligence research, days after the pair were pushed out of OpenAI, the company they co-founded. Writing on X on Monday, Microsoft chief executive Satya Nadella said that Altman and Brockman, “together with colleagues, will be joining Microsoft to lead a new advanced AI research team”. “We look forward to moving quickly to provide them with the resources needed for their success,” he added. Altman retweeted Nadella’s post on Monday, adding: “the mission continues”. Source: FT

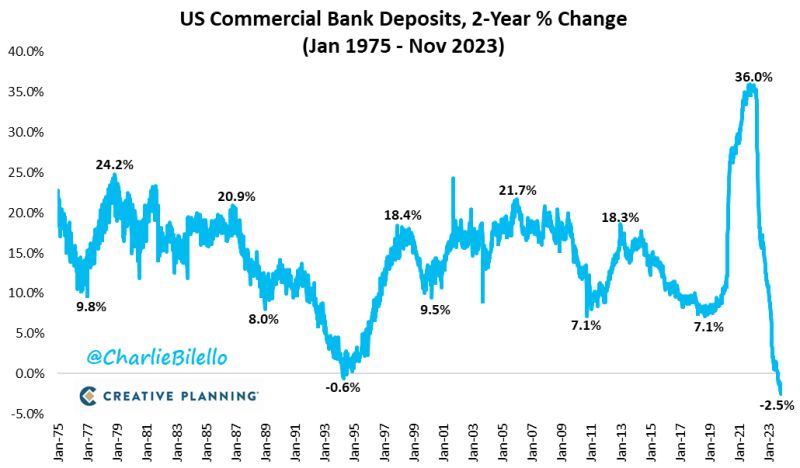

US Commercial Bank deposits fell 2.5% over the last 2 years, the largest 2-year decline on record

Source: Charlie Bilello

BREAKING >>> Sam Altman will NOT be returning as CEO of OpenAI after drama-full weekend for the AI space

Negotiations to get Altman back in the company started less than 24 hours after he was fired. Investors including Microsoft attempted many rounds of negotiations. Staff at OpenAI have also threatened to quit if Altman does not return. But according to CNBC and Bloomberg, the board of OpenAI is bringing in former Twitch CEO Emmett Shear to run the artificial intelligence company, two days after the sudden ouster of Sam Altman, CNBC has confirmed. The Information and Bloomberg both reported on the hiring of Shear earlier. The news was confirmed to CNBC by a person familiar with the matter who asked not to be named because the discussions were confidential. Source: CNBC

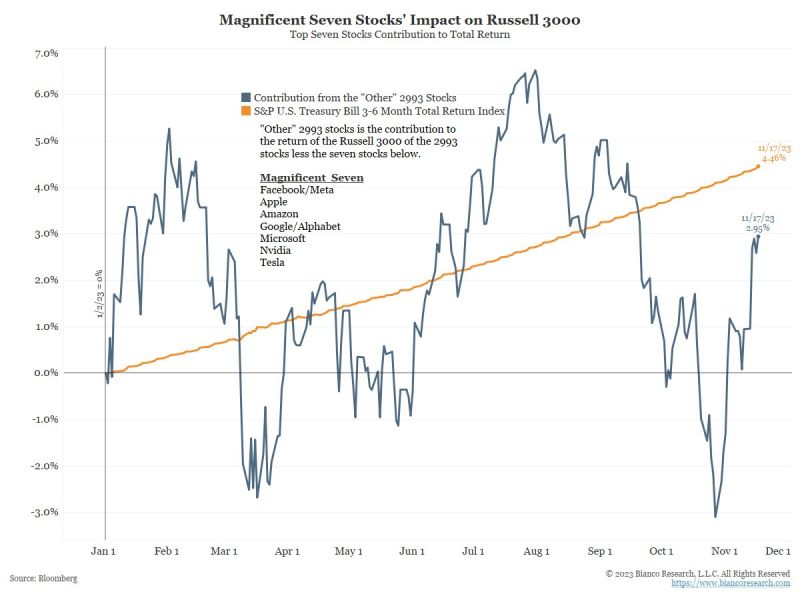

US stocks (Russell 3000) less the Mag 7 is up only +2.95% this year. It is thus underperforming cash for the second straight year.

Source: Jim Bianco

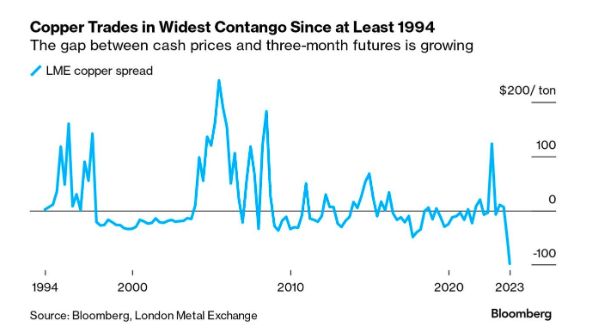

Copper hits widest contango in AT LEAST 29 years

Source: Barchart, Bloomberg

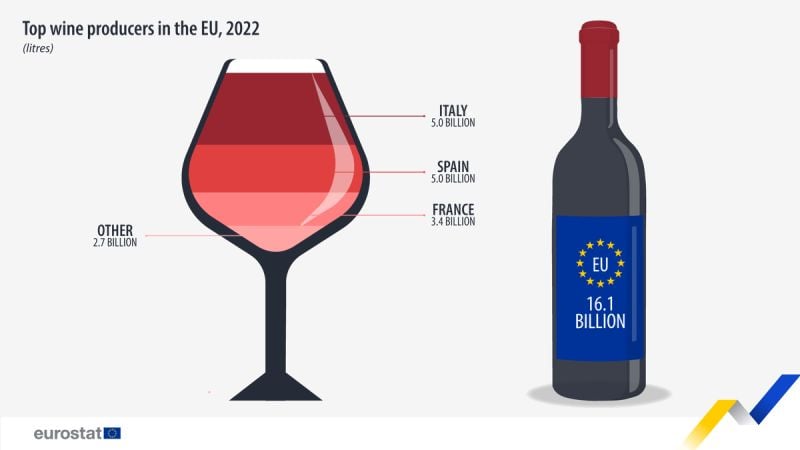

Wine production reached 16.1 billion (bn) litres in the EU in 2022. Top producers:

1) Italy (5.0 bn litres) 2) Spain (5.0 bn litres) 3) France (3.4 bn litres) Source: EU Eurostat

Investing with intelligence

Our latest research, commentary and market outlooks