Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

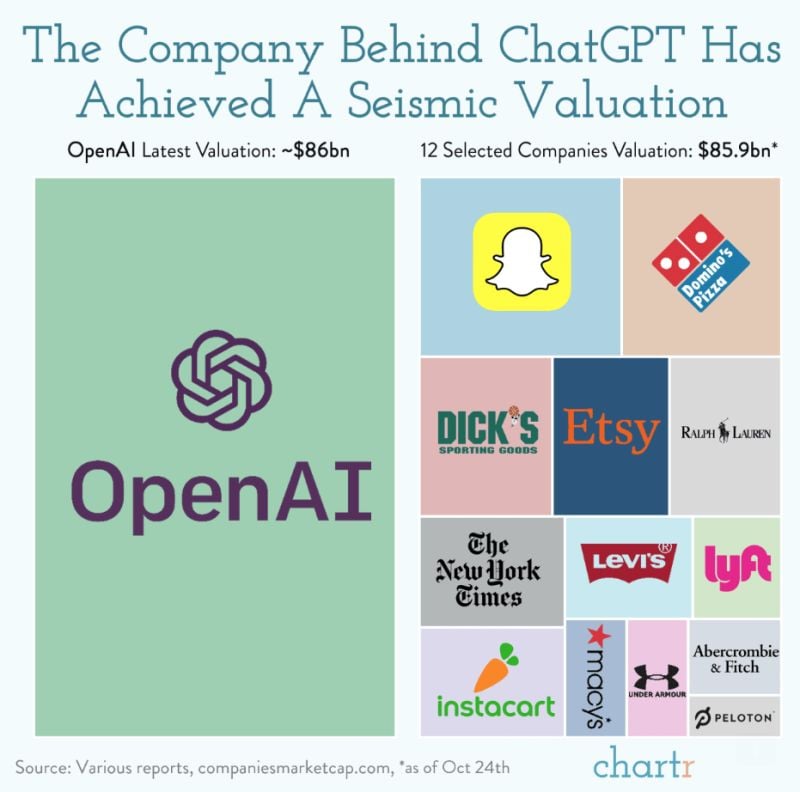

OpenAI valuation in perspective - chart by Chartr

Talk is meant to be cheap, but OpenAI, the force behind the viral hit ChatGPT, has turned it into an absolute goldmine, with the company currently in discussions to sell shares at a valuation of $86 billion. That's a remarkable three-fold increase from just 6 months ago, with the WSJ reporting an initial range of $80-90bn, before Bloomberg narrowed the figure to around $86bn, citing sources familiar with the matter. That would place OpenAI among the most valuable tech startups in the world, only behind giants like ByteDance (TikTok owner) and SpaceX. For context, it’s also roughly equivalent to the value of 12 of the biggest consumer brands in America combined — a theoretical corporate frankenstein including SNAP, The New York Times, Etsy, Domino’s and 8 others.

Meta’s ad rebound gets huge assist from China even though its services are banned there

Meta may be banned from operating in China, but the company is counting on advertisers there to boost its growth. Finance chief Susan Li told analysts on Wednesday’s earnings call that Chinese companies played a major role this quarter. Online commerce and gaming “benefited from spend among advertisers in China reaching customers in other markets,” Li said. Source: CNBC

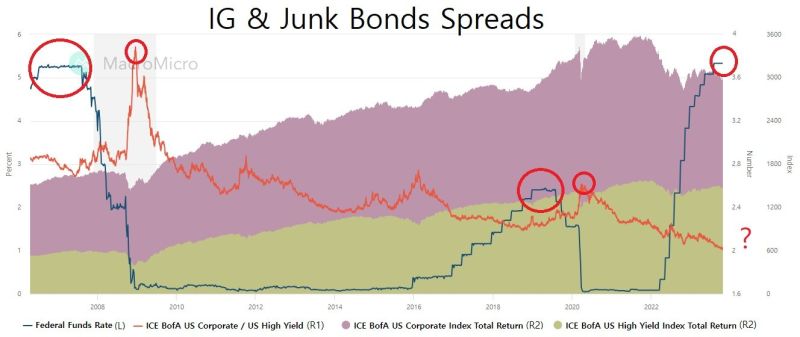

How long does it take for the FED to break the corporate bond market?

2008 : 1 year of plateau, resulted in credit event after another 1 full year. (Total 2 years) 2020 : 7 months of plateau, resulted in credit event after 6 months. (Total 13 months, 54% of 2008) 2023 : it's been 3 months into plateau so far. Chart made from MacroMicroMe - source: James Choi

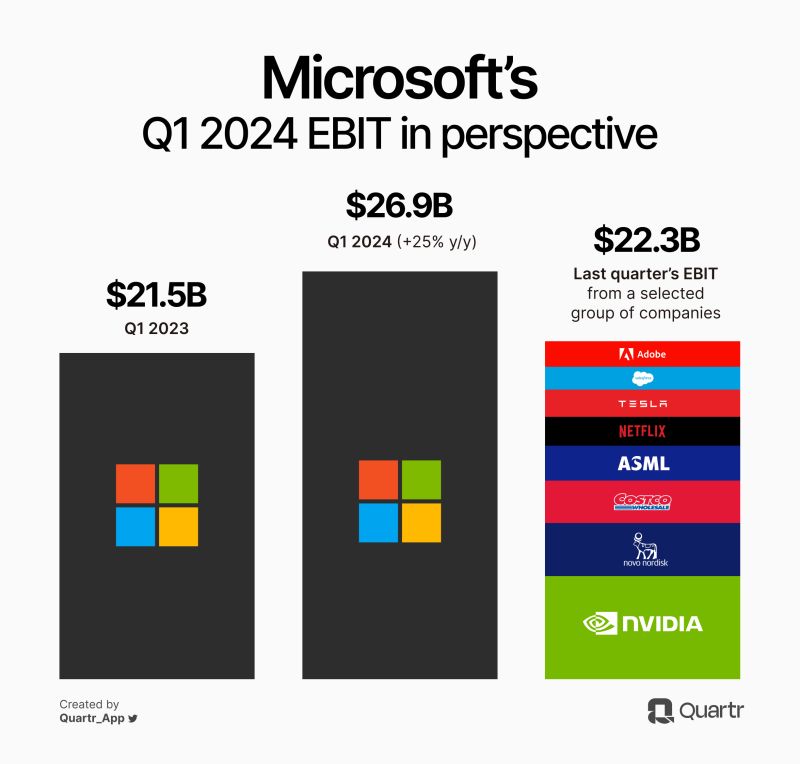

$MSFT FY Q1 2024 in perspective

Revenue +13% *Prod. & Business +13% *Intelligent Cloud +19% *Pers. Computing +3% *Azure +29% *LinkedIn +8% *Xbox C&S +13% EBIT +25% *marg 48% (43) EPS +27% Source: Quartr

According to RT, Russia has conducted a major exercise aimed at testing its strategic nuclear forces, the Kremlin said on Wednesday

The drills focused on the simulated delivery of ‘a massive nuclear strike by the strategic offensive-oriented forces in response to a nuclear strike by a simulated enemy’. Note that gold and bitcoin both jumped on the news.

Investing with intelligence

Our latest research, commentary and market outlooks