Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

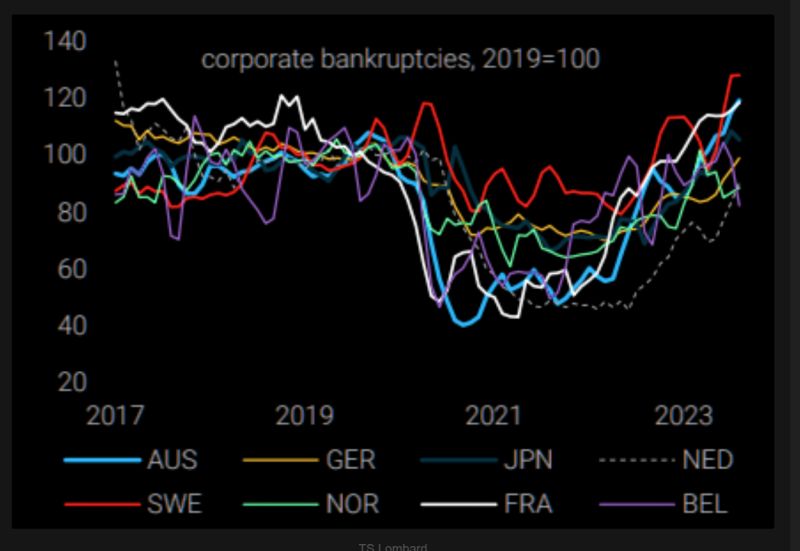

The bull market in bankruptcies...

Source: TME, TS Lombard

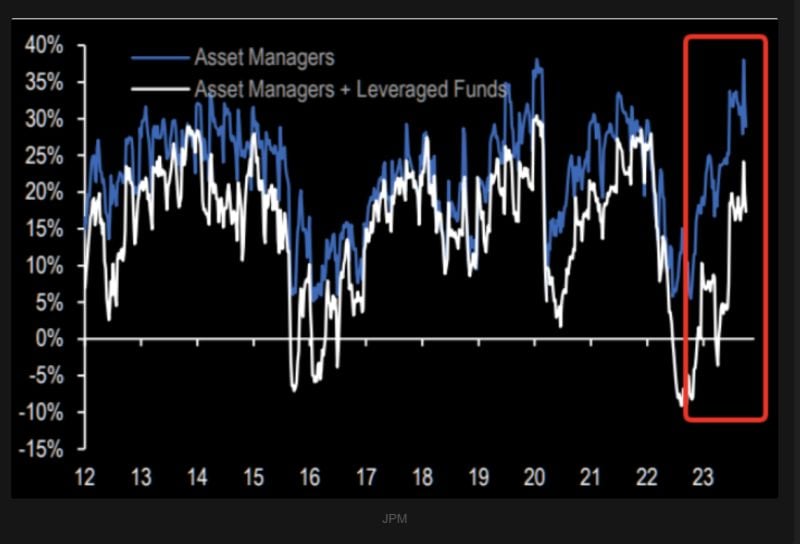

Yes, Hedge funds are short equities

But don't forget the bigger picture: positioning among asset managers and leveraged funds is rather long... Source: TME, JP Morgan

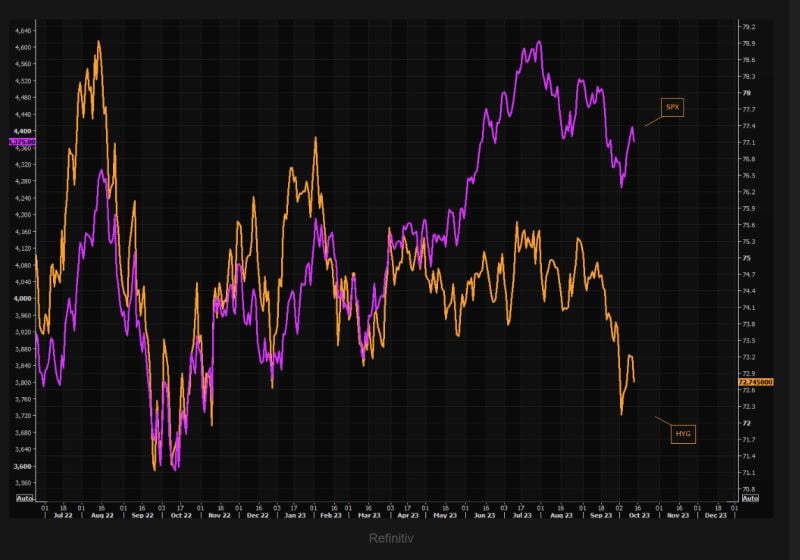

The gap between HYG (US High Yield) and the SPX (S&P 500) is getting wider and wider...

Source: TME

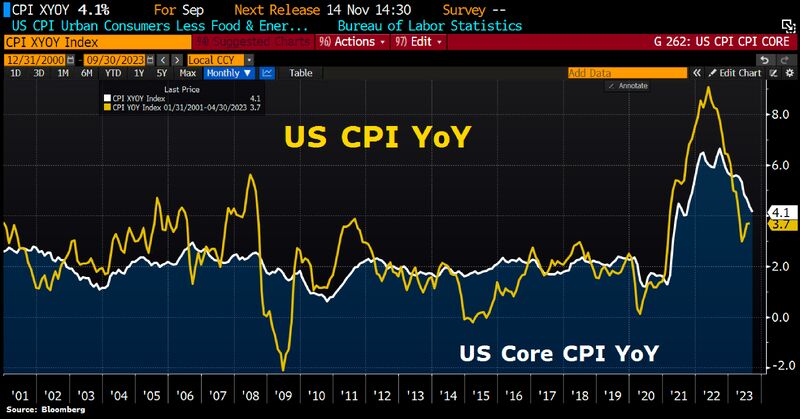

US inflation is cooling, but only slowly

From the perspective of the Fed, the figures are probably not worrying enough to trigger another interest rate hike. However, they are not good enough to sound the all-clear either, CBK says. Source: HolgerZ, Bloomberg

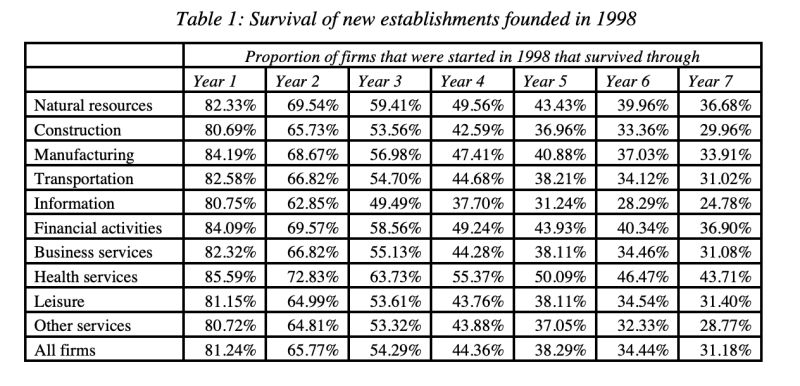

Survival of the fittest..

Only 31% of companies started in 1998 were still alive in 2005... Source: Brian Feroldi

JPMorgan Debuts Tokenization Platform, BlackRock Among Key Clients According to a report by cointelegraph

United States banking giant JPMorgan debuted its in-house blockchain-based tokenization application, the Tokenized Collateral Network (TCN), on Oct. 11, according to Bloomberg. TCN settled its first trade for asset management giant BlackRock. The Tokenized Collateral Network is an application that allows investors to utilize assets as collateral. Using #blockchain technology, investors can transfer collateral ownership without moving assets in underlying ledgers. In its first public collateralized trade between JPMorgan and BlackRock, the TCN turned shares of one money market fund into digital tokens, which were then transferred to Barclays bank as security for an over-the-counter derivatives exchange between the two companies. Source: www.zerohedge.com, www.cointelegraph.com

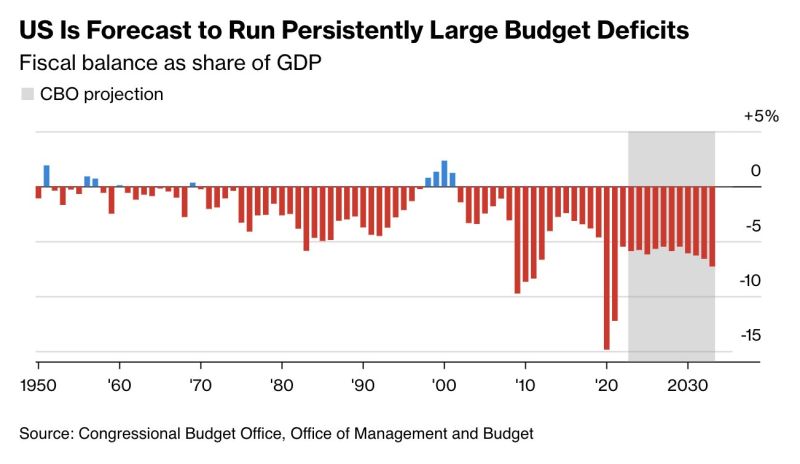

The United States is on an unsustainable fiscal path warns the IMF which projects the U.S. deficit to be 'elevated and persistent

Source: barchart, CBO

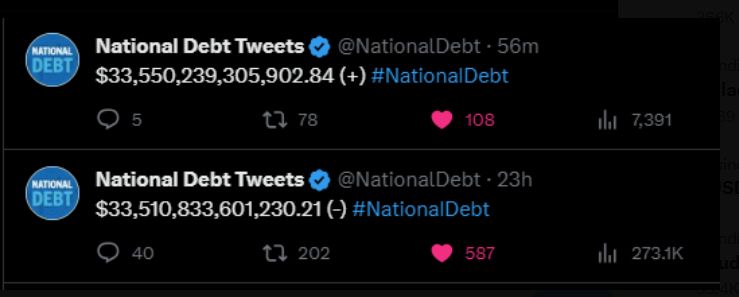

Another $40 billion in US debt today

US national debt has jumped by $550 billion in the past 3 weeks. This is WAY above the pace of $2 trillion per year expected by the government. The US was at $31.4 trillion just 4 months ago. Debt has increased by $2.1 trillion in the past 4 months. Source: WallStreetSilver

Investing with intelligence

Our latest research, commentary and market outlooks