Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

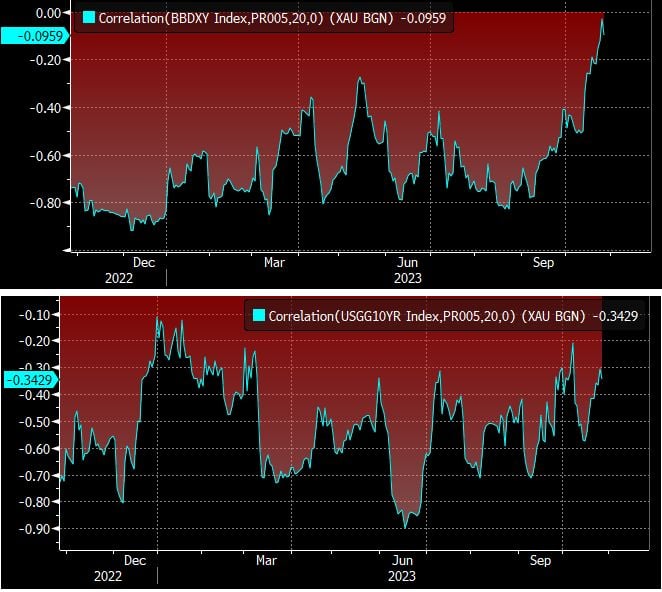

Gold's normal negative correlation to the dollar (upper chart) and US bond yields continue to collapse

Highlighting the current support for XAU as an alternative investment amid rising financial risks as yields surge and investors worry about developments in the Middle East (Chart: Bloomberg)

P/E Forward for the largest US companies - Magnificent 7

$TSLA Tesla 62 $AMZN Amazon 58 $NVDA NVIDIA 40 $MSFT Microsoft 30. $AAPL Apple 28 $GOOGL Alphabet 24 $META Meta 23 Source: Vlad Bastion

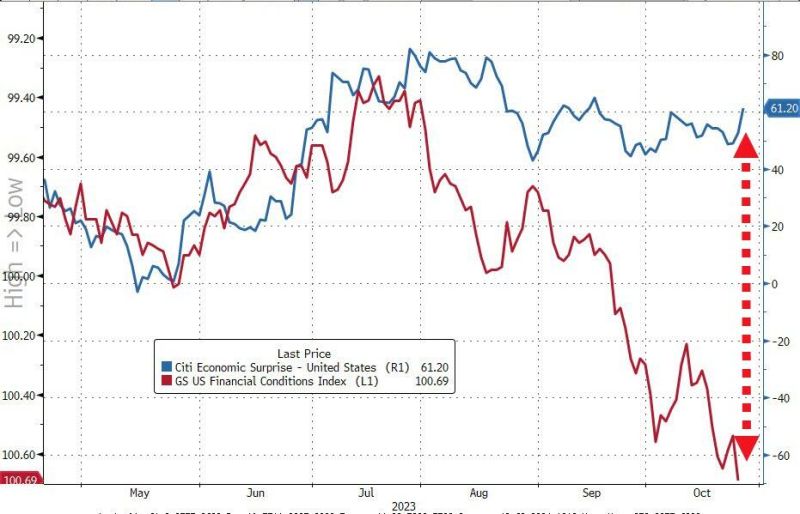

For now, the monetary policy transmission route of tightening US financial conditions are NOT reaching the economy...

Indeed, an avalanche of US macro data on Thursday presented a positive blend of updates across growth (better), inflation (lower), and labor markets (looser/worse). - Economic Growth: Real GDP rose 4.9% in 3Q (consensus 4.5%) driven by strong demand across consumer and federal/state government, and inventories. However, a major contribution from inventories could in turn weigh significantly on growth in 4Q - Manufacturing: Orders for Durable and core capital goods also grew by more than expected... thanks to a massive surge in non-defense aircraft orders (so don't expect it to last). - Housing: Pending home sales rose 1.1% month over month in September, above expectations for a decline... but brace for October to be a bloodbath as mortgage rates re-accelerated. - Inflation: Core PCE prices component of the GDP report rose less than expected. - Labor: Initial and continuing jobless claims both increased by more than expected -- a positive for markets which are focused on labor market re-balancing (i.e., could benefit from less wage inflation).

Nasdaq 100 dropped 1.9%, now down 11% from Jul high, so Big Tech now in correction territory

It looks like some P/E air is being let out of the Magnificent 7 bubble... Source: HolgerZ, Bloomberg

He probably has a point ->

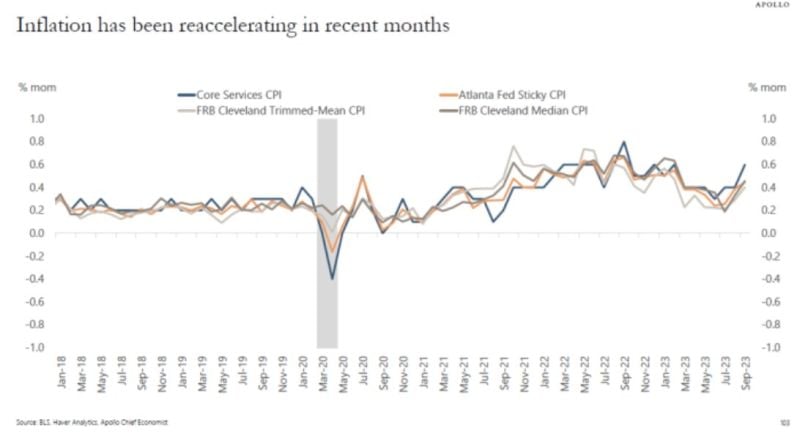

"Key measures of inflation have reaccelerated in recent months...The implication for investors is that the Fed will keep rates high until nonfarm payrolls go negative, because that is what is needed to get inflation under control:" Apollo's Slok through Lisa Abramowitz

Amazon reports better-than-expected results, as revenue jumps 13%

Amazon said fourth-quarter sales will be between $160 billion and $167 billion. Analysts were expecting revenue of $166.6 billion, according to LSEG. At the mid-point of its guidance range, revenue of $163.5 billion would represent growth of 9.6% from $149.2 billion a year earlier. Revenue climbed 13% in the third quarter, a sign that the business is seeing some acceleration after a difficult 2022 that was marred by soaring inflation and rising interest rates. Amazon has been in cost-cutting mode for the past year as it became clear that it expanded too quickly during the pandemic. The company has laid off 27,000 employees since last fall, and it’s axed some of its more unprofitable bets.

US GDP grew 4.9% in Q3 QoQ annualized, way faster than +4.3% expected

However, bond yields dropped in the afternoon session. This Bloomberg US GDP chart shows why. Indeed, US GDP growth in Q3 was mainly driven by private consumption & inventories. This may not last. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks