Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Moody’s cuts U.S. credit outlook from stable to negative. Will markets just shrug it off on Monday?

Source: Trend Spider

The growth rate of capital being poured into retail money market funds (MMFs) is at its highest level in several decades

Retail MMFs recently surpassed $1.6 trillion; a record high. Source: Koyfin @KoyfinCharts

Sheikh Hamdan bin Mohammed, Crown Prince of Dubai, has announced plans for a challenge focused on generative artificial intelligence

The winners is set to receive a total of Dh1 million ($272,290) amid the emirate's shift towards the future economy. The Global Prompt Engineering Championship will be held in May next year at Dubai’s Museum of the Future. In the context of AI, a prompt refers to a specific request made to a language model such as ChatGPT, which can in turn provide a response or solution for a user. Source: The National News

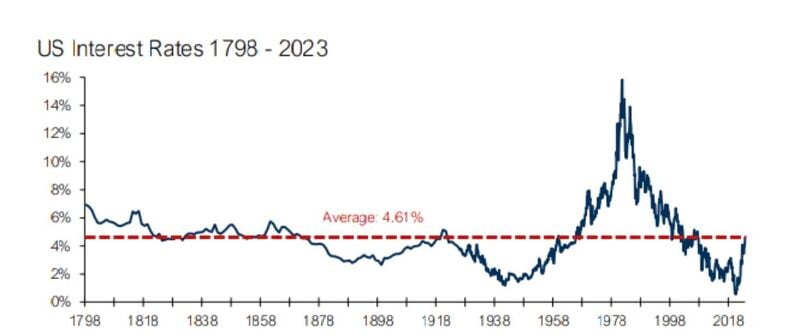

200+ years of US interest rates…

The Long View @HayekAndKeynes

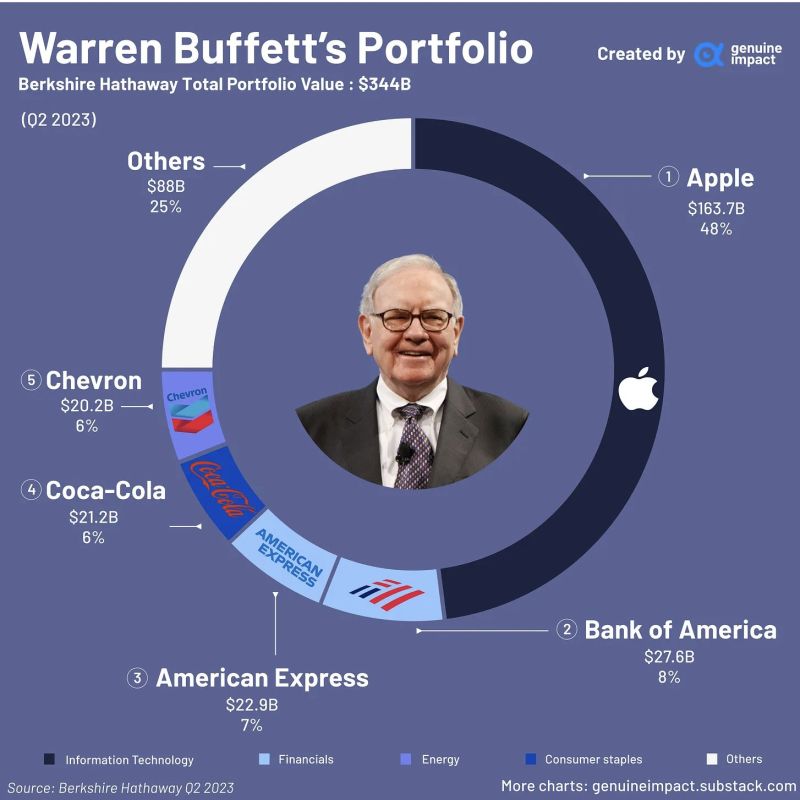

This is how Waren Buffet manages risk

Instead of over-diversifying, he takes big bets on companies / stocks on which he has super-strong conviction and knowledge. Almost half of Warren Buffett’s portfolio is made up of Apple at 48%, and valued at $163.7B. The top 5 holdings account for over 75% of the total portfolio... Source: Genuine Impact

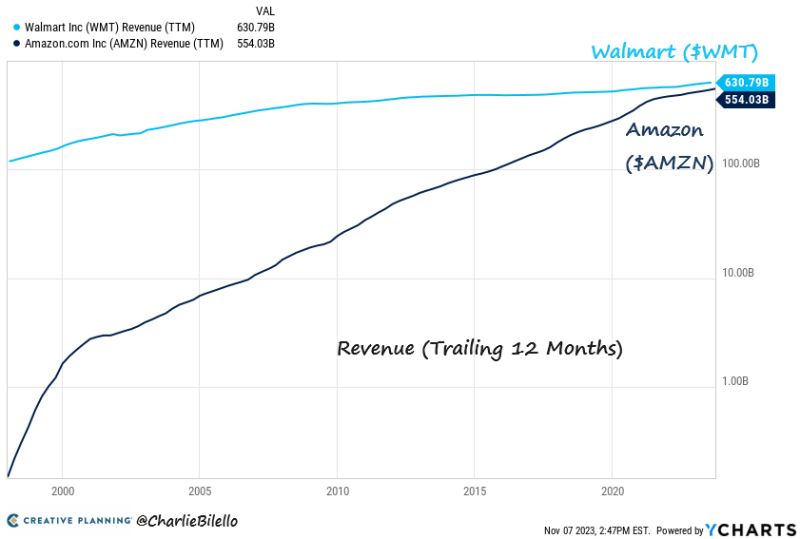

Walmart vs Amazon

25 yrs ago: Walmart revenue 305x larger than Amazon. 20 yrs ago: Walmart revenue 51x larger than Amazon. 10 yrs ago: Walmart revenue 7x larger than Amazon. 5 yrs ago: Walmart revenue 2x larger than Amazon. Today: Walmart revenue 1.1x larger than Amazon. Source: Charlie Bilello

Did you know that the biggest e-Commerce app in Asia AND EUROPE trades at 10X earnings?!

$BABA Source: A.J. Button

Investing with intelligence

Our latest research, commentary and market outlooks