Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

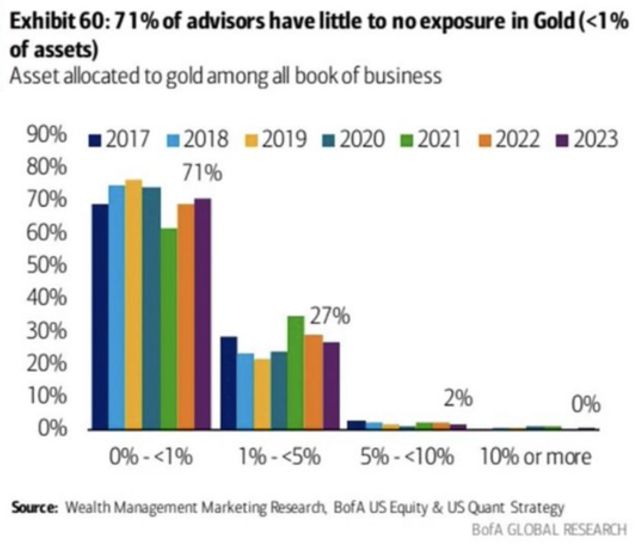

As highlighted by Tavi Costa, despite the recent push toward new highs, gold remains severely under-allocated

In fact, 71% of US advisors have little to no exposure to the metal. Similar to how Central banks continue to aggressively accumulate the metal, conventional investment portfolios have yet to take steps to find true diversifiers. Sources: Tavi Costa, BobEUnlimited

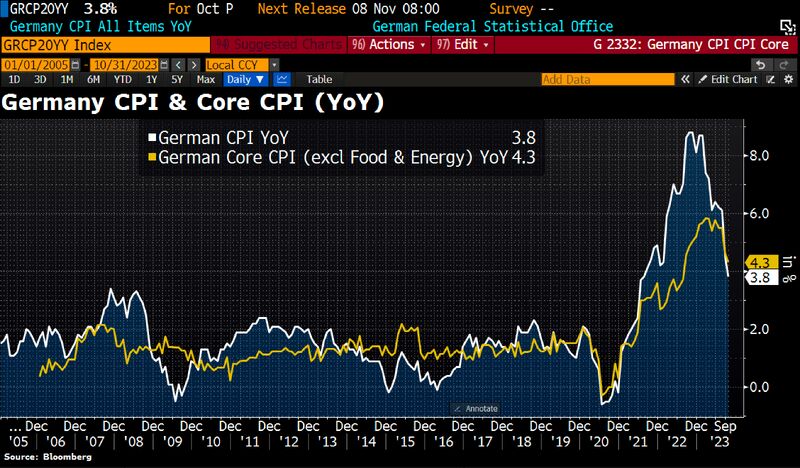

Germany's inflation slowed to 3.8% YoY in Oct from 4.5% in Sep vs 4% expected and lowest since Aug 2021 as energy prices dropped 3.2% YoY and food inflation slowed to 6.1% YoY

German October Core CPI dropped to 3.8% from 4.6% in September. Source: HolgerZ, Bloomberg

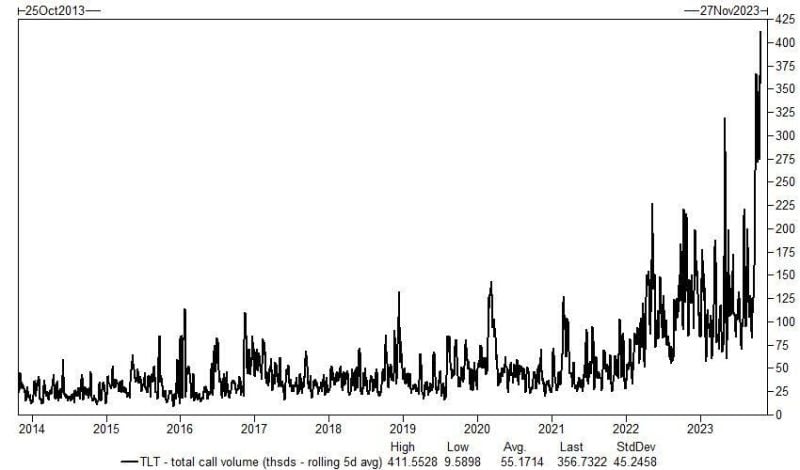

Goldman's Derivatives desk:

Demand for TLT calls and call spreads exploded this week. That's because "this is a cheap way to play for a snapback in bonds." As shown below, average TLT call volume this was over 350k contracts per day, an all-time highs...

Getting cheaper...

Global stocks have lost another $1.5tn in mkt cap this week on still-elevated US 10y yields and on not good enough earnings results. All stocks now worth $98.2tn, less than global GDP. This means that the Buffett Indicator is once again below the critical level of 100. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks