Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US To Borrow $1.5 Trillion In Debt This & Next Quarter, After Borrowing A Massive $1 Trillion Last Quarter

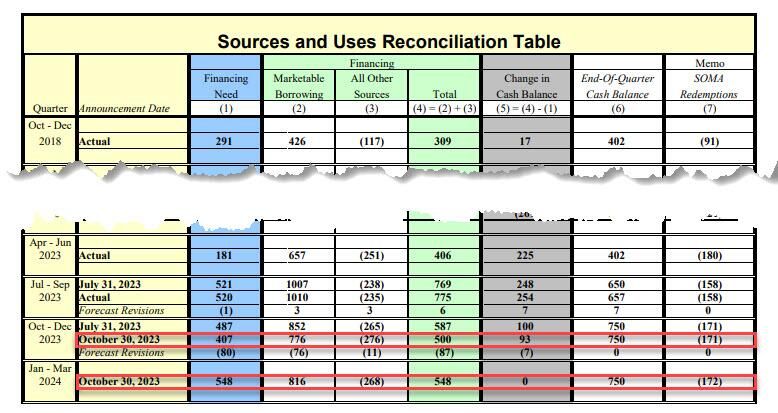

During the October – December 2023 quarter, Treasury expects to borrow $776 billion in privately-held net marketable debt, assuming an end-of-December cash balance of $750 billion. The borrowing estimate is $76 billion lower than announced in July 2023, largely due to projections of higher receipts somewhat offset by higher outlays. During the January – March 2024 quarter, Treasury expects to borrow $816 billion in privately-held net marketable debt, assuming an end-of-March cash balance of $750 billion. Source: www.zerohedge.com

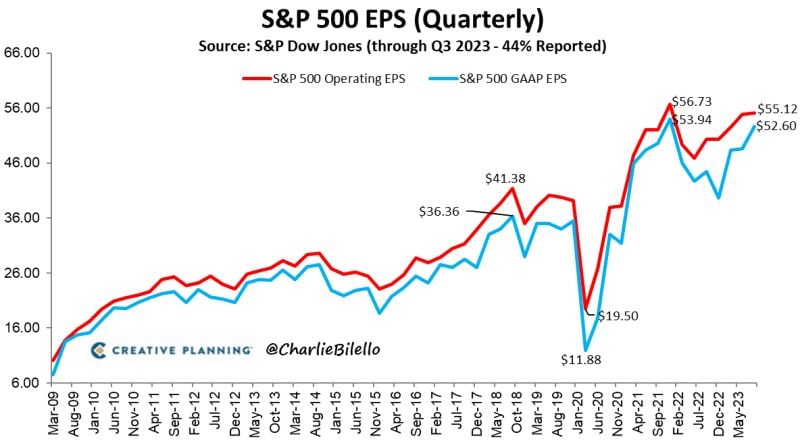

S&P 500 Q3 GAAP earnings per share are 18% higher than a year ago, the 3rd straight quarter of positive YoY growth. Quarterly earnings are now just 2% below the record high from Q4 2021

Source: Charlie Bilello

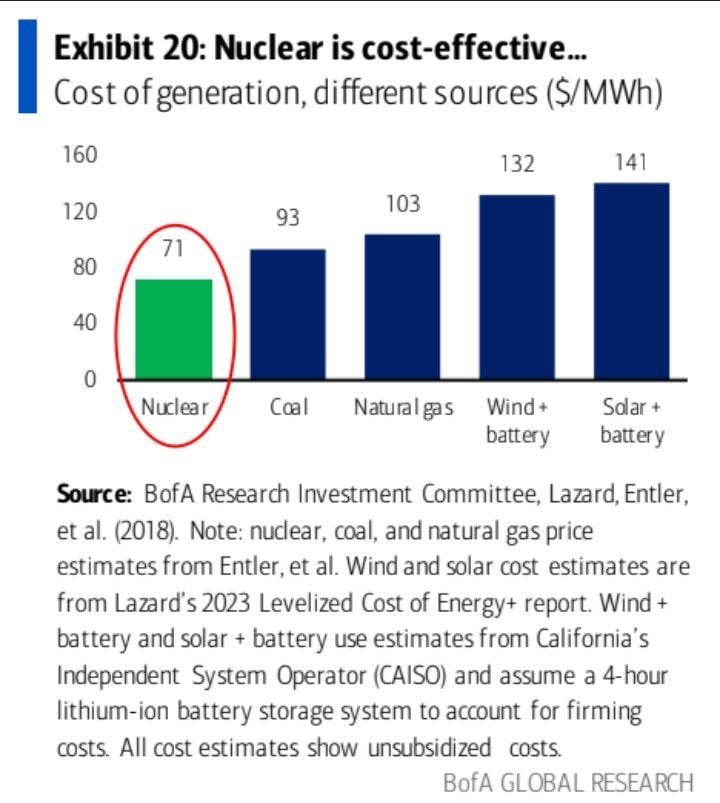

Bank of America research:

"Industry research suggests that, after accounting for efficiency, storage needs, the cost of transmission, and other broad system costs, nuclear power plants are one of the least expensive sources of energy." Source: BofA Global Research, Gustavo Philippsen Fuhr

Elon Musk’s X is worth less than half of price he paid for Twitter

X is worth $19 billion a year after the $44 billion purchase. Employee restricted stock units are awarded at $45 a share. Source: Bloomberg, HolgerZ

Eurozone inflation sinks to 2y low as Eurozone economy shrinks:

CPI slowed to 2.9% in Oct, down from 4.3% and better than expected 3.1%. But Core CPI – that excluding food & energy is retreating less rapidly. It moderated to 4.2% in October from 4.5% the previous month. Our take: disinflationary trend is firmly in place in the EZ although wage inf’still stickiness and more difficult comps in H2 prevent core inflation to decline more meaningfully. We believe there is enough progress for the ECB to stay put (i.e rates hike cycle is over) and potentially cut rates next year if EZ economy slows down meaningfully Source: HolgerZ, Bloomberg

The US treasury curve is going in all directions

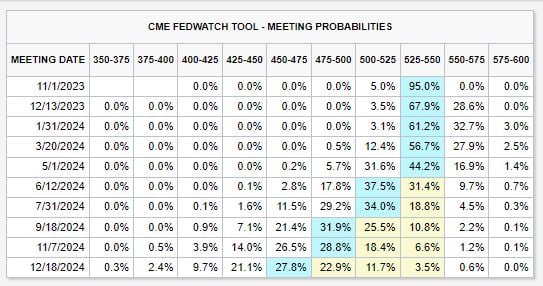

Interest rate futures are beginning to price-in a potential rate CUT this week, at a 5% chance. Meanwhile, the base case still shows rate cuts beginning in June 2024. However, odds of another HIKE in January 2024 are now up to ~36%... Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks