Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

We have not seen NASDAQ move lower with $BTC exploding to the upside in a long time

Source: TME, Refinitiv

This chart illustrates another factor contributing to the increase in US bond yields:

Concerns about the govt's ability to manage its debt responsibly. The price of insuring against the possibility of the US government defaulting on its obligations (CDS Price) has recently jumped Source: HolgerZ, Bloomberg

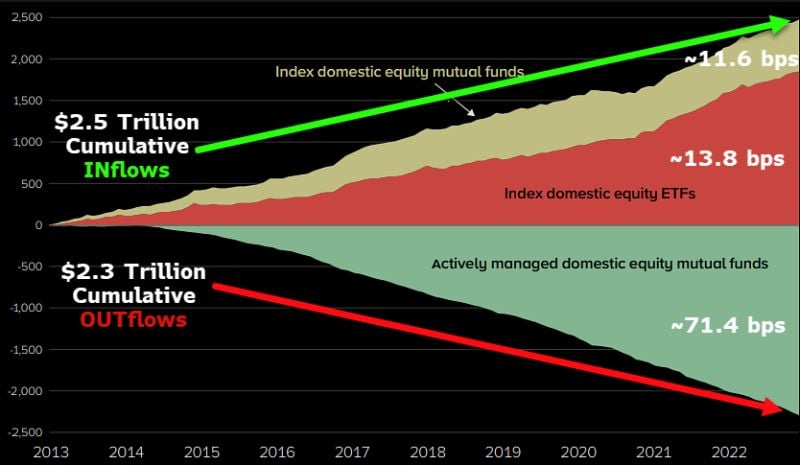

Great ICI-inspired chart showing three of the biggest trends in one shot:

active to passive, mutual fund to ETF and high cost to low cost. Active equity MFs have seen outflows every year for a decade equaling $2.3T (altho their aum still ok bc of bull mkt subsidy) via @JSeyff via Eric Balchunas / Bloomberg

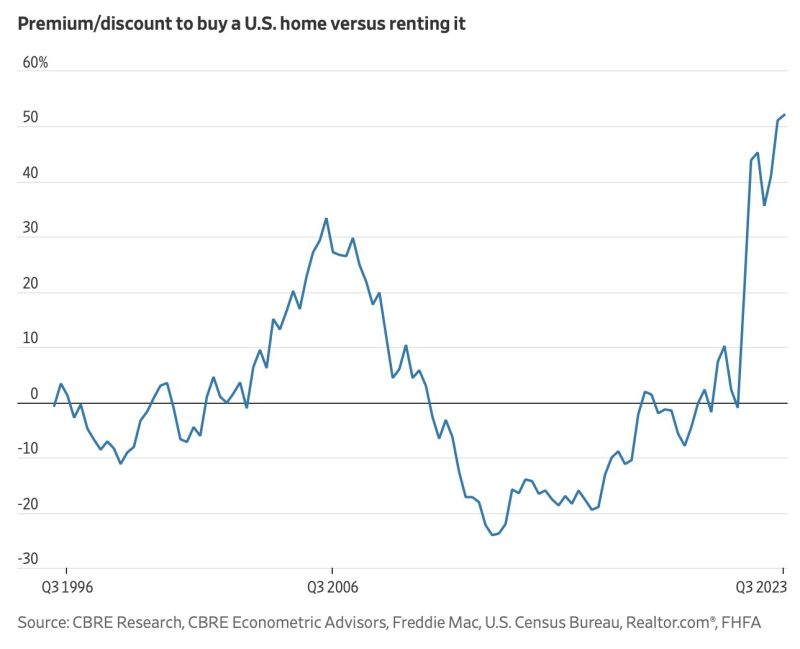

The premium to buy a home vs. rent one has soared to 52%, the highest level ever recorded

Even in 2008, the premium to own peaked at 33%. Source: barchart

Investing with intelligence

Our latest research, commentary and market outlooks