Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

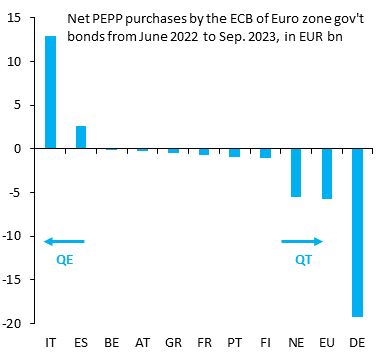

This chart from Robin Brooks highlights what is curently happening at ECB level: QE for some and QT for others

This was NOT supposed to happen. Remember: founding principle for the ECB is separation of monetary and fiscal policy. That's why ECB QE was initially subject to the capital key, so it couldn't favor one country over another. Could this last for ever? Source: Robin Brooks

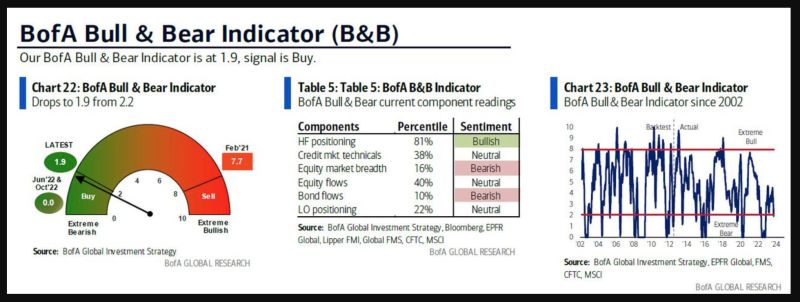

Wall Street biggest bear (BofA's Harnett) turns bullish as investors' sentiment turns extremely bearish (which is bullish from a contrarian perspective)

Indeed, with the S&P down in five of the past seven weeks, BofA's Bull & Bear Indicator just printed at 1.9 (extreme bearish), which according to Hartnett means that a contrarian buy signal for risk assets has been triggered.

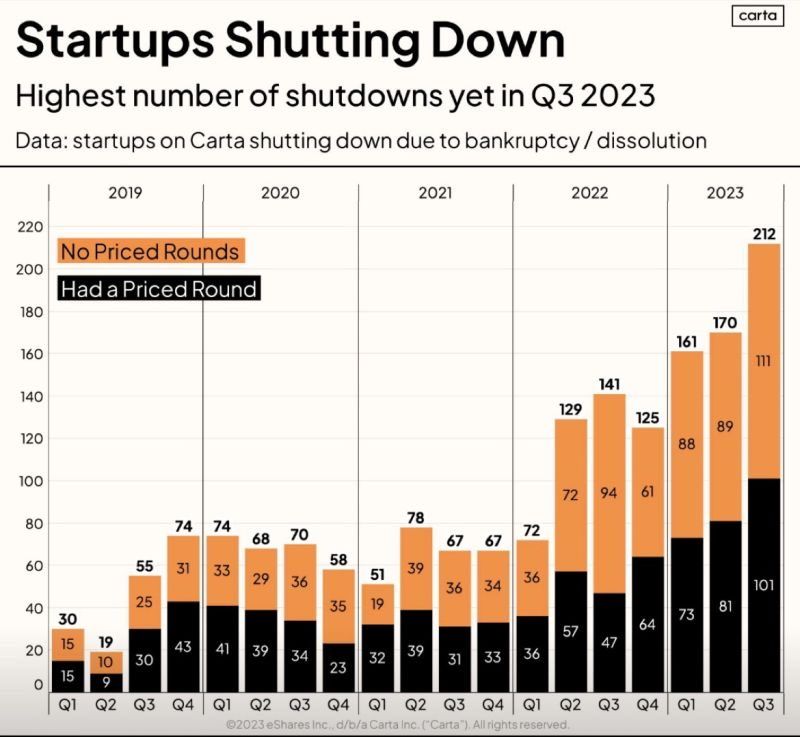

Startups are increasingly shutting down

Rising rates, lower liquidity and reduced risk appetite are hurting funding. Difficult business conditions are eroding viability further. Source: Markets & Mayhem

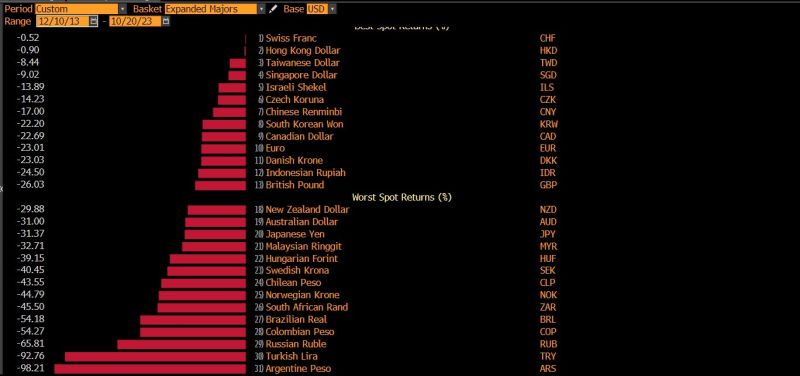

Argentina's currency has lost 96% of its value vs the USD in the past decade

In that period, the central bank has increased the monetary base by 2,046% to finance government political spending... Source: Bloomberg

The correlation was weaker in the 1980s/1990s, but starting after 2000, gold has historically done quite well whenever the Fed pauses or cuts

Source: Lyn Alden

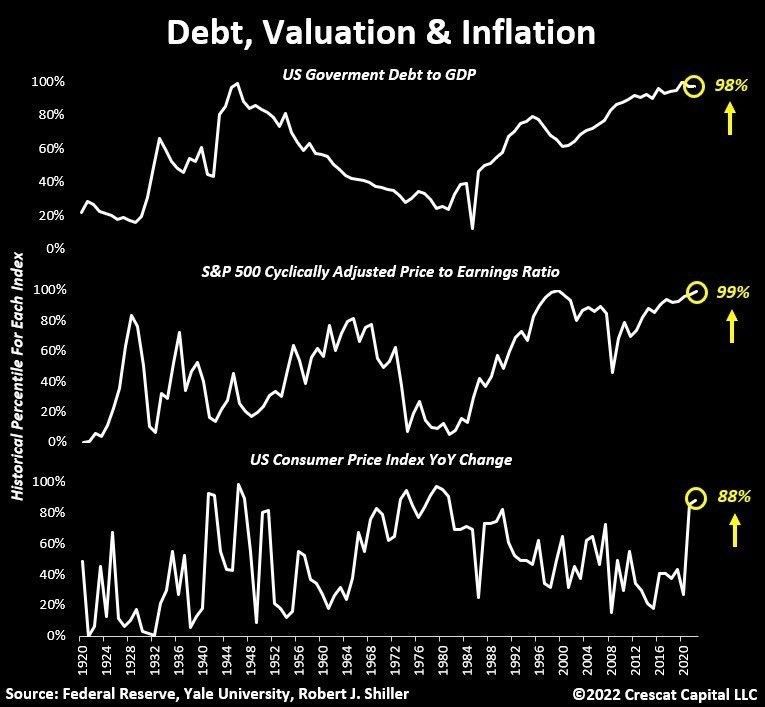

Where do we stand in terms of percentile each year for the below aggregates in the US:

- US Government Debt to GDP = 98th percentile - SP500 Cyclically-adjusted-PE ratio = 99th percentile - US Consumer Price Index YoY change = 88th percentile Sounds like an interesting trifecta... Source: Crescat Capital

Investing with intelligence

Our latest research, commentary and market outlooks