Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Has there been a better pairs trade than long US, short world... ever?

This relationship has generated steady alpha for a decade and a half now. Growth over value and large over small have also been excellent long / short pairs. Source: Steven Strazza

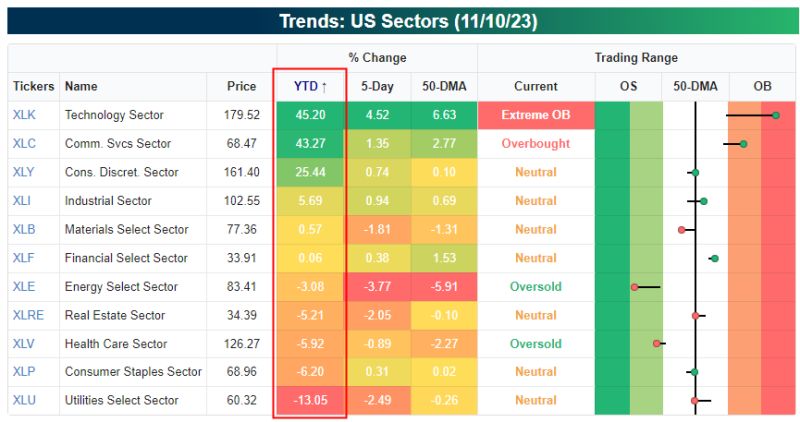

When the book on 2023 closes, extreme sector divergence will surely be considered one of the major plot points

Technology and Communication Services are each up more than 40% YTD, while five of eleven sectors are in the red on the year. Source: Bespoke

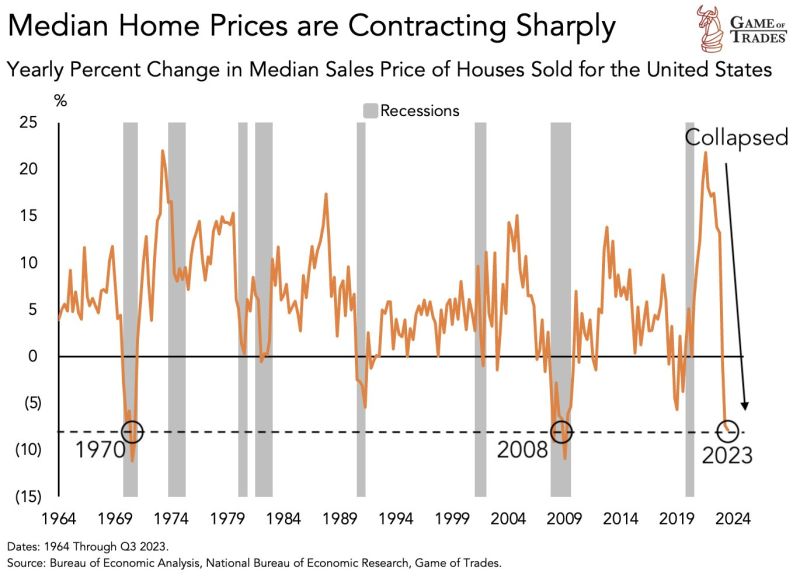

US median home prices are contracting aggressively. In just 2 years, the % has gone from over 20% to -7.9%. This is THE sharpest collapse on record

Current levels have occurred ONLY 2 times in the last 60 years: 1. 1970 2. 2008 Both instances ended with equities declining more than 30%. Source: Game of Trades

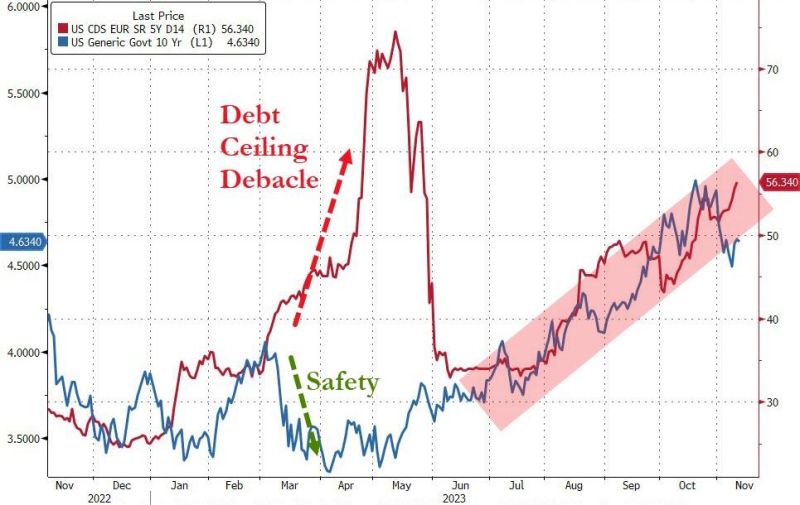

In a regime-shift from historical norms, the US Treasury yields are broadly trending higher with USA Sovereign credit risk...

Source: www.zerohedge.com, Bloomberg

Tech relative to small caps JUST hit the highest level EVER seen This ratio is higher than even the peak of the Dot Com bubble

Source: Game of Trades

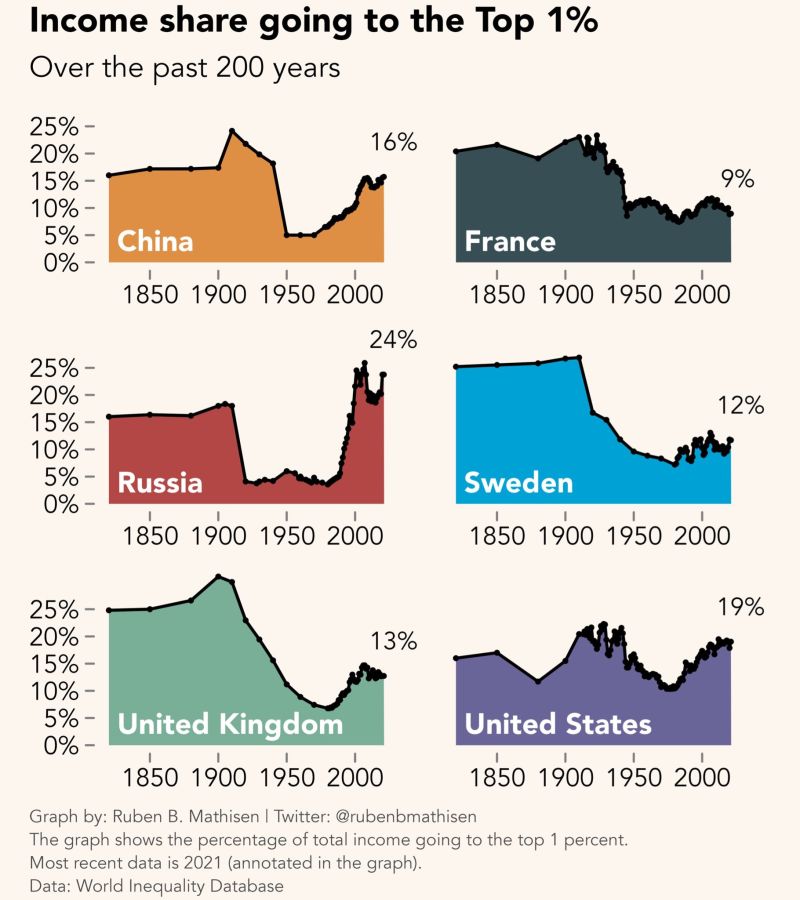

Income & wealth inequality is not just a capitalist country story. Watch Russia and China...

Source: Ruben Mathisen

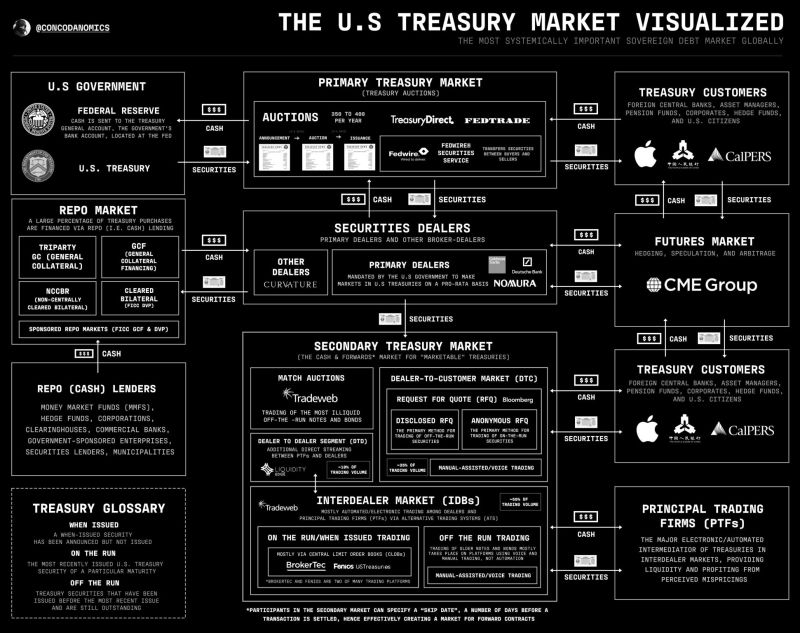

The U.S. Treasury market visualized

Source: X @concodanomics thru Audrey Wang, CFA🇭🇰

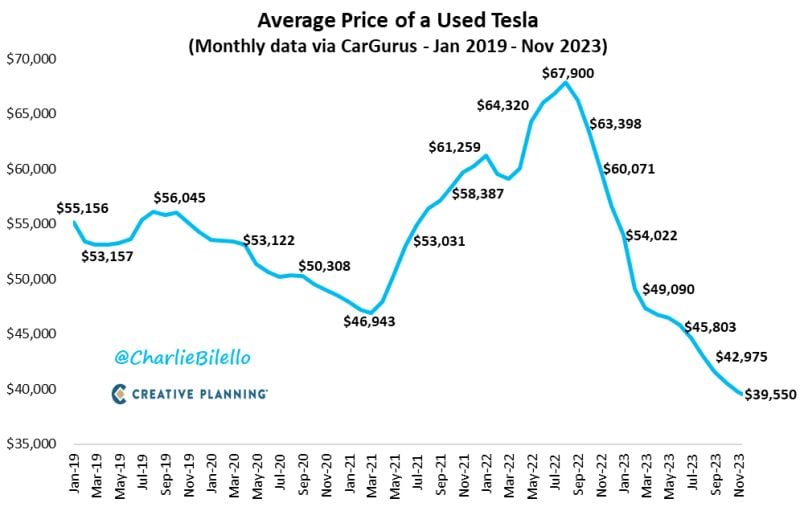

The average price of a used Tesla has declined 16 months in a row, moving from a record high of $67,900 in July 2022 to a record low of $39,550 today (-42%). $TSLA

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks