Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

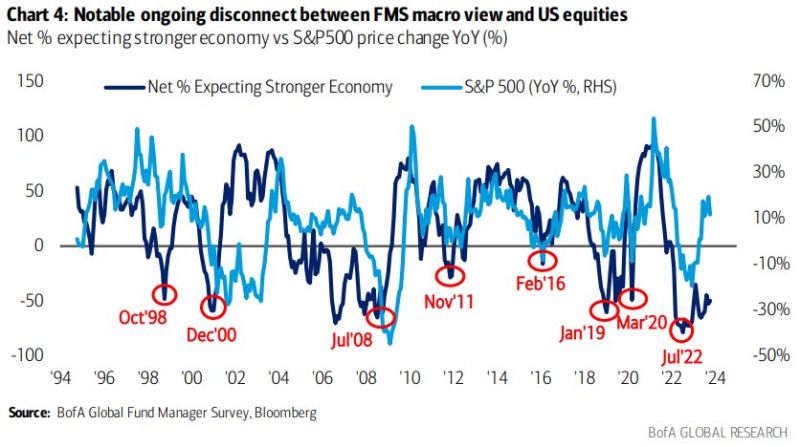

It’s not a disconnect between macro view and S&P 500, it’s simply Mag7 euphoria driving the divergence

S&P 493 is valued more in line with macro expectations. Source: BofA, Michel A.Arouet

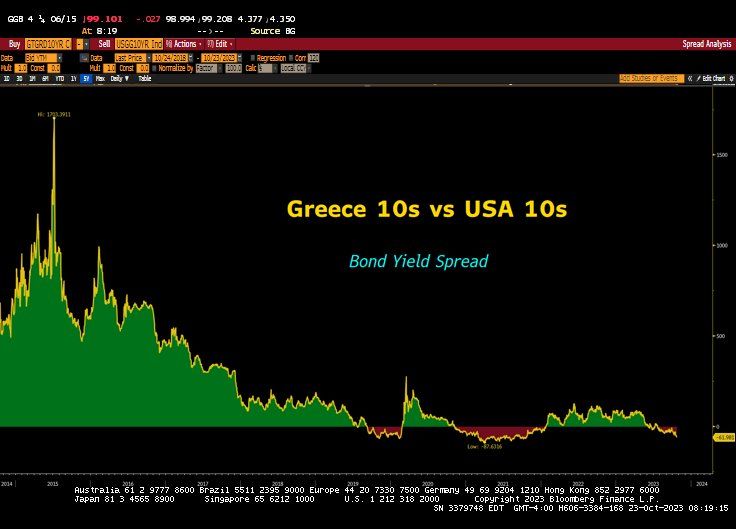

10-Year Bond Yields

USA 5.00% Greece 4.36% Source: Bloomberg, Lawrence McDonald

Here's a chart of gold in yen

Japan has been ahead of the curve when it comes to FIAT currency debasement and the way its currency is trading against gold is rather frightening with another huge ~10% new ATH move this month. Will other FIAT currencies follow the yen path? Source: Graddhy - Commodities TA+Cycles

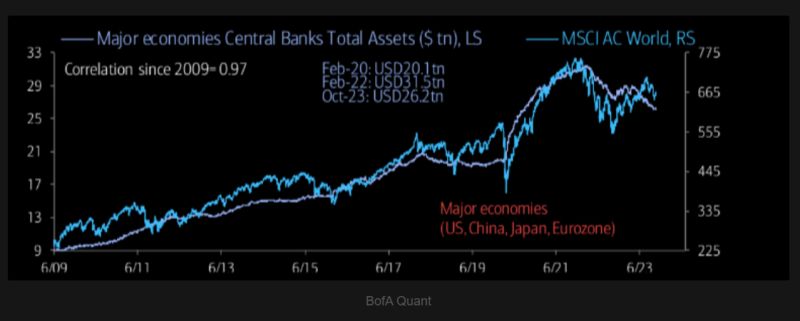

Quantitative tightening (QT) may have taken a backseat in recent months, but is still very much in vogue

Source: BofA, TME

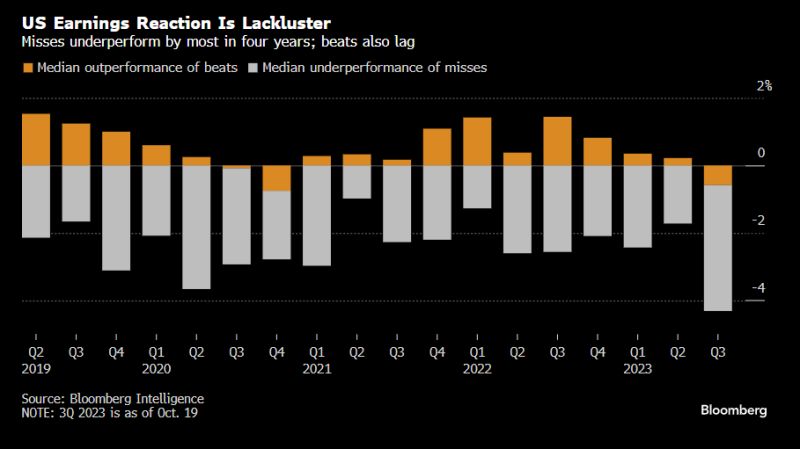

Shares of US firms that miss profit estimates are falling by the most in four years:

Bloomberg Intelligence

Investing with intelligence

Our latest research, commentary and market outlooks