Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

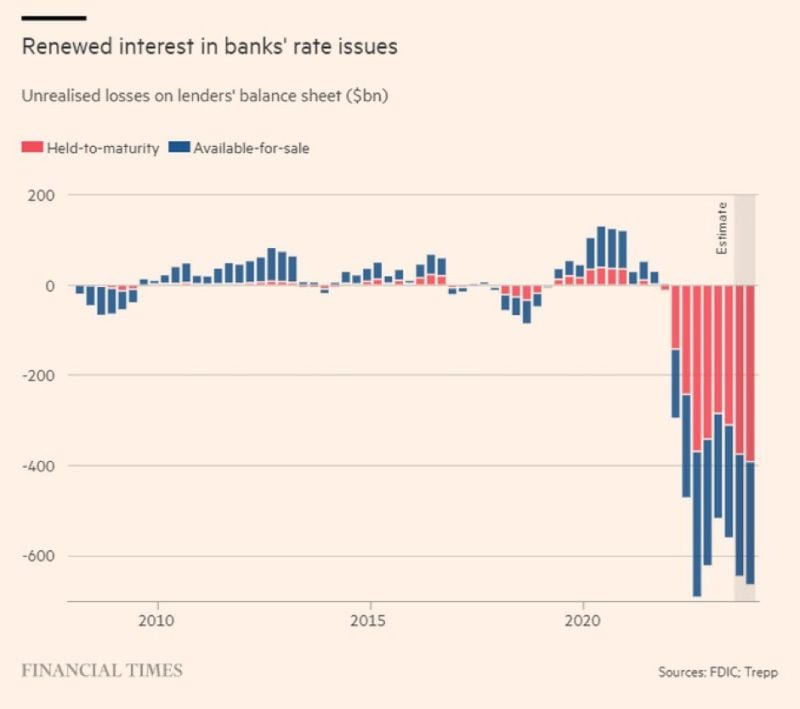

U.S. Bank losses on held-to-maturity assets have soared to an ALL-TIME HIGH of $400 Billion

Source: Barchart

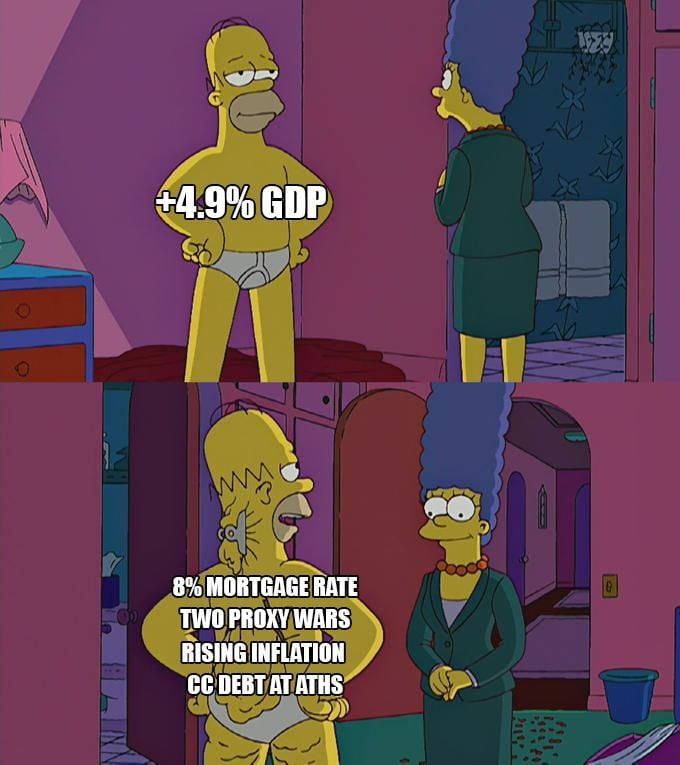

US Q3 GDP numbers summarized in one cartoon

Source: Elizabeth Oliveira Fonseca

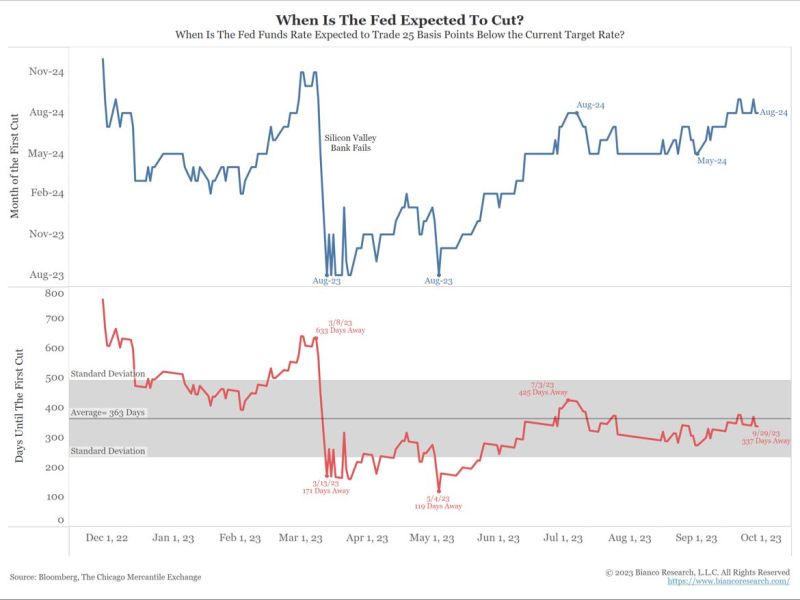

When will the Fed start cutting rates?

This chart from James Bianco is derived from market pricing. The first cut is currently priced for August 2024 (top panel), or 337 days away (bottom panel). Notice the first cut is always about 10 to 12 months away. It never gets any closer.

Some updates on Chatgpt by Linas Beliūnas

OpenAI just released two biggest updates to ChatGPT ever 😳

Investing with intelligence

Our latest research, commentary and market outlooks