Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Prospective California homeowners currently in the market would need to make $221,200 annually to qualify to purchase a median-price, single-story home in California, typically costing $843,600

The latest figures show that California’s housing affordability rates continue to decrease. The figures released during the third quarter are down from 16% in the second quarter of 2023. For comparison, about 56% of California home buyers could afford a home during the first quarter of 2012, the index’s peak high. Source: Wall Street Silver

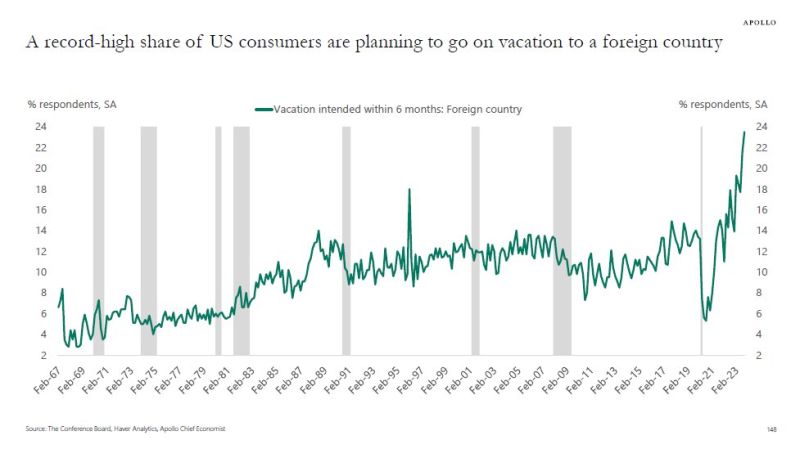

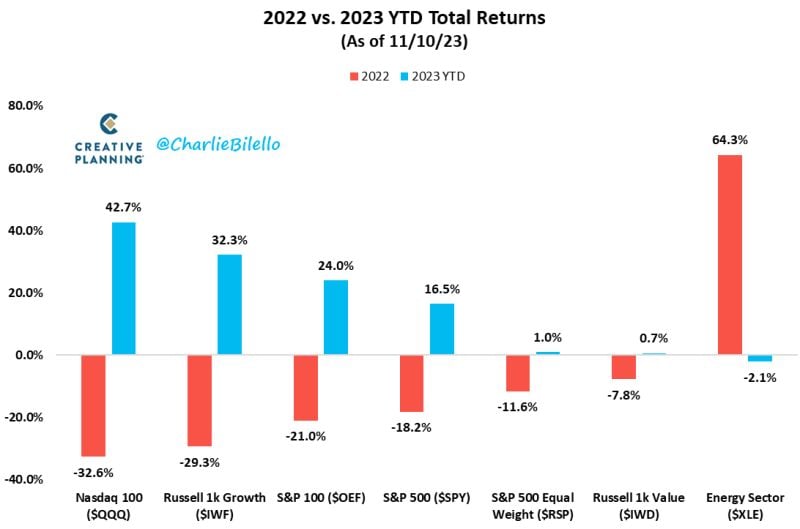

The richsession...

A record-high share of US consumers are planning to go on vacation to a foreign country within the next six months. Via Apollo/Slok

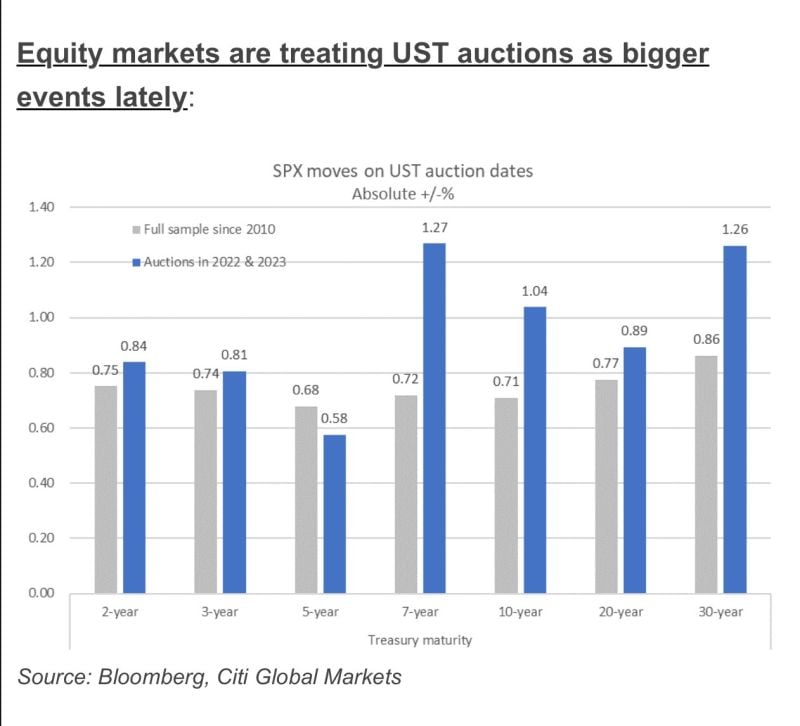

Stock markets care much more about US Treasury auctions now than they used to

Chart from Citi’s Stuart Kaiser thus Lisa Abramowitz

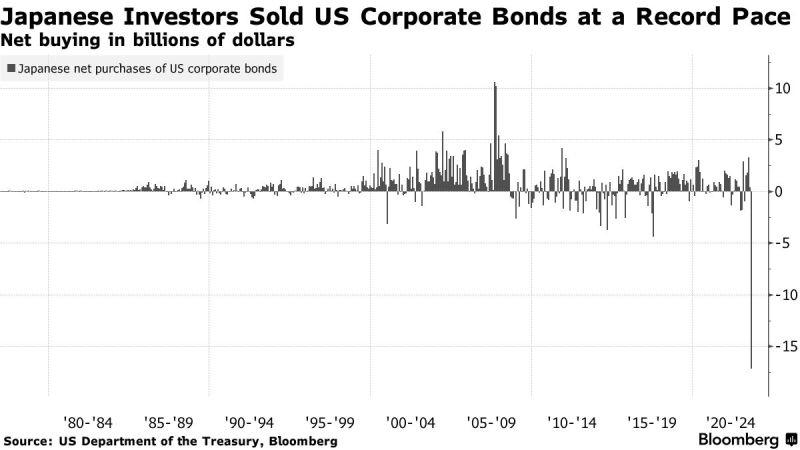

Japanese investors are selling US corporate debt at a record pace 👀

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks